Destination USA

The Founder’s

Guide to US Expansion

The Index Ventures experience

Our insight

Index Ventures partners with founders, across both Europe and the US, who are building world changing businesses. Operating at this level of ambition requires dedication, grit, and a relentless focus on doing what is best for your company. In the majority of cases, taking on the behemoth that is the US market is a necessity to achieve global leadership.

We have supported more than 40 European tech companies that have expanded to the US, including 9 that have gone on to become public companies. Being involved at every step of the journey - planning, launch, and scaling - has taught us a great deal about the opportunities and pitfalls.

Index also has personal experience of crossing the Atlantic, being the only European-born VC firm that has successfully expanded to the US. We now have a team and portfolio equally balanced across both continents. Much of the advice in this book therefore reflects not just the learnings of the entrepreneurs we work with, but our own first hand experience of launching and scaling in the US.

Transforming into a global tech player by making it in the hyper-competitive US environment is a daunting challenge. This guide has been written to help you. We provide frameworks you can use to plan and execute the right combination of strategic, tactical and practical moves. We aim to help you understand what you need to do, when you need to do it, and how to do it, in order to win in the US.

Changing landscapes

Fifteen years ago, building a major tech business in Europe was extremely difficult. Faced with a paucity of tech-savvy customers, talent and capital, founders often chose to relocate their businesses to the US as early as they could. Zendesk and MySQL are prominent examples of European-born companies that moved over in their entirety at Series A, and continued to build their companies successfully from there.

Today, conditions are very different. Europe has many success stories, including two tech leaders, Adyen and Spotify, approaching $50bn valuations. At the same time, building an engineering team in the Bay Area is more challenging and expensive than ever. With these forces in play, founders have more choices about how long, and in what capacity, to remain in Europe.

Starting in Europe nowadays can have advantages; technical talent is more available (and affordable) than in the US, and employees tend to be more loyal. Europeans, with smaller domestic markets, also tend to think internationally from day one, which is much less common in the US. And certain sectors, including finance, luxury, travel, and gaming, have a rich heritage in Europe, offering domain expertise and partners that can actually give Europe a competitive edge versus the US.

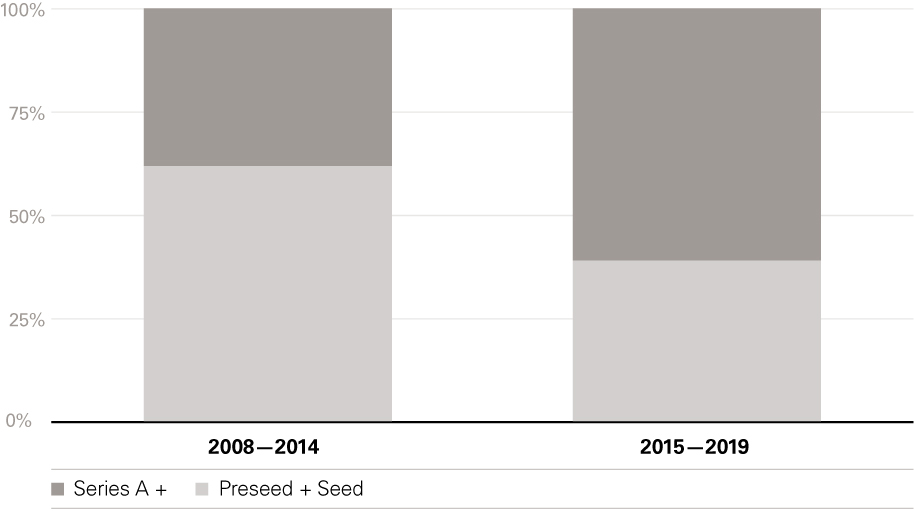

As a result of this evolution in Europe, we are seeing four distinct trends.

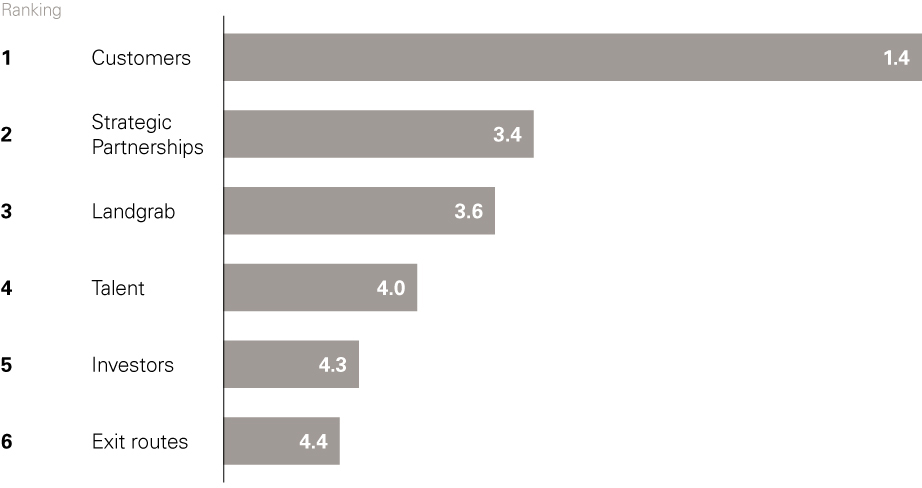

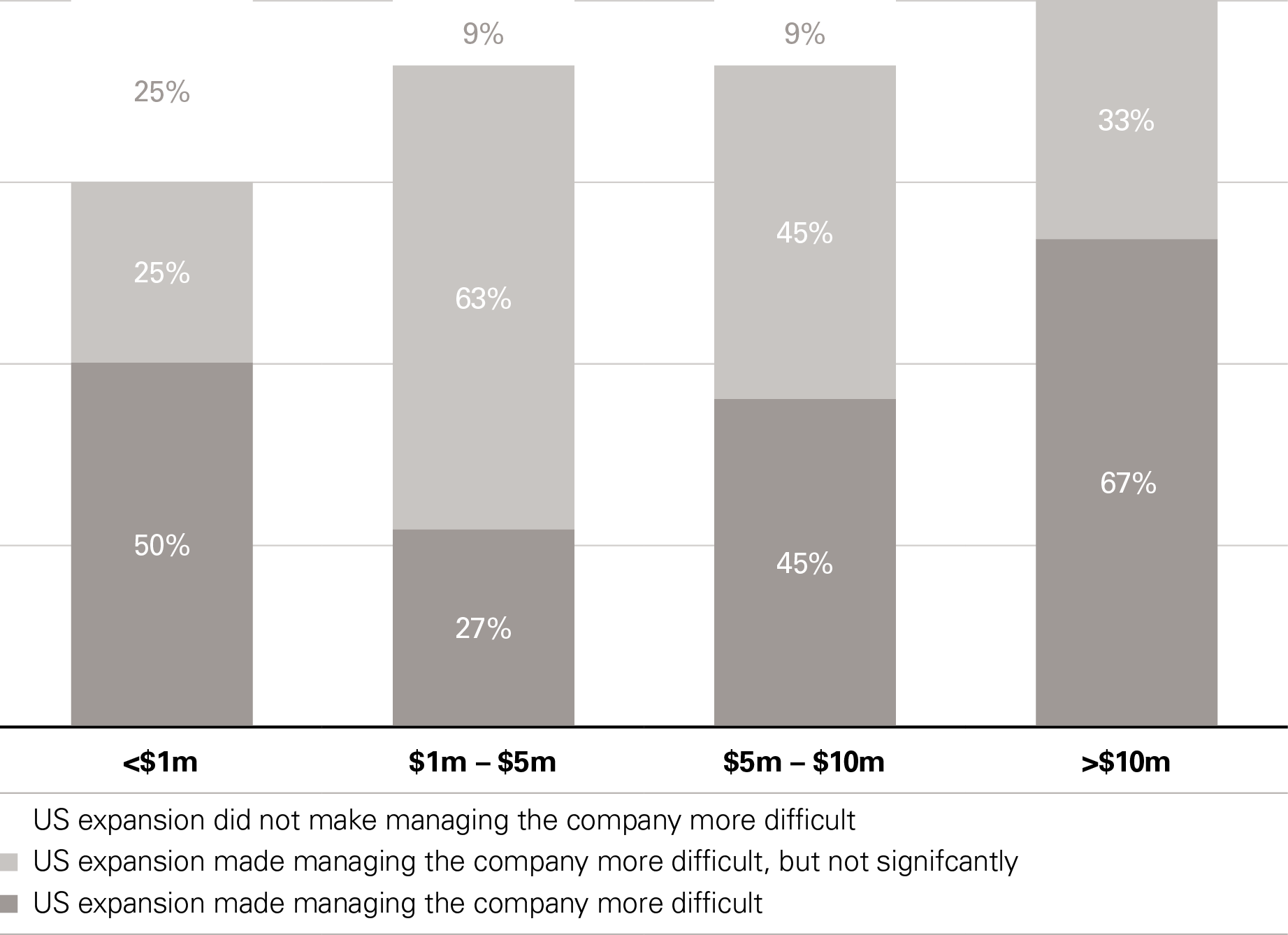

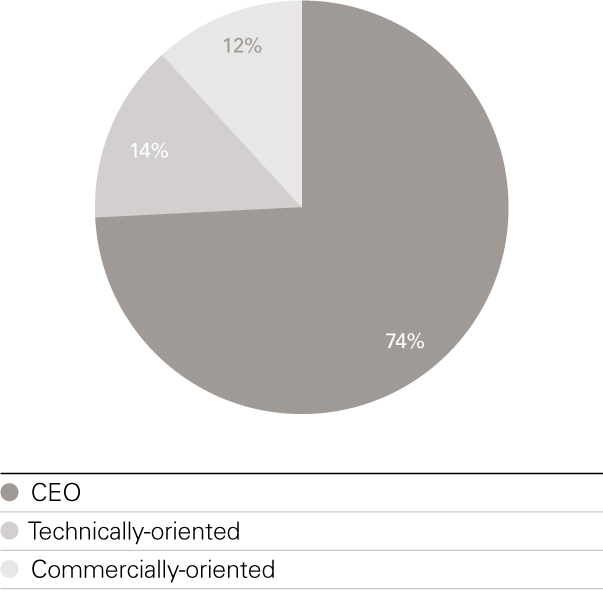

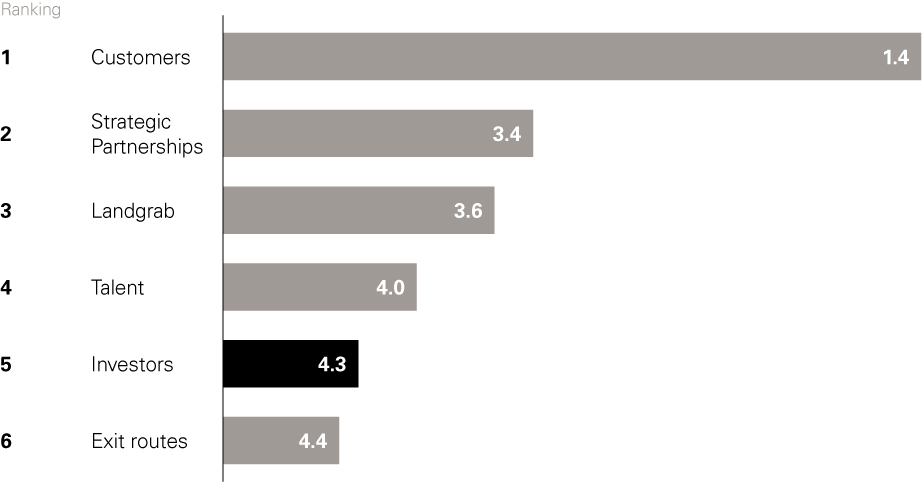

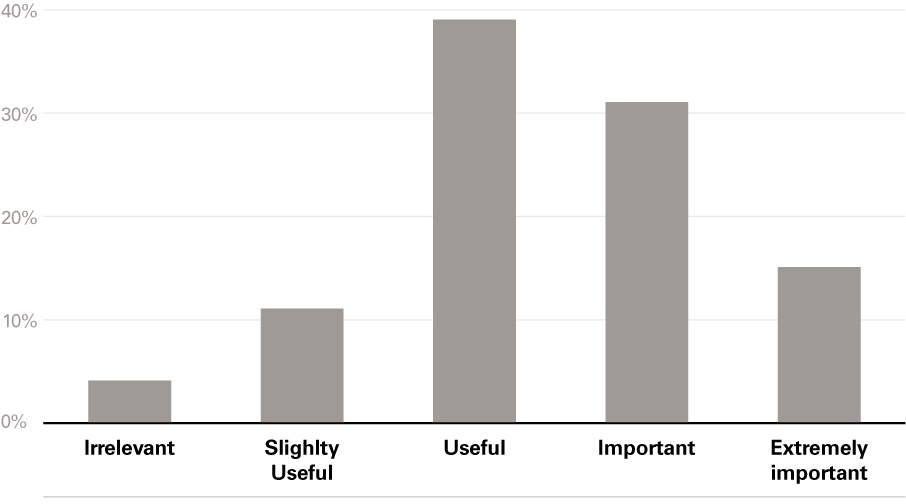

i) Startups are further along in terms of scaling at the point they expand to the US than they were 5 or 10 years ago, in terms of funding, customers, and headcount. US expansion is primarily for commercial roll-out. Our survey of European and Israeli founders who have expanded to the US validates this, with 78% ranking ‘access to customers’ as their #1 reason.

Rank your reasons for expanding to the US

Average weighted ranking of factors Index survey of European founders who have expanded to the US. Sample size = 47

Index survey of European founders who have expanded to the US. Sample size = 47

Score from 1-5 shows average weighting of each response

ii) Europe has built global B2C successes with limited US team presence by leveraging online distribution channels. For example, King, Supercell, and TransferWise achieved significant scale from their bases in Sweden, Finland, and the UK, respectively.

iii) Europe is building B2B successes which do not operate at all in the US. Broader adoption of digital and cloud services means that market opportunities outside of the US have widened, and we are seeing regional B2B companies on trajectories to $5bn+ valuations. iZettle, a point-of-sale payments company for small merchants, is an example of this emerging trend. Retaining its HQ in its birthplace in Sweden, iZettle raised €273m and established a strong presence across Europe and Latin America, The company was acquired by Paypal in 2018 for $2.2bn.

A cohort of promising European-focused B2B companies are now addressing markets that are sizable, yet don’t necessarily translate to the US context. For example, Swile (Series C) is disrupting and digitising the market for meal vouchers - an employee benefit that does not exist in the US. Others operate in regulated sectors which are fundamentally different in the US from Europe - for example, KRY (Series D), offers remote access to primary healthcare services.

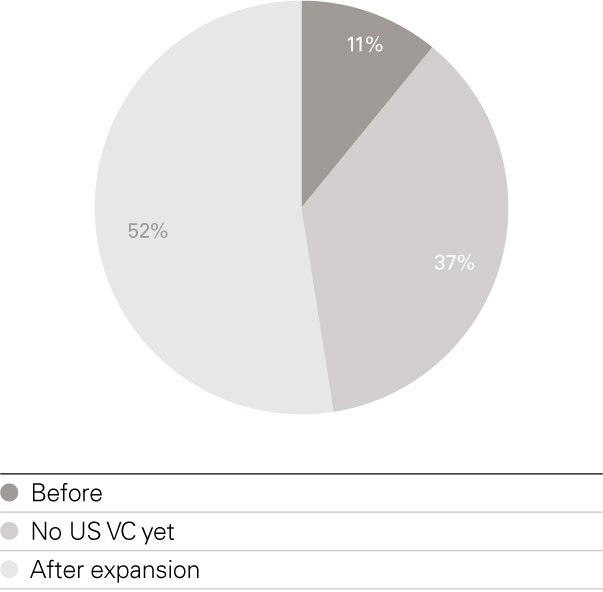

iv) European founders are increasingly securing funding from top US investors without needing to move to the US. US investors are increasingly willing to come to Europe looking for entrepreneurs to back. It is no longer necessary to be on the doorstep of Sand Hill Road to forge these relationships, nor to commit to moving to Silicon Valley as part of any fundraising with them. Not to mention the extraordinary growth in funding available to entrepreneurs from increasingly sophisticated European-based VC’s.

Some European founders will still choose to relocate from day one, and to build their entire business in the US, following the examples of Stripe (the Collison brothers moved from Ireland), or Datadog (Olivier and Alexis moved to New York from France). While this can be a valid and exciting proposition, it is not our focus here.

We will instead focus on companies that base themselves, and build their product, initially in Europe, and that only later expand to the US.

Covid-19 update

At the time of writing, it is August 2020, and our world is in the throes of the Covid-19 pandemic. We have seen over 700,000 deaths globally. Many countries remain in full lockdown. Others are experimenting with opening-up, despite signs of a resurgence in infections. Multiple vaccines are in development, but no-one is sure when one will be approved, nor whether a vaccine will actually offer lasting immunity. Limitations on social interaction may be required for years to come. Economies are reeling, and the future of international air travel is, ironically, ‘up in the air’. Meanwhile, certain sub-sectors in tech, such as ecommerce, and applications around remote- work and healthcare, have become critical to the orderly functioning of society. Underlying tech and fulfilment infrastructure has been rapidly extended to accommodate the explosion in demand.

Whilst it is unclear how long economic recovery will take, we are certain that innovative technologies, and the creativity and resilience of startups in particular, will be critical to the path forward.

Most of the research underlying this guide was conducted before the pandemic. Our conclusions and strategic advice remain broadly unchanged. We believe that the underlying thesis we have set out will remain intact: The US will still be a critical market for European tech startups, and the overall playbook for winning in the US will persist.

Tactically, however, the expansion playbook of the past will need to be adapted, driven by two new realities:

| Short-term | Longer-term | |

|---|---|---|

International Air Travel |

Not possible, or very limited |

Less frequent trips |

Face-to-Face interactions |

Not possible, or very limited |

Less frequent meetings |

Visa applications for US |

Visa services suspended and/or backlogged |

Visa services resume, but political pressure to keep application criteria tight |

In the short-term, restrictions are in place that curtail most travel between Europe and the US, and most non-essential gatherings. These may slowly be lifted, but there will be a reluctance to return to ‘business as usual’ so long as there remains the risk of a second wave of infection. At the same time, US visa services are suspended, so relocating staff from Europe to the US is not possible. This is likely to remain the case through 2020, and much of 2021.

I’m keen to relocate to New York, but it’s simply not possible for the time being, especially since I have children. The team continues to sell into the US remotely, and I’m hiring a local salesperson, with a fully virtual interview process. We’ll hold off on a senior sales lead until I can get out there.

Anonymous European Founder

In the longer-term, we can expect ‘a new normal’ in how we work. The prolonged lockdown has permanently shifted our habits, although we don’t yet know how far. Will we ever return to our offices Monday through Friday? Will business relationships, or closing deals, go back to requiring face-to-face meetings? Concerns around climate change, cost of living, and lengthy commute times, were already shifting behaviour. The lockdown has given the world a crash-course on how to use Zoom, Slack, and other modern tools, accelerating these trends by 5 years or more.

Let’s explore how we specifically expect these changes to affect startups expanding from Europe to the US:

| Theme | Short-term | Longer-term |

|---|---|---|

Landing Teams & Founder Moves |

Not possible until air travel and visa restrictions are lifted |

Will remain a critical part of the playbook |

First Local Hires |

First hires may need to be made fully remotely, before a landing team is in place. As a result, first hires likely to be less senior than planned - eg ICs not managers |

Will remain a critical part of the playbook |

Sales and Customer Engagement |

No face-to-face meetings possible, entirely remote model |

Wider acceptance of ‘inside’ sales model, even for big-ticket purchases. But sales cycles and complexity unlikely to be reduced |

Remote Teams |

Enforced work-from-home for all |

Fully remote models will become more common versus the idea of a US ‘hub’. But most companies will adopt a hybrid, flexible model |

Travel between US/Europe offices, including full-team offsites |

Not possible |

Will shift towards fewer, but longer, trips and gatherings. |

Although we expect sales travel to decline substantially, we believe that in-person meetings will still hold significant value with particular customers or at certain points in the sales cycle.

Abakar Saidov

CEO & co-founder, Beamery

With the immediate digitalization of society because of covid-19 and the forced WFH regimes, the world is ready to see world-leading startups not just come from anywhere but also grow up anywhere.

Mårten Mickos

Former CEO, MySQL

We will update this book, as the path forward becomes clearer.

Outlier Successes

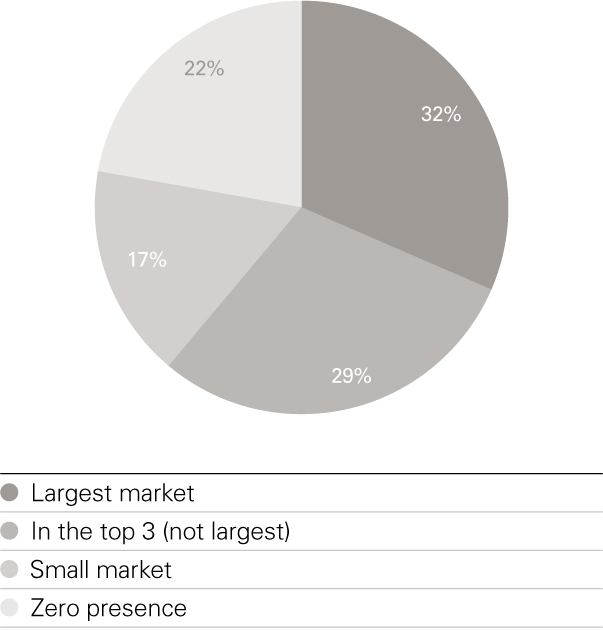

Our research identified 33 European-born tech ‘unicorns’ created since 2008, and a further 23 from Israel, that have gone on to achieve success in the US. Success has been defined through a combination of total US revenues, US growth, US percentage of overall revenues, and US category leadership (top three). They span different sectors, business models, and expansion strategies. Of these 57 outliers, 43 (75%) are B2B, and 14 (25%) are B2C.

Colour logos indicate Index investments.

Europe B2B

Europe B2C

Israel B2B

Israel B2C

Our take

We are confident that Europe will produce more and more tech success stories in the years ahead. The ambition is there, and the essential elements are coming together: strong talent pools; experienced leaders, investors, and service providers; excellent infrastructure; and generally well-regarded legal systems and regulation.

Some of these startups will succeed without looking to the US, achieving a scale beyond anything we have witnessed to date, and creating tech leaders that will list on European stock markets. But the majority will still operate in global markets, with global ambitions. Europe can support the R&D and investment needs of these startups, and they will be able to sell to consumers across the world.

However, in one area, Europe continues to slip further behind. Its corporations are still too conservative when it comes to innovative technology. They invest less in technology, and when they do, it is too often focused on compliance, rather than on business transformation. European software companies selling into enterprises are therefore forced to succeed in the US, before they are given the chance to do so in Europe. Until this changes, we will continue to see entrepreneurs crossing the Atlantic to scale and to list software companies. And the global competitiveness of European corporates will continue to be eroded.

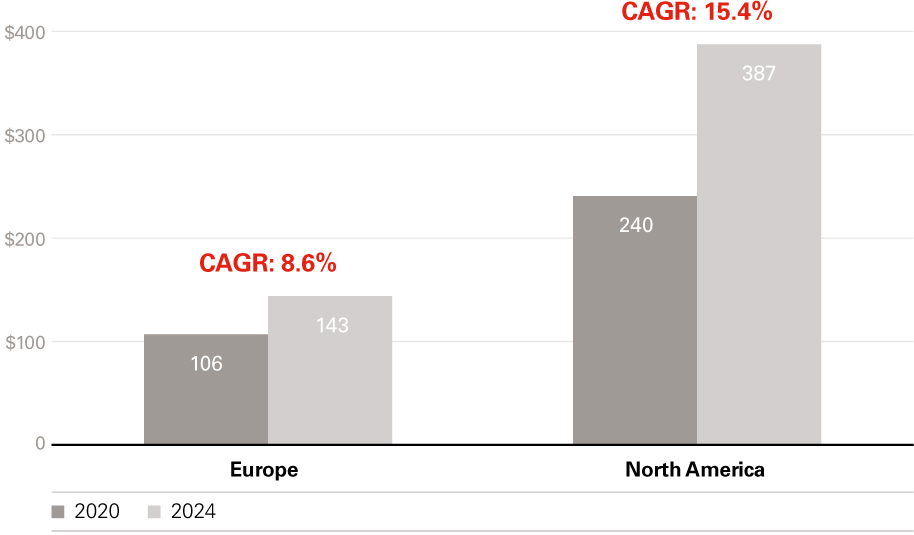

Investment in B2B software 2020-2024 ($billions)

Source: Gartner

Source: Gartner

Methodology

The recommendations in this handbook are based on the most extensive research ever undertaken into US expansion by European tech startups:

- Analysis of 353 European (275) and Israeli (78) VC-backed startups that have expanded into the US over the last 10 years

- Extensive survey covering US expansion strategies, completed by the founders of 104 of these startups

- Deep-dive research into the 33 European unicorns that have succeeded in the US

- In-depth interviews with the founders of 23 European companies at different stages of US expansion, including 11 unicorns

- Insight and experience drawn from the Index team across Europe and the US

- Advice from leading service providers, including lawyers, recruiters, tax advisors, and investors

Archetypes for expansion

Only a small proportion of European tech companies that expand into the US grow to the scale of global category winners. For those that have succeeded, what are the strategies and factors that enabled success? And how did they design their organisations to maximize their potential?

A lot of my time is spent working with founders on where they are headed, thinking ahead and helping them chart the course to where they want to get to.

Ari Helgason

Index Ventures

We have synthesised our analysis and case studies into four distinct archetypes. These are organisational templates that startups can follow as they expand into the US.

The archetype that is right for you will depend more than anything on how you would answer these two questions:

How large is the US as a percentage of your total addressable market (TAM), and to what extent are you focused on capturing this market?

Do you need boots on the ground in order to either acquire (sales) or serve (operations) customers?

Other factors can also influence which archetype is right for you, but the classic business tenet ‘follow the customer’ is still usually true today, even as software continues to eat the world.

Remove all patriotism from the discussion. Be coolly rational, not emotional, and go where it makes sense for your business.

Mårten Mickos

Former CEO, MySQL

Regardless of which of the following four archetypes is applicable, for the purpose of this book, startups tend to share similar beginnings. The founder, or founding team, is based in Europe. They have a vision for a new product or service. Europe is where they build their early product, raise angel or seed funding, and make their initial hires. Typically, the first users or customers are in Europe. Sometimes there might also be early US users or customers, either introduced via the personal networks of the founders or early investors, or acquired from marketing activity in Europe. By working with these early users, the team finds its way towards product/market fit (PMF).

It is after this phase that we start to see forks in the road, as different companies chart different courses.

First we will outline the Compass - the extreme pivot to the US.

Second, the Anchor - a more modest expansion model.

Third we will cover the ‘middle way’, or Pendulum.

And finally the Telescope, relevant to self-serve and marketing-based models of customer acquisition.

Compass

Compass

Anchor

Anchor

Pendulum

Pendulum

Telescope

Telescope

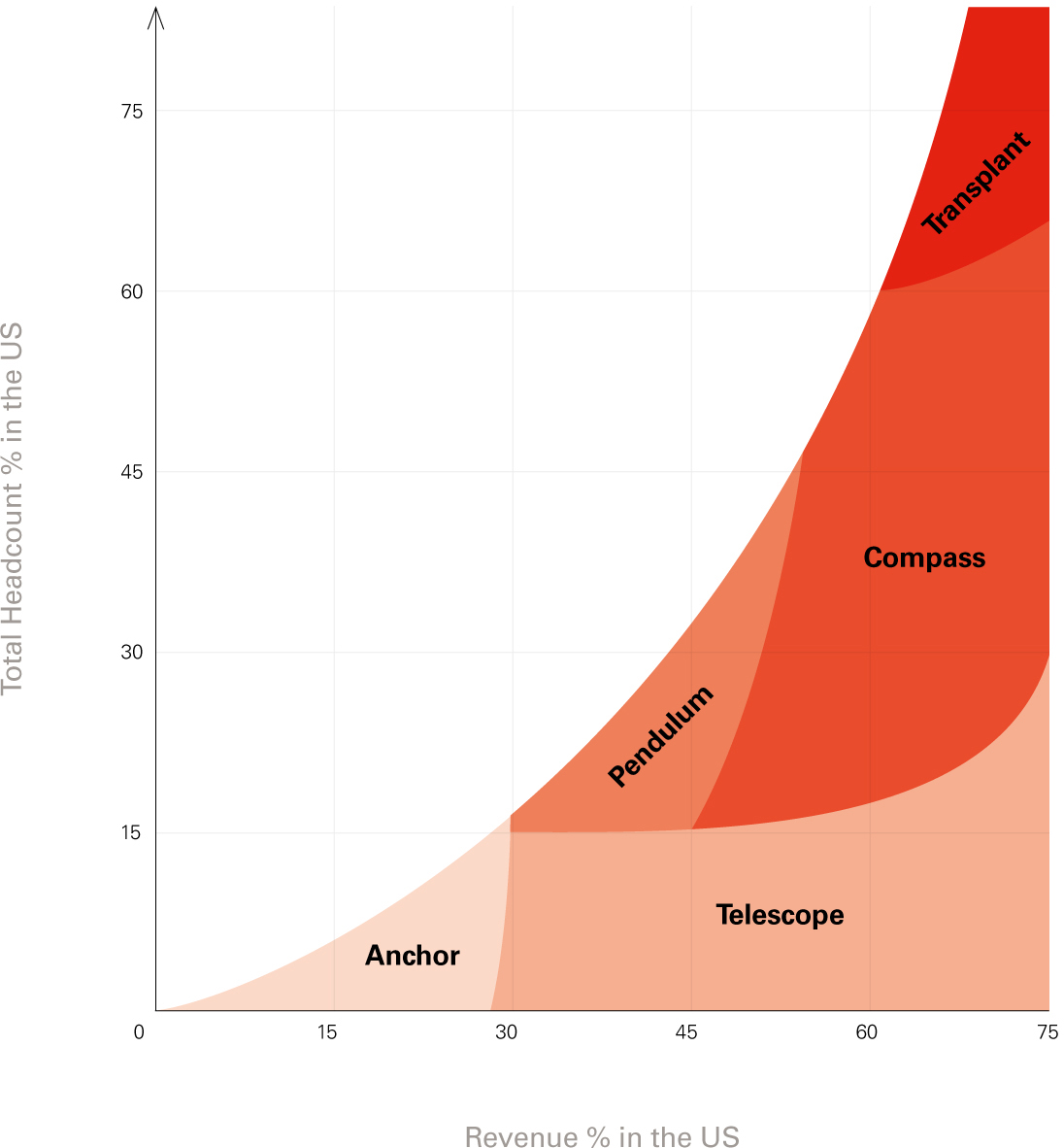

For the sake of completeness, we also mention two other approaches (neither is treated as an Archetype): Transplant, where the full team relocates from Europe to the US early in the journey, and Regional, where the company chooses not to enter the US market at all.

To determine which archetype your company is, and to visualise what you journey to US expansion might look like, check out our ExpansionPlan web app, available on the Index Ventures website, in the Resources section.

Summary of Archetypes - organisation at point of listing or IPO

| Archetype | US % of Revenues | Executives in US | GTM hub | Engineering hub | Listing |

|---|---|---|---|---|---|

Transplant |

>50% |

All execs |

US |

US |

US |

Compass |

>50% |

CEO/founder |

US |

Europe |

US |

Pendulum |

30-50% |

CEO (later or temporary) Some functional execs |

US and Europe |

Europe |

US or Europe |

Anchor |

15-30% |

President US |

Europe |

Europe |

US or Europe |

Telescope |

Any % |

VP Business Development |

Europe |

Europe |

US or Europe |

Regional |

0% |

- |

Europe |

Europe |

Europe |

Mapping our archetypes in terms of US% of Revenue and US% of Total Headcount

Compass

Compass

Built in Europe, sold in the US.

For companies with a large (>50%) US TAM, as well as the ambition to pursue it, the organisation and leadership as a whole needs to pivot to the US as its new ‘true North’. You will gravitate towards a setup where the bulk of R&D (engineering & product) remains in Europe, but the CEO moves to the US, and your GTM (go-to-market) teams are focused there. Over time, a new set of global functional leaders is hired in the US.

Compass is the dominant archetype for enterprise software startups.

B2B examples: Collibra, Mimecast, Algolia, Nexthink, UiPath, Unity Technologies

B2C examples: None

Compass - Typical Journey

Raise Seed funding, and build product from Europe, establishing product/market fit.

Acquire customers from the US and service them remotely.

Raise Series A led by transatlantic or US investor.

Refocus efforts on US versus Europe - both for sales, and for product roadmap.

Strengthen product management, so the CEO can step away from day to day involvement.

CEO moves to (or spends more time in) the US.

Build a small sales team in US, led by a player/coach.

Raise Series B led by US investor.

Scale your GTM team in US - including CMO and CRO.

CEO relocates (if they haven’t already).

Raise Series C.

All non-technical leadership is now in the US, with the exception of a dedicated GM EMEA.

Raise Series D.

Hire CTO and/or CPO in the US, as it’s hard to find candidates in Europe with proven experience at this scale

Consider a secondary engineering centre in US.

Build customer-oriented product team in US, to complement technically-oriented product team in Europe.

Further fundraising, as required for continued expansion.

List in the US.

Anchor

Anchor

Tethered, like an anchor, in Europe

For companies with a larger opportunity in Europe and the rest of the world, and a US market representing 15-30% of TAM, the centre of gravity will likely remain in Europe.

The Anchor archetype is common in situations where US expansion comes later in the journey. At this point, you will have a substantial European business to protect and grow, and a more mature leadership team in place. It will take some time for the US to become as significant a market, so you don’t want to pivot your attention and organisation there, at least initially.

The Anchor archetype is often appropriate for markets with cross-border value propositions, where Europe’s patchwork of wealthy national markets presents more opportunity than the borderless US. In the Anchor model, you leverage the leadership and expertise built in European markets, in order to launch a localised version to capture market share in the even larger US market.

B2B examples: Adyen, Funding Circle

B2C examples: Farfetch, TransferWise, Revolut, HelloFresh, Secret Escapes

Anchor - Typical Journey

Raise Seed funding, and build product from Europe, establishing product/market fit.

Focus on domestic customers. If you operate cross-border, localise in English.

Raise Series A led by European investor.

Focus on European expansion for now, rather than on US and expand into an additional European market.

Raise Series B led by European investor with strong US network.

Expand into further European markets.

Research the US market, with frequent visits, and preparing a launch plan.

Raise large Series C, led by transatlantic investor.

Send a landing team to launch the US, and support them on product as you’ll need early US localisation to succeed.

Retain your leadership team in Europe. It is likely to include one or two executives relocating from the US.

Raise Series D, led by transatlantic or US investor.

Hire US President as traction becomes clear.

Retain all other leadership in Europe, and founders remain in Europe.

Raise Series E.

Listing in Europe (maybe in US).

Pendulum

Pendulum

Distributed customers, distributed organisation

For companies whose US market size falls somewhere between 30-50% of TAM, it can be challenging to decide which continent should hold the centre of gravity. You need to balance these demands by embracing distributed leadership, ambiguous prioritisation, and organisational complexity and duplication. It is still possible to achieve exceptional growth in this scenario. But it requires more discipline in strategic decision-making, and in leadership communication.

Pendulums are usually companies that have delayed their launch into the US market. This may reflect an attractive opportunity to consolidate a leadership position across Europe (and potentially other geographies too). Alternatively, US market entry may require a level of funding that isn’t available early in the journey (particularly in B2C), or complex product localisation that cannot be tackled earlier. However, delayed US launch can also be the result of poor strategic decision-making, or poor execution.

By the time that attention turns to the US, the organisation is more mature, with an established leadership structure in Europe. Competitors in the US may have also moved ahead, limiting the landgrab opportunity.

As traction builds in the US (often following the Anchor archetype in the early days), and the growth potential is proven, the company needs to divide its attention: Retaining focus on its existing and dominant European markets, but needing to prioritise the US opportunity to stand any chance of winning there. Over time, the organisation and leadership spread out. Founders may split their time (ie their lives) between the US and Europe, and functional heads will be hired in either geography. A global mindset is essential, plus a tolerance for extensive travel, and calls at all hours of the day or night.

B2B example: Criteo

B2C example: Spotify

Pendulum - Typical journey

Raise Seed funding, and build product from Europe, establishing product/market fit.

Focus on European customers, but establish English as primary language, for product and internally.

Raise Series A from a European investor with strong US network.

Focus on European expansion, launching into 2 additional European markets.

But research US market, with frequent visits and preparing a launch plan.

Raise large Series B led by transatlantic investor.

Send a landing team to launch the US, supporting them on product as you’ll need early US localisation to succeed.

Strengthen product leadership to free up time for CEO. Likewise for European commercial leadership.

Founder spends extensive time in the US to oversee the ramp-up.

Raise Series C led by US investor.

Founder potentially relocates to the US as traction proven, else splits time.

Hire leadership, and build functions, based on where you find the best talent (US or Europe).

Raise Series D.

US probably single largest market by now.

If the right CTO/CPO candidates can no longer be found in Europe, relocate execs from US as it’s hard to find candidates in Europe with experience at this scale.

Leadership team now distributed across Europe and US.

Raise Series E.

Consider a US engineering centre.

List where it makes most sense for your business - US or Europe.

Telescope

Telescope

Focus on US, through a lens located in Europe

The US might represent the majority of your overall TAM, but you have a GTM model that is self-serve; ie customer acquisition is through marketing and growth. And your product is also purely software, so you don’t need an extensive distribution or fulfilment structure. Without the need to build out a complex sales or operations organisation on-the-ground, the bulk of your leadership and headcount can remain in Europe. The US - and if applicable, Asia - only requires a smaller team, focused on customer support, plus potentially business development. The organisation is like a telescope, able to focus on the US market and customers, through a lens located back in Europe.

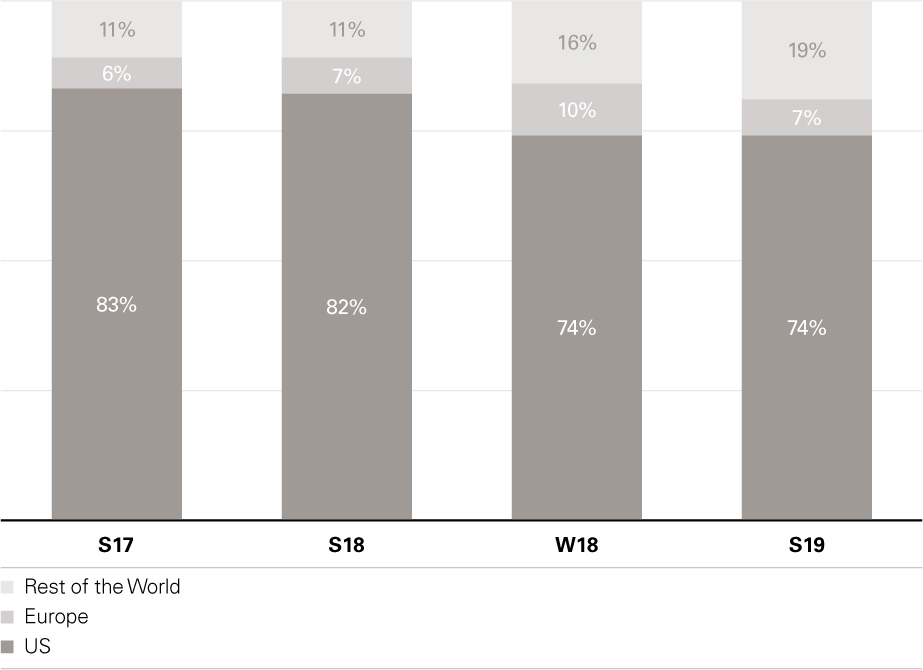

This is the main archetype for B2C startups when distribution is through app stores or digital marketing channels. In B2B, even if software companies start with a self-serve GTM model, few stick with it as they scale. Self-serve can work for selling to small businesses, or to individuals within larger enterprises. But with success and ambition, companies usually move up the value chain, selling larger deals, to larger customers - requiring an increasingly sophisticated sales model. At Index, we have witnessed this evolution first-hand at Zendesk, Dropbox, and Slack. So in practice, the Telescope archetype tends to morph into the Pendulum or Compass in the most successful B2B companies, albeit postponed by a few years.

B2B examples: Typeform, Pipedrive, Gett

B2C examples: King, Supercell, Skype, Lightricks, Waze

Telescope - Typical journey

Raise Seed funding, and build product from Europe, establishing product/market fit.

Acquire customers globally, but localise in particular for US users.

Raise Series A from transatlantic or European investor.

Focus on growth metrics across the whole funnel, optimising in particular for US users.

Make frequent visits to the US to cultivate relationships with strategic distribution partners.

Establish small business development team (likely in the Bay Area) as you’ll probably have major channel or product partners in the US.

Raise Series B led by transatlantic investor.

Hire business development lead in US.

Build US support team in secondary hub, or remote.

Explore ways of moving up the value chain with higher ACVs and larger organisations, using inside sales (B2B only).

Raise Series C led by US investor.

Scale-up inside sales in US secondary hub (B2B only).

Leadership team mostly in Europe, but likely to include several executives relocating from US (eg VP Growth or VP Product).

Raise Series D.

Set up enterprise sales function, if you continue to move up the value chain (B2B only). If this happens, you’re likely to morph into the Compass archetype...

If the right CTO/CPO candidates can no longer be found in Europe, relocate execs from US as it’s hard to find candidates in Europe with experience at this scale.

Raise Series E.

Listing probably in the US.

For completeness, we can identify two other archetypes. However, these fall outside the scope of this handbook:

Transplant

As noted earlier, European founders targeting sectors with a large (>50%) US TAM may choose to relocate entirely to the US at an early stage, and build the company wholly from there. Effectively, they are creating a US company from day one. As they scale, these companies often leverage their network and brand to rebuild a European team, with significant, but secondary, engineering and GTM teams.

B2B examples: Zendesk, MySQL, Stripe, Datadog

Regional

For European companies with zero US TAM, there is of course no need to expand to the US at all. As noted earlier, we predict a lot more European-focused success stories, in B2B as well as B2C, in the years ahead. Particularly in regulated sectors such as financial services, insurance, property, healthcare, and education.

B2B examples: Personio, Alan, KRY, Swile, Payfit

B2C examples: Deliveroo, Just Eat Takeaway, Delivery Hero, Zalando, BlaBlaCar

How Important is the US Market?

To determine which of our proposed archetypes offers the best roadmap for your startup, you need to quantify the importance of the US market to your success. What percentage does the US represent of your Total Addressable Market (TAM)?

We were driven by the view that the US would be the biggest market eventually, so our GTM plans were heavily based around this consideration.

Joshua Jian

Head of Corporate Development, Credit Benchmark

Startups should think of TAM in terms of primary markets - where you need to succeed, in order to achieve category leadership. This usually means:

- North America

- Europe

- Japan

- Australia

- South Korea

- Singapore

Does winning mean winning the US? This is a huge question and I keep asking it. If it does, it requires a huge change in my life and in the organisation.

Christophe Pasquier

CEO & co-founder, Slite

Secondary markets are those where your product is still relevant, but where the opportunity is likely to be smaller, and more fragmented. These usually include:

- Middle East

- Latin America

- South East Asia

- South Asia

- Africa

You should not expand into these regions if doing so could reduce your chances of success in core markets. Expansion is usually best delayed until you are close to, or following, listing.

China and Russia are out-of-bounds for most (but not all) startups, due to embedded domestic competitors, and barriers to doing business (regulation, political risk, or the need for local JV partners).

There can be exceptions to these general rules. For example, Farfetch (luxury B2C) has been very successful in China, and TransferWise (cross-border B2C payments) is highly relevant to immigrant communities from emerging markets. Even in B2B, core markets can vary, particularly for SMB-focused propositions. For example, iZettle scored major successes in Brazil and Mexico, as did Mimecast in South Africa. You therefore need to adjust which countries are core versus secondary, according to the dynamics of your sector.

Recasting data from IDC’s Global IT Spending 2020 report leads to the following TAM breakdown across core markets:

- North America 53%

- Europe 31%

- Japan 11%

- Australia 3%

- South Korea 2%

From this ‘base case’ of roughly 50% US TAM, we expect most European B2B companies will therefore continue to fall into our Compass archetype, particularly in enterprise SaaS.

Figure out where the opportunity is, figure out where the money is, and grow your business there.

Jan Hammer

Index Ventures

We see more openness to new and innovative technologies from US corporates, relative to those in Europe. Where US corporations see technology as an investment, and as a source of competitive advantage, Europeans are still more likely to view it as a cost.

This is reflected in much higher US corporate IT budgets. According to Gartner, expenditure on B2B software in North America will be $240bn in 2020, compared to $106bn in Europe. Over the next four years, they forecast growth of 15.4% CAGR in North America, compared to just 8.6% in Europe. And this doesn’t even capture differences between on-prem and cloud software, where we suspect the gap would be even wider.

Corporations headquartered in the US generally recognize two important things earlier than their European counterparts. First is that technology is a source of competitive advantage. Second is that, to be competitive in the war for tech talent, you have to enable your people to access and use the best technology. These two forces have resulted in a swifter adoption of products from early stage companies in the US.

Jacob Jofe

Index Ventures

US businesses are more likely to increase IT spending in order to upgrade outdated infrastructure (whilst) European ones are more likely to turn on the boosters due to regulations like GDPR.

2020 State of European IT

Spiceworks

European corporates tend to be more risk-averse, avoiding startups and preferring instead to buy legacy solutions from established software providers. Early-adopters are therefore concentrated in the US. We also see shorter average US sales cycles and higher ACVs, even in the metrics of later-stage SaaS businesses.

Once you have US case studies, you can sell more easily to corporates in Europe.

Felix van de Maele

CEO & co-founder, Collibra

We’ve just landed a European blue-chip after 3 years. In the US, the same decision would have taken 3 months - they are just more open to innovation.

Sacha Herrmann

CFO Nexthink

For enterprise B2B startups, these factors can make the US an even more important market than the 50% US TAM headline suggests. This is less true for SMB-focused startups, which may therefore align more closely with the Pendulum archetype, rather than the Compass.

Our US users are more savvy, more engaged, and monetise better across all use-cases.

Christophe Pasquier

Founder and CEO, Slite

You get media and PR attention from top tier outlets once you make inroads in the US market.

Ran Peled

Former VP marketing, Trigo

Corporate conservatism is one of the biggest weaknesses in Europe’s innovation ecosystem, and it needs greater attention from Europe’s corporate CEOs and CIOs.

Dominic Jacquesson

Index Ventures

The Archetypes in B2B

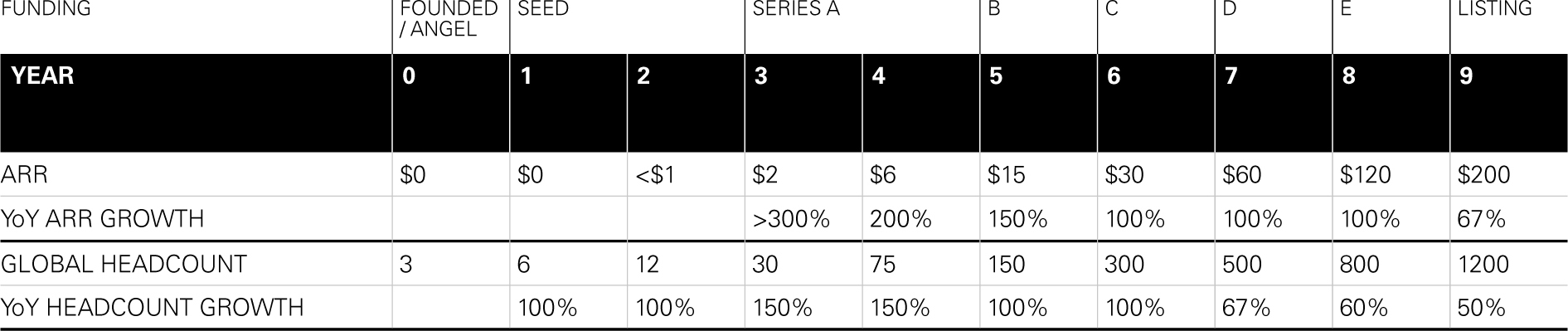

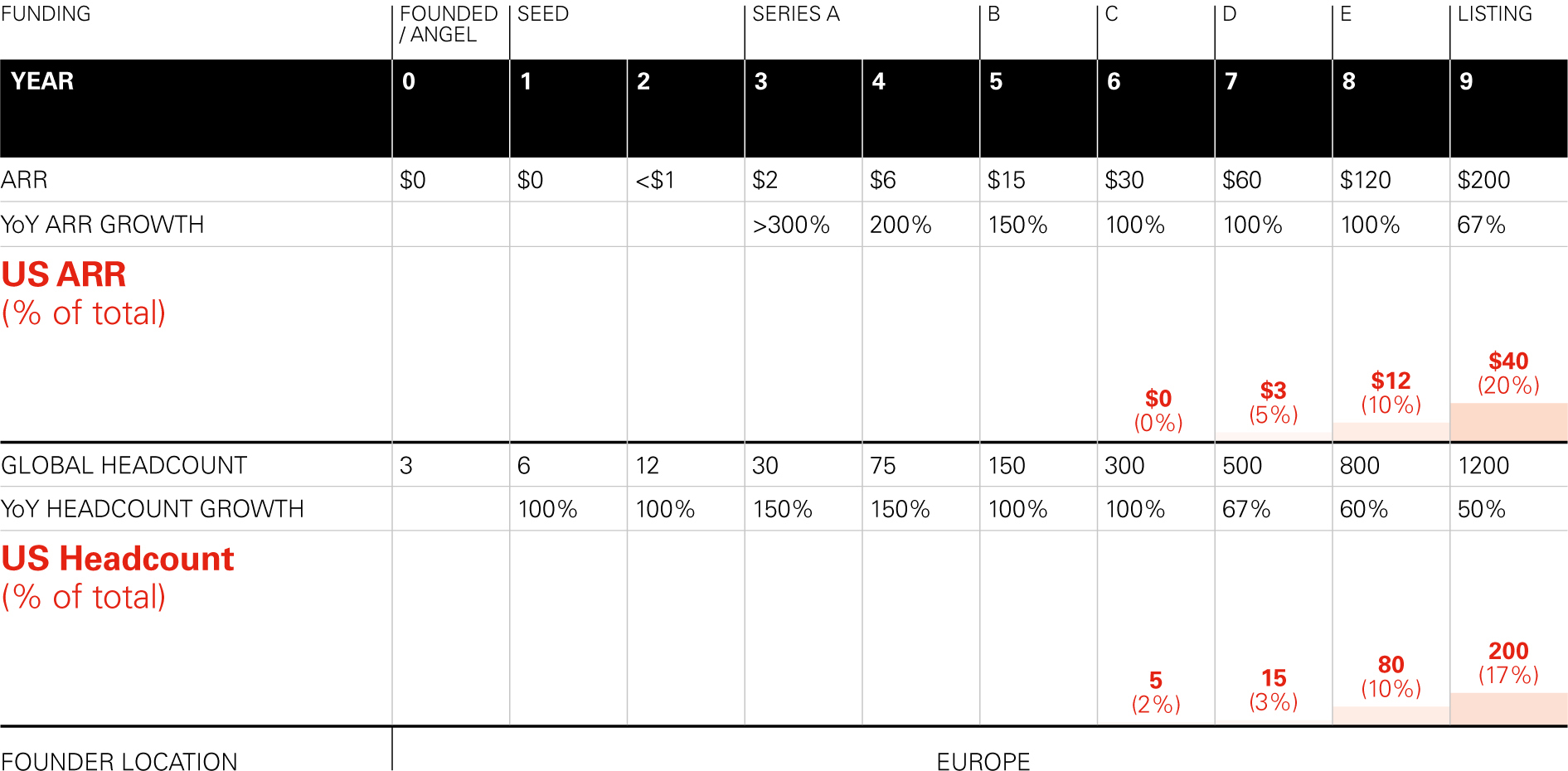

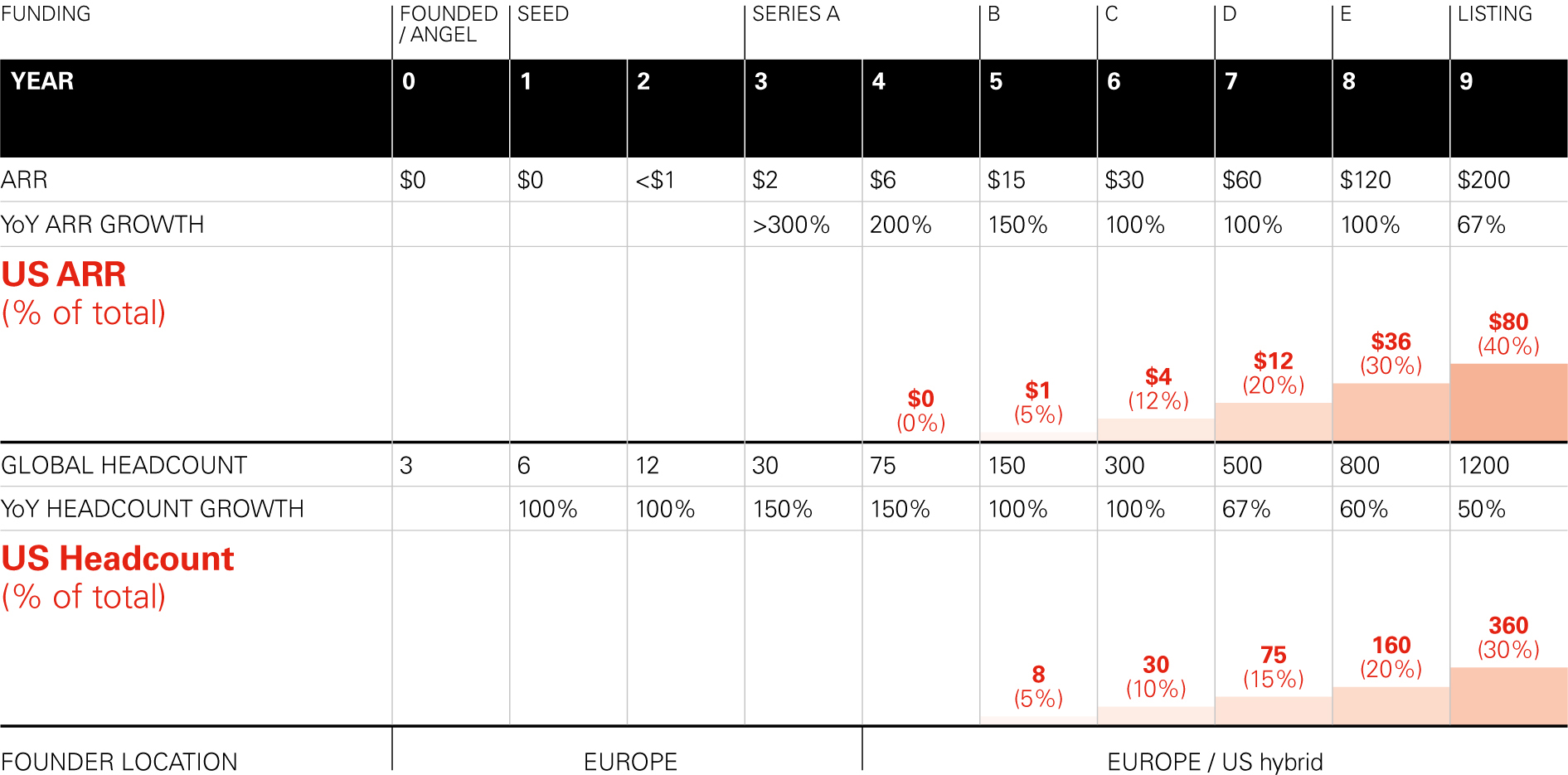

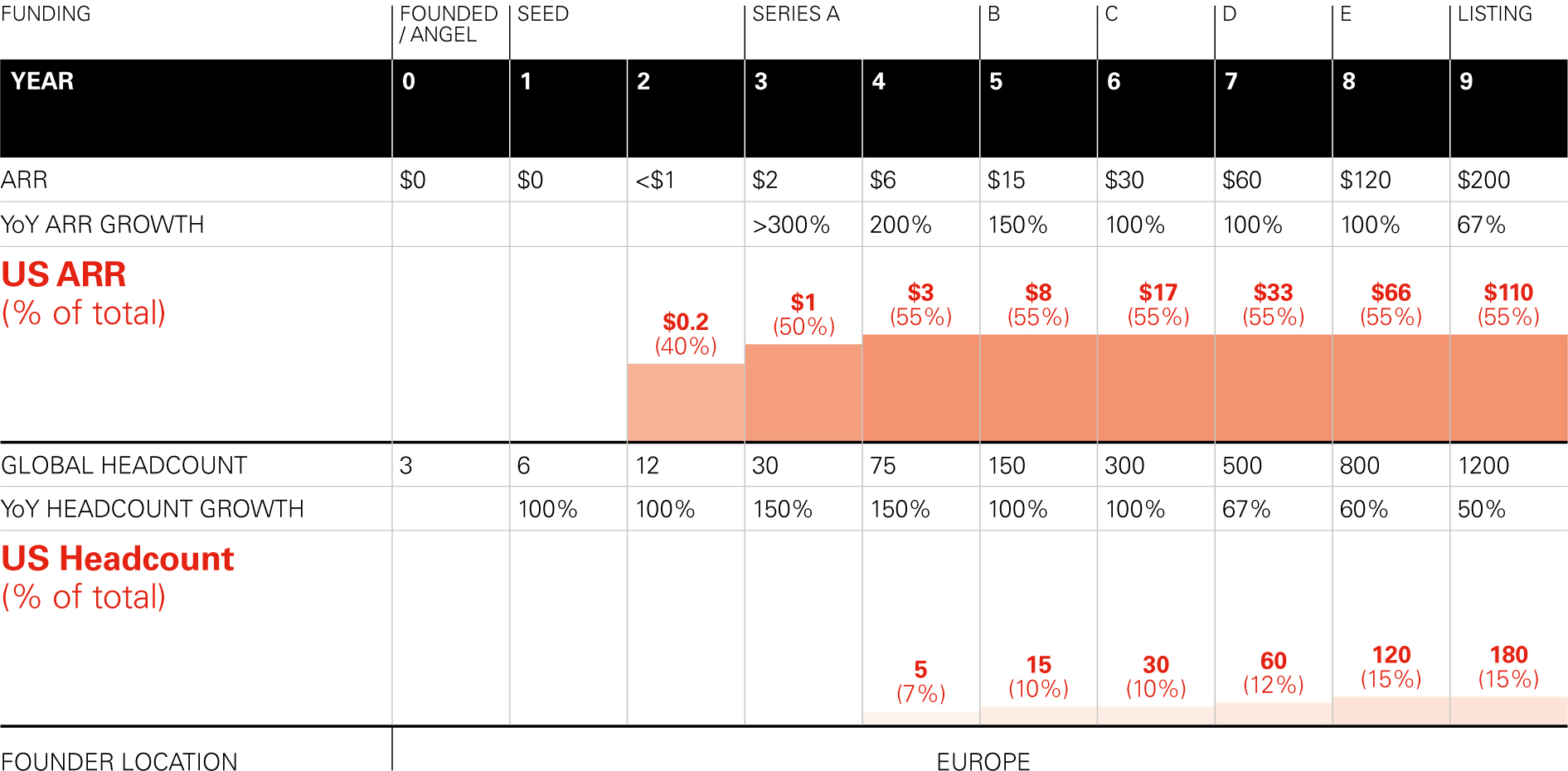

The most successful B2B startups sustain exceptional revenue growth year-after-year. However, using public listing as a milestone of having achieved true scale and success, the journey from founding is still a long one. Whilst every company’s route is unique, we have summarised a whirlwind, but credible, 9 year timeline for an ambitious SaaS startup today, in terms of funding, headcount, and ARR (annually recurring revenue).

In the sections which follow, we will present a case study that illustrates each of our four archetypes for US expansion. In each case, we will explore how headcount and revenue metrics might break out between Europe and the US.

Journey from Founding to Listing for a SaaS startup

B2B Compass

Compass Archetype

Illustrative journey from Founding to Listing

Archetype

Compass

Compass

Collibra - A playbook for European enterprise SaaS success

About: Collibra helps organisations unlock the value of their data, turning it into a strategic asset.

Founded: Brussels, 2008

Fundraising:

2009 €1.2M Seed

2012 €1M Series A

2015 $23M Series B (Index)

2017 $50M Series C

2017 $58M Series D

2019 $100M Series E

Fundraising to date: $234m, Series E

US as % of TAM: >50%

US % revenue: >50%

Headcount split: 660. 50% US, 40% Europe, 10% RoW

GTM: Enterprise sales

Leadership location: COO moved to US after Series A, and CEO after Series B. Entirely US now

Engineering location: Entirely Europe. US engineering centre planned for 2020

Founder location: New York

Founder/CEO: Felix Van de Maele

Built out of Europe (2008-11)

Collibra was building a new category of enterprise software, which required early-adopter customers. They found five early European test customers, including international banks in London, but the founders always knew that the US was the real prize.

Early US Traction (2012-14)

Collibra began to sell remotely into the US, sponsoring conferences and sending over team members to attend. They added 10-12 new clients this way, servicing them remotely.

In 2013, to ramp up US sales, they set up a New York WeWork office, with a team of five. New York was the obvious location, since at the time they were primarily selling into banks.

Co-founders Stijn (COO) and Pieter (Chief Science Officer) relocated, with co-founder Benny (VP sales) also spending 60% of his time there.

The biggest difference in the US is that enterprises see the value of paying more for software. We saw more US traction once we were present in NY, and were able to close our first $1m deal.

Felix van de Maele

CEO & co-founder

Felix, CEO, stayed in Belgium, overseeing engineering & product. He was too immersed in day-to-day product decisions to be able to also move to NY.

The first 10 US hires were AE’s - individual contributors, rather than managers. With hindsight, it was clear that these were mis-hires. The company lacked the capital, or brand-name investors, to give it credibility to hire the talent that was really needed. Furthermore, they found it challenging to evaluate US candidates - something that other European founders have also admitted.

Everyone appears to be amazing. We used to ask candidates how they rated themselves on a scale of 0-10. In Europe people would say between 6 and 8. Iin the US they were giving us 11’s and 12’s!

Felix van de Maele

CEO & co-founder

Commitment and Scaling (2015-17)

In 2015, following an Index-led Series B, Felix moved to NY. He was already in the US 50% of the time, and by this point, he had been able to relinquish his product responsibilities.

Pre-Index, we were pretty much bootstrapped. It was only post-Index that we could properly scale, with the mental shift to create a really big company.

Felix van de Maele

CEO & co-founder

Everything is much more expensive in the US - everything. Salaries, housing, office space, travel. So you need decent fundraising first.

Felix van de Maele

CEO & co-founder

Knowing how to hire effectively in the US was a challenge, as was localising HR policies and practices established in Europe. Hiring a Chief People Officer, Jarlath, in 2016 was extremely valuable. Originally European, he could effectively translate cultural expectations.

The European team used to share hotel rooms at conferences - a practice that was not common for US employees.

Jarlath Doherty

Chief People Officer

Collibra was scaling beyond a level that any of the European leadership had experienced. To prepare for the next growth phase, Felix hired seasoned US global functional executives, including a CFO, CRO, and CMO. All these hires had an international flavour of some kind - having lived in London, run global teams, or worked at European companies.

International outlook or experience is a key criterion for all our exec hires. And these types tend to be attracted to us too.

Jarlath Doherty

Chief People Officer

In 2020 Collibra set up a secondary hub in Atlanta, a much lower-cost location than NY, with strong talent pools across SDRs, customer success, plus marketing and finance ops.

The understanding of SaaS selling, including customer success, is way better in the US. There is still cloud hesitancy in Europe, and more of a licence orientation.

Felix van de Maele

CEO & co-founder

Product & Engineering Leadership (2018-20)

The product function was still entirely located in Belgium, close to engineering. Felix communicated and translated market requirements to this team. But with a 500 person organisation to lead, and a majority of US-based customers, this became unworkable. A Chief Product Officer was hired in the US in 2018. There is now a small but experienced team of customer-facing product managers in the US, to complement the engineering-facing team in Belgium.

It has been important to have product people close to sales, to make sure that what we’re promising is deliverable.

Jarlath Doherty

Chief People Officer

All engineering to-date has been located in Europe (Belgium, Poland and the Czech Republic). However, with a team over 200 strong, Collibra had to search in the US for a CTO with the requisite experience, who will soon also be opening a US engineering centre.

Balancing cultures, levelling and communicating

Making sure that teams across all offices felt valued has been a constant challenge. Poland used to feel secondary to Belgium. Later, with the move of Felix and decision-making to NY, morale in Belgium fell.

The leadership has learnt the importance of being thoughtful in its efforts to level the playing field. They pay careful attention to the locations of all-hands, board meetings, offsites, etc.

Collibra introduced core manager training that included cultural awareness content to create a common internal language and approach. Four day long global employee summits were held each year, in ‘neutral’ locations - Vancouver, Malta, Lisbon, New Orleans - which promoted bonding and unity.

Collibra’s top tips for European founders looking at US expansion:

Make sure you have PMF (product market fit) before you move

You can achieve a lot through travel

Raise a big round before you expand

Have investors that understand the US and can help you scale

Be prepared to make mistakes, but fix them quickly

B2B Anchor

Anchor Archetype

Illustrative journey from Founding to Listing

Archetype

Anchor

Anchor

Spectacular global success, anchored in Amsterdam

About: Adyen is a global payments company that allows merchants to accept e-commerce, mobile, and point-of-sale payments.

Founded: Amsterdam, 2006

Fundraising: 2011 €16M Series A (index)

2014 $250M Series B

2015 $50M Venture Round

Fundraising up to listing: $316m, Series C

Listing: June 2018, Euronext (Amsterdam)

US as % of TAM: <30% for cross-border payments

US % revenue: 30%

Headcount split: 1,200. 75% Europe, 17% US, 8% RoW

GTM: Enterprise and mid-market sales

Leadership location: Entirely in Amsterdam (except for COO)

Engineering location: Entirely in Amsterdam

Founder location: Amsterdam

Founder/CEO: Pieter van der Does

Starting small with a long term vision (2006-10)

Adyen was founded in Amsterdam in 2006, by a founding team with deep experience in the payments sector. They built an end-to-end payment platform, optimised for a wide range of international payment methods. The company went into hypergrowth early on, resonating particularly with e-commerce clients.

Adyen opened a small office in Boston, in 2008, hiring someone from their network to help with the set-up. Although this was very early from a commercial point of view, it was necessary in order to acquire US regulatory licenses.

European companies understand how to operate in a complex environment (legislation, currencies, etc) early on, so expanding to the US is less of a leap.

Ingo Uytdehaage,

CFO (since 2011)

Commitment: US Leadership (2011-15)

In 2011, following their Index-led Series A fundraise, Adyen realised that they needed to be closer to key US tech players on the West Coast. A small SF office was opened at the end of 2012 - a couple of salespeople with payments experience were hired locally, supported by someone from Adyen’s Amsterdam team. Uber was their first big tech account, with Adyen chosen to process all non-US payments.

They then conducted a search for a heavyweight US president, and in 2014 hired Kamran Zaki, previously global payments lead at both Netflix and PayPal. Kamran’s product and merchant experience made him the perfect fit for the role, and also resonated well with customers and talent. Roelant (employee #15 and CCO) moved to SF for Kamran’s first year, which was critical for helping him to ramp up. After Roelant returned to Amsterdam in 2015, Sam Halse (COO from 2011-19) went to SF in his place. All executives, including Pieter (CEO), made regular visits to the US.

Having a member of our Management Board based in the US continuously from 2014 [Roelant and then Sam], working alongside Kamran, was critical to ensuring our success there.

Ingo Uytdehaage,

CFO (since 2011)

European IPO (2016-18)

Although Adyen had originally planned a NY listing, they found that institutional investors (even from the US) were open to an Amsterdam one. They could see other advantages to listing in Europe - a scarcity of opportunities to invest in tech stocks, and inclusion in the main index, which would not have been the case in NY. It also positioned them next door to their banking regulator. All this shifted their decision towards listing in Amsterdam, and they haven’t looked back. With a market capitalisation in excess of $40bn, Adyen has set a new bar for the ambitions of European B2B tech companies.

More than 50% of the institutional shareholder register is US-based... Adyen proves that if you have a great business, then exchange location doesn’t matter.

Jan Hammer

Index Ventures

Global P&L but leadership in Europe

Adyen operates as a unified company, with a single global P&L. The leadership team sits in Amsterdam with the exception of Kamran, who in 2020 stepped-up from US President to become COO.

As the company has scaled, they have hired and relocated experienced leaders into Amsterdam, from the US and elsewhere. As an international hub where almost everybody speaks English, they haven’t felt disadvantaged in attracting the right calibre of people.

Culture and Collaboration

Adyen prides itself on being a global company, and they never talk about Amsterdam as an HQ. They encourage all employees to travel and move between offices, with an extremely empowering travel policy. T&E is their second biggest cost item, after salaries.

Roles and responsibilities are more fluid than is typical in the US. Working across timezones can create tension and misunderstandings, so Adyen has a core principle of “don’t hide behind email.” They continuously communicate why picking up the phone is so important, which is particularly important for avoiding language miscommunications. Investing in communication tools like Zoom has also made a big difference.

Adyen’s top tips for European founders looking at US expansion:

Start early if you have regulatory barriers to overcome.

Locate yourself close to your key customers.

Hire local leadership, but make sure they are aligned with your long-term vision.

Don’t assume that a US listing is the only, or even the best, way to go.

B2B Pendulum

Pendulum Archetype: Illustrative journey from Founding to Listing

Pendulum Archetype

Illustrative journey from Founding to Listing Sample size = 47

Sample size = 47

Archetype

Pendulum

Pendulum

Global leadership for a global company

About: Criteo is the global leader in digital performance display advertising, partnering with over 3,000 international advertisers to deliver highly-targeted campaigns.

Founded: Paris, 2006

Fundraising: 2007 €3M Series A

2008 $10M Series B (Index)

2010 $7M Series C

2012 $40M Series D

Fundraising up to listing: $61m, Series D

Listing: September 2013, NASDAQ

US as % of TAM: 50%

US % revenue: 30-50%

Headcount split: 3,100. 62% Europe, 25% US, 13% RoW

GTM: Enterprise and mid-market sales, plus publisher partnerships on supply-side

Leadership location: Distributed across Europe and US, plus EVP Americas

Engineering location: Majority Paris, but also elsewhere in Europe and the US

Founder location Moved to Palo Alto, then to London

Founder/CEO Jean-Baptiste (JB) Rudelle, until 2019, now Chairman

PMF and Growth in Europe (2006-09)

The early years were a struggle, hunting for product/market fit. In 2008, Criteo found its business model, and raised a Series B led by Index. In 2009, revenue grew to €16m and headcount to 70, with mostly French customers, plus a few inroads into the UK and Germany.

At this point, we faced a decision; should we stay concentrated in Europe, or conquer the world - ie the US?

JB Rudelle

Chairman & founder (former CEO)

Ultimately, a decision in favour of US expansion was made, because there was a landgrab opportunity, with no embedded US competitor yet.

US clients favour local players enormously. As an outsider, you need a vastly better product to compete.

JB Rudelle

Chairman & founder (former CEO)

Commitment and teething pains (2009-10)

JB’s research found that European success in the US always involved the founder moving. His co-founders were both technical, so it made most sense for him to relocate, whilst they led the R&D team in Paris. By now, Criteo had strong sales and business development leaders in Europe, so JB felt he was leaving it in safe hands.

The US office was designed to be a commercial subsidiary, with JB’s role to seed the market. But the first 18 months proved extremely difficult.

Managing the US as a European is a complete shock. It took several years for me to understand how they work. You feel so European when you’re out there!

JB Rudelle

Chairman & founder (former CEO)

Criteo had only been able to sign US subsidiaries of their European clients. Closing Zappos proved to be a pivotal moment in changing perceptions.

JB pushed back against the US sales team who were arguing the need for major US product localisation. Being on the ground meant he had the local insight to know that this wasn’t as high a priority as they thought it was, which was critical for staying focused.

US Location and Leadership (2011-14)

The biggest early mistake in the US had been starting on the West Coast rather than the East Coast. This decision had been made for family, rather than for business reasons, and it created extra friction in terms of timezone and travel. Criteo’s US clients ended up being distributed across the US, so there was no advantage to being in Silicon Valley.

I would advise European entrepreneurs against setting up in SV. It is very shiny, but it is much harder.

JB Rudelle

Chairman & founder (former CEO)

I thought one advantage to being on the West Coast was that I could pilot APAC - but in reality, you’re no closer to Asia than you would be in Europe.

JB Rudelle

Chairman & founder (former CEO)

The team started to build across four hubs - Paris, London, Palo Alto, and New York. This was great for tapping into a broad talent pool, but it put a high burden on management time and personal lives.

Despite incredible growth, Criteo were still struggling to hire senior talent in the US, and supplemented with a landing team from Europe.

After closing 2010 with €70m in revenue, Criteo was able to make a transformative hire: Greg Coleman, who joined as US President, from the Huffington Post. He stayed until 2014 and rebuilt the US team, shifting the centre of gravity from Palo Alto to New York.

Greg had a media pedigree that could attract the best people.

Dom Vidal

Index Ventures

The distributed leadership model at Criteo persisted (in fact, through to today). JB was managing six direct reports in four locations. Functional teams (except for engineering) were also distributed. It required extreme trust, because you can’t micro-manage across continents. But despite the challenges, JB feels it could not have been any other way.

If the whole management team had been in Paris, I don’t think we would have been able to hire Greg, and there were certain skill-sets that just didn’t exist in Europe. But having the leadership entirely in NY wouldn’t have worked either - as a European company, the people you are able to hire in the US are lower quality than those you can access in Europe.

JB Rudelle

Chairman & founder (former CEO)

The key to making the distributed model work was having a very clear vision of what needed to be achieved, and being crystal-clear on KPIs. In 2011, Criteo closed on €140m revenues, growing to €270m in 2012.

This pace of scaling with a distributed team was only possible because we were focused on 1 product, which had already achieved great product market fit. At an earlier stage, you need lots of iteration, and later on, you need to diversify.

JB Rudelle

Chairman & founder (former CEO)

The US is now the largest region for Criteo, but revenues are globally spread, including significant contribution from JAPAC.

IPO (2012)

In 2012, Criteo went public on Nasdaq. The primary reason for choosing the US was to be seen as a local player. It opened doors in the US that had been closed before.

Strangely, it was much harder for us to get a CEO meeting in the US than in Japan. In Japan we were doing something different, but the US adtech space was just too noisy.

JB Rudelle

Chairman & founder (former CEO)

JB has continued to move locations, according to the priorities of the company, and his personal preferences. He was in London from 2012-14, then returned to the West Coast, and he is currently based in Barcelona.

Criteo’s top tips for European founders looking at US expansion:

Set up on the East Coast unless you have a very clear reason for being in SF. Time-zone is brutal.

A founder must move over.

Hire the best leadership talent you can, no matter where they are located.

B2B Telescope

Telescope Archetype: Illustrative journey from Founding to Listing

Telescope Archetype

Illustrative journey from Founding to Listing

Archetype

Telescope

Telescope

Barcelona base, with strategic partnering in Silicon Valley

About: Typeform helps brands & communities have meaningful conversations through a suite of interfaces where people exchange information in a fun and engaging way, and without the need for a single line of code.

Founded: Barcelona, 2012

Fundraising: 2014 €1.2M Seed

2015 €15M Series A (Index)

2015 $35M Series B

Fundraising to date: $51M, Series B

US as % of TAM: >50%

US % revenue: 40-50%

Headcount split: 289. 79% Spain, 11% US, 10% RoW

GTM: Self-serve mostly, some inside sales

Leadership location: All in Barcelona, except VP Business Development (VPBD)

Engineering location: 72% in Barcelona, 24% Remote, 4% in the US

Founder location: Barcelona

Founder/CEO: CEO: Joaquim Lechà

Co-founders: David Okuniev & Robert Muñoz

Early attempt at US expansion

Typeform, born and based in Barcelona, saw a huge opportunity in the US. From the outset, and through to their US expansion, the US has been their largest market, although less than 50% of revenues or users. In the run up to raising a Series B, the company started forming their expansion plan.

They explored the pros and cons of being in San Francisco, New York, Denver, Austin, Atlanta, and Phoenix. They decided on San Francisco for access to potential partners, and the start-up ecosystem. Typeform sent over a few European employees as a landing team, including their customer success lead. However, there wasn’t a clear objective behind the expansion - supporting US customers, trialling inside sales, or partnering? This became clearer as they made a number of US hires. Typeform regrouped, and has now hired a small team of experienced specialists in the SF office, focusing on product & reseller partnerships, and on developer advocacy around their API offering.

It’s very important to have a general manager who possesses the skills you actually require. You can support culture by sending people from your HQ to the US. But do not optimise for culture first, unless you are creating an office with 50+ people.

Robert Muñoz

Co-founder

Almost all our important partners or potential partners are in the US (eg Mailchimp, WordPress), and many of them are in the Bay Area - Slack, Intercom, Hubspot, Salesforce, etc. Being here gives us credibility and a chance to form deeper, personal relationships with the key people.

Francois Grenier

Head of Tech Partnerships

Renewed US strategy

This new strategy made very clear what the team needed in a US leader, and it was a profile that they neither had in the Barcelona team, nor one that was accessible there.

We have reshaped our strategy to focus on partnerships. We started too wide with the US, trying to build a critical mass there, without realising why we were doing it.

Robert Muñoz

Co-founder

They had the benefit of a very well-known and respected brand, which helped them to hire a seasoned partnerships lead in San Francisco, with previous experience at Hubspot.

Hiring our Global Head of Business Development in the US is proving to be critical. Now, with bigger goals and clearer plans, we are strongly considering having a more full stacked team in the US.

Joaquim Lechà

CEO

Getting meetings with decision-takers in companies we would like to partner with has been easier than we expected.

Joaquim Lechà

CEO

Their US team is about 20 strong, and growing. The SF team is focused on partnerships, resellers, developer advocacy, and product marketing. These are all areas where being in SF is necessary to access the ecosystem, and talent with relevant experience. They have also hired a few engineers, who focus on technical integrations with partners. Customer support also has a number of people in the US, although these are remote, rather than being centralised, or in SF.

Having support coverage in the US has been critical for our success and reputation here.

Nicolas Grenié

Developer Advocate

Typeform’s growth since day one has been powered by growth mechanics and bottom-up adoption, including a high degree of product virality. As the company has matured, it has broadened its product offering. They are now experimenting with selling company-wide licences, and have hired an inside sales leader in SF to lead this effort.

Leadership in Barcelona

The rest of Typeform’s leadership remains in Barcelona. They have been able to relocate experienced talent from elsewhere in Europe and the US, supported by their brand, design ethos, and the attractiveness of Barcelona as a place to live and work.

In Barcelona we do not have that many SaaS experienced professionals who have ‘been there and done that’. Therefore it is necessary to relocate them so that we can learn and scale our business faster.

Joaquim Lechà

CEO

B2B Transplant

Although the Transplant archetype is outside of the scope of this book, it is instructive to explore why founders have chosen it.

Archetype Transplant B2B

European founders who relocated early, and built a global leader in San Francisco

About: Zendesk is a customer service software company.

Founded: Copenhagen, 2007

Fundraising: 2008 500k Seed Round

2009 $6M Series A&B

2010 $19M Series C (Index)

2012 $60M Series D

Fundraising up to listing: $86M, Series D

Listing: May 2014, NYSE

US as % of TAM: >50%

US % revenue: >50%

Headcount split: 4000. 50% US, 24% Europe, 26% RoW

GTM: Mix of enterprise and inside sales, plus self-serve

Leadership location: All US based

Engineering location: Initially all in the US, but now multiple engineering sites (Dublin, Copenhagen, Krakow, Singapore, and Melbourne)

Founder location: San Francisco

Founder/CEO: Mikkel Svane

Expansion to access funding, customers and talent

When Zendesk was founded in a Copenhagen loft in 2007, the startup climate in Europe was very different to today. There was very little infrastructure, and no strong B2B role models. They acquired a small but highly engaged customer base through a self-serve model, which was growing fast. They had no permanent employees at this point.

No Danish lawyer had even seen a venture term sheet back then!

Mikkel Svane

CEO & Founder

The three co-founders Mikkel, Morten (CTO), and Alexander (CPO), tried to raise funding in Europe but were unsuccessful.

Index was the only proper VC in Europe, and you turned us down at Series A!

Mikkel Svane

CEO & Founder

(Yes, we make mistakes, and we try to draw lessons from every one of them)

The US investors they spoke to made it a condition that they move to the US. All three co-founders relocated to Boston, raising a Series A from Charles River Ventures. After they flipped the company to a Delaware topco, Benchmark pre-empted a Series B.

After this fundraise, they moved to San Francisco, to be a part of the local ecosystem, and to access start-up talent.

Silicon Valley has far higher talent quality and density than anywhere else on the planet. Even people who are mediocre here would be considered stars in Europe, across all roles.

Mikkel Svane

CEO & Founder

Taking advantage of European roots

Zendesk capitalised on being a European-born company, celebrating their Danish heritage as part of their brand.

We are not a US company - we have broad international DNA because of our roots. Half of our revenue is outside the US, and the same with our employees.

Mikkel Svane

CEO & Founder

Zendesk was also steadily moving towards larger deals, building teams initially for inside sales, and then enterprise sales. Self-serve acquisition was a smaller proportion of the overall business. Pre-Series D, with a global team of 60 and 2,500 EMEA customers, they hired a VP EMEA based in London, to drive sales expansion.

As their team grew, and the SF engineering talent market got tighter, they opened a Copenhagen engineering centre in 2011, and another in Dublin in 2012.

Zendesk now has almost 1,000 employees across Europe, a quarter of their global workforce.

The Archetypes in B2C

Tech journalists in Europe love to ask “Why don’t we have any tech giants at the scale of Google, Amazon or Alibaba?” Europe is fragmented by language and regulations, and these twin challenges aren’t going to disappear any time soon. They slow down blitzscaling relative to B2C startups in the US or China. Some specific friction points they generate are:

Localisation

Brand-building

Word of mouth marketing

Network effects

Physical distribution

These same issues conversely create a ‘moat’ against US entrants, and there have been multiple pan-European B2C winners. For example, Just Eat Takeaway, Delivery Hero, Zalando, and Deliveroo. But scale is inevitably limited if you are not operating in the world’s two biggest global markets.

It would have been hard to convince brands, customers and investors that we were a global marketplace if we didn’t have the US.

Andrew Robb

Former COO, Farfetch

However, there are many B2C sectors where Europe has inherent advantages, and in these we have seen the emergence of global tech category leaders:

Music

Sweden offered labels a low-risk laboratory for adapting to streaming (Spotify).

Gambling

US laws were restrictive for domestic startups (Betfair, Fanduel, Bet365).

Luxury

Europe globally dominant for both supply and talent (Farfetch).

Travel

A huge category in Europe, particularly cross-border (Booking.com, Skyscanner).

Gaming

Language much less of an issue, and global distribution through app platforms (King, Supercell, Rovio).

Money transfer

High cross-border charges in Europe made it ripe for disruption (TransferWise, Revolut, WorldRemit).

Telecoms

Expensive international calling across Europe offered consumers huge cost savings (Skype).

Ride sharing

US cultural anxiety about riding with a stranger, relative to Europe (BlaBlaCar).

European B2C founders with global ambitions would be wise to identify and target categories where they can leverage their European home base, versus being held back by it.

Historically, European startups have sold up before they could reach massive scale. Otherwise they have ended up listing in the US. But ambition is increasing year upon year. If built in Europe today, we can be confident that Booking.com would not be sold for $135m (Priceline 2005), or Skype for $2.6bn (eBay 2005).

Another feature of many globally successful European B2C startups is to scale ‘via London’. In effect, these companies have followed a modified ‘Compass’ archetype, establishing GTM and leadership in the UK rather than the US, but with R&D teams based elsewhere in Europe. In many cases, one or more of the founders was based in London from day one (Farfetch, King, Revolut, TransferWise). In others, the centre of gravity shifted over time (Skype, Spotify, Just Eat). This partially reflects the access to customers, talent, and investors that London offers, relative to elsewhere in Europe - although these advantages are narrowing over time, as other major tech hubs emerge across the Continent. But beyond that, the UK offers an attractive test-case ahead of US expansion - English-speaking; closely aligned to the US in terms of culture, and legal framework; physically accessible; but lower-risk in terms of capital requirements for launch.

The UK can be a great on-ramp to test product propositions and branding, before you take on the US.

Danny Rimer

Index Ventures

Marketing talent in London is used to running international campaigns.

Andrew Robb

Former COO, Farfetch

Digital pure-plays, where acquisition and fulfilment don’t require boots on the ground, usually follow the Telescope model, only building a small US team. Businesses which involve physical distribution, such as e-commerce, or with regulatory hurdles, tend to be Anchors; they need to mirror their operating models within the US, with a strong local leader and a multi-functional team. These types of companies are also capital-intensive, so they tend to expand to the US at a later stage of maturity, when they have proven unit economics. If they scale beyond 30% US revenues, pressure develops to evolve from the Anchor archetype to the Pendulum, with leadership distributed across Europe and the US.

As predicted by these archetype journeys, no founders of B2C outliers from Europe have fully relocated to the US - it’s just not an essential requirement for success. Conversely, there are no examples - at least not yet - of successful B2C Compasses, which do require a founder move.

Given the different balance of B2C versus B2B companies falling into the different expansion archetypes, we will present B2C case studies in a different order:

- Telescope - King

- Anchor - Farfetch

- Pendulum - Spotify

Archetype

Telescope

Telescope

Built in Europe, closely connected to strategic partners on the West Coast

About: King is an interactive entertainment company creating mobile games including the Candy Crush franchise.

Founded: Stockholm and London, 2003

Fundraising to listing: $9M

Listing: March 2014 on NYSE, then acquired by Activision Blizzard in November 2015 for $5.9bn

US as % of TAM: >50% (for revenue not users)

US % revenue: >50%

Headcount split: 2660. 12% US, 80% Europe, 8% RoW

GTM: Mobile app platforms

Leadership location: Europe (London and Stockholm)

Engineering location: Multiple engineering centres in Europe

Founder location: London through to present

Founder/CEO: Riccardo Zacconi until 2019

Building out of Europe

King was founded in 2003, with product and tech in Sweden, and commercial and marketing based in London. King’s early years were as an online casual gaming portal. They started marketing web based games through distribution partnerships. These would see games embedded with a co-brand in the online properties of their partners. The first partners were in Germany, and in 2005 they signed an exclusive deal for Europe and the US with Yahoo, the largest portal at the time. To manage these distribution partnerships, they first opened an office in Germany, and then in the US. This was in Los Angeles, initially led by a British expat who already knew the King team. By 2006, Yahoo US was their largest distribution partner, and King became their largest partner in games.

In 2009 the business was disrupted by the exponential growth of Facebook; Yahoo games lost 40% of their users in one year. They had to go all-in on cracking Facebook. They put half the development team on reinventing how to bring games to market on the Facebook platform. The other half maintained the existing business and revenues to sustain the company. Reinvention also meant bringing in highly-experienced marketing talent in London in 2010 and in 2011, and closing down the marketing-focused office in Germany.

After two and a half years of experimentation they finally landed their first successful game on Facebook in April 2011, Bubble Saga. With a second Facebook game, Bubble Witch Saga, they learned more about how to monetise and market on Facebook. The game climbed up the rankings to become the largest Facebook game in terms of players within a year. In 2012 they launched Candy Crush Saga, first on Facebook web and later in the year on mobile. As Candy Crush Saga started growing exponentially, they fuelled the growth by massively ramping the marketing, up to $100m investment per quarter. Candy Crush Saga became the world’s top grossing mobile game. From the outset, the US accounted for a majority of revenues and they focused a large part of the marketing budget on the US, including working with US ad agencies for TV commercials.

Stephane was introduced to Riccardo in 2010 by investors, Apax, as a seasoned operator who they knew and respected. He joined just ahead of the release of Bubble Saga.

King tried to keep efficiency high by centralising engineering in Sweden. But as they outgrew the Stockholm talent pool, they opened engineering centres in London and Barcelona in 2013-14. They opened additional gaming studios in Malmo (2011), plus London, Barcelona, and Bucharest (2013-14), and acquired studios in Seattle and Singapore.

Gaming is one of the hardest industries to crack, because it requires a blend of creative, quantitative, and engineering. To get these three constituencies aligned and working for the business is challenging.

Stephane Kurgan

Venture Partner at Index Ventures, and former COO of King (2011-18)

US strategy

King’s primary goal for US expansion in 2013 onwards was to become the most influential content partner to their key distribution platforms - Apple, Google, and Facebook. Rather than Los Angeles, they now needed a small but senior team in the Bay Area, who had close relationships with the tech platforms. In 2014, King was able to hire two platform partnership leads, including the highly respected former Head of Platform relations from Zynga, who built out the remainder of the partnership team.

The only reason for gaming businesses to have local offices is for distribution partnerships - and this doesn’t need large teams. This basically means the US and China.

Stephane Kurgan

Venture Partner at Index Ventures, and former COO of King (2011-18)

Starting in 2013, the CEO and COO would travel to the US for quarterly platform meetings. It took a while to establish this rhythm, but it enabled them to forge close relationships. The discussions allowed a valuable sharing of thinking about platform product roadmaps, based on a raft of data collated by King’s partnership team.

They really appreciated our data, even though we stripped the numbers themselves from our charts. They were interested to learn from us.

Stephane Kurgan

Venture Partner at Index Ventures, and former COO of King (2011-18)

The rest of the business team remained mostly in London, and this worked well. The greater challenge was scaling and managing the technology and studio teams across multiple locations.

The US team increased, including some studio and technical staff, but in total it still remains below 10% of global headcount.

The London advantage

King found it very effective to build out of London, particularly due to the availability of world-class talent in performance marketing, media and advertising. Collaboration between the marketing and product teams was essential when it came to the mechanics of player reactivation and viral growth. This reinforced the decision to keep marketing centralised in Europe, rather than hiring locally in the US.

Most of King’s leadership team was hired from within Europe. The European gaming sector has a strong talent pool, which made this possible. However, as they prepared for an IPO in New York, they found an experienced CFO in the US, who relocated to London.

Archetype

Anchor

Anchor

Farfetch is the leading global platform for the luxury fashion industry

About: Farfetch is the world’s biggest online marketplace for independent fashion boutiques.

Founded: Porto and London, 2007

Fundraising: 2010 $4.5M Series A

2012 $18M Series B (Index)

2013 $20M Series C

2014 $66M Series D

2015 $86M Series E

2016 $110M Series F

2017 $397M Corporate round

Fundraising to listing: $952M

Listing: September 2018, NYSE

US as % of TAM: c.30%

US % revenue: US largest market, but % undisclosed

Headcount split: c.4,500. 5% US, 90% Europe, 5% RoW (estimates via LinkedIn, unverified)

GTM: Primarily online marketplace

Leadership location: London & Porto, plus regional leads including US President

Engineering location: Majority in Porto, but also London and Sao Paolo

Founder location: London through to present

Founder/CEO: José Neves

Started in London and Porto

The company was founded by José in London (where he was living), and Porto (where he was from). Europe dominates in luxury fashion, and José had a rich network from his previous shoe-focused startup. Launching in 2008 during an economic downturn helped, because retailers were under pressure, and were drawn to Farfetch as a route to increase sales.

Farfetch began life with supply from boutiques in five countries, but with customers from across the globe.

We always saw Farfetch as a global marketplace. And the US is ¼ to ⅓ of the global luxury goods sector, so we anticipated it being our largest market.

Andrew Robb

Former COO

Pre-Series A, and with minimal localisation, the US was already the top market. The key was offering curated access to exclusive stock - with good pricing, and ‘good-enough’ logistics. This proved to be enough of a draw for customers, despite hassles with duties and import taxes.

The key is whether you have a strong enough proposition to win.

Andrew Robb

Former COO

Customer acquisition was a mix of affiliates and performance marketing. For branded goods, there was an SEM/SEO focus, and for non-branded, it was more about building the Farfetch brand and social media strategy. London was an excellent base for digital marketing expertise.

Entering the US via a joint venture

Having a physical US presence was deemed strategically critical by José, to avoid US-based copycats from locking them out, and also to secure US boutiques on the supply side.

One of our values is ‘Think Global’. We needed it in our DNA to succeed. This pushed us to go deeper as we scaled.

Andrew Robb

Former COO

Once established, the supply-side is fairly defensible - big luxury brands want to be be seen together with their peers.

Andrew Robb

Former COO

The initial US scaling was done through a joint venture. In 2009 (pre Series A), Farfetch signed a 50/50 JV with Revolve, a $1bn GMV bootstrapped fashion e-commerce business in LA. José found himself seated next to Michael, one of the co-founders of Revolve, at a dinner, and they clicked. José invited him to the Farfetch launch, after which they wrote out terms for a US JV on a napkin. José flew out to LA the following week to sign the deal. Revolve provided logistics and equity funding, and Farfetch provided the supply, brand, and tech. José and Michael jointly banged on the doors of top US boutiques to sign them up.

The hardest thing about the US is finding a good leader - the JV solved that for us.

Andrew Robb

Former COO

Management of the JV was purely driven by José and Andrew - which involved lots of travel, but minimised disruption for the rest of the Farfetch team. Revolve sold their stake steadily as Farfetch scaled (Series B-D), making the JV a win-win.

LA was chosen simply because it was Revolve’s base.

LA’s not a recognised fashion hub but it does have cost-advantages.

Andrew Robb

Former COO

Scaling the Team in Europe

Fashion talent can be largely found in Europe. But as they uplevelled their leadership, Farfetch always ran global searches including the US. The CPO and CMO both relocated from the US.

Farfetch kept almost all development in Portugal. They ramped up recruiting efforts from domestic universities, supplemented in particular by relocating engineers from Brazil. The product team was mostly in London, together with data science.

US Scaling

For the US, the team began to build local leadership, first in Customer Service, and then in Private Clients, in 2014.

It took a certain type of person to fit with our model - someone ok with late-night calls and global travel.

Andrew Robb

Former COO