Destination Europe

The Founder’s

Guide to European

Expansion

- Share this handbook

- X.com

- Product hunt

Index Ventures

Technology will have a profound impact on every aspect of our lives. What we have seen to date is just the beginning.

We are a venture capital firm spanning the US and European startup ecosystems. The entrepreneurs we work with are creating the next generation of iconic companies, and include luminaries such as Pieter van der Does (Adyen), Drew Houston (Dropbox), Samir Desai (Funding Circle), Ilkka Paananen (Supercell) and Stewart Butterfield (Slack).

Our eclectic experience, insatiable curiosity, and unique point of view are driven by a common purpose – to make a positive contribution to the world.

We love the process of exploring and understanding entrepreneurs’ ambitions – from seed, to venture, to growth. We help to harness and focus their energy, expand to the next level, and bring their visions to life.

We only back the hungriest and most aspirational startups. If you feel ready to join our international network of founders, investors, creators and operators call us, and let’s begin the conversation.

April 2017

The Index Ventures experience

Our unique insight

This handbook will help you internationalise from the US to Europe. It’s packed with useful information to get started, quotes from people who have successfully made the transition, and a selection of case studies.

Working in Europe is not just about work. It’s about identity, tradition, style, provenance, and socialisation that revolves around food and drink. You will need to learn the nuances of different cultures and languages which – despite globalisation – influence everything from communicating brand, to recruitment, to marketing, to legal issues.

The companies we invest in span multiple sectors and go-to-market models, including Enterprise Sales, Inside Sales, B2C, Business Services, Adtech, hardware, infrastructure and Fintech. While startups also hire developers or development teams in Europe, we have primarily focused on commercially oriented expansion.

And to help you get up to speed with the jargon, we include an acronym glossary covering US and European terminology in the appendix.

Successful expansions

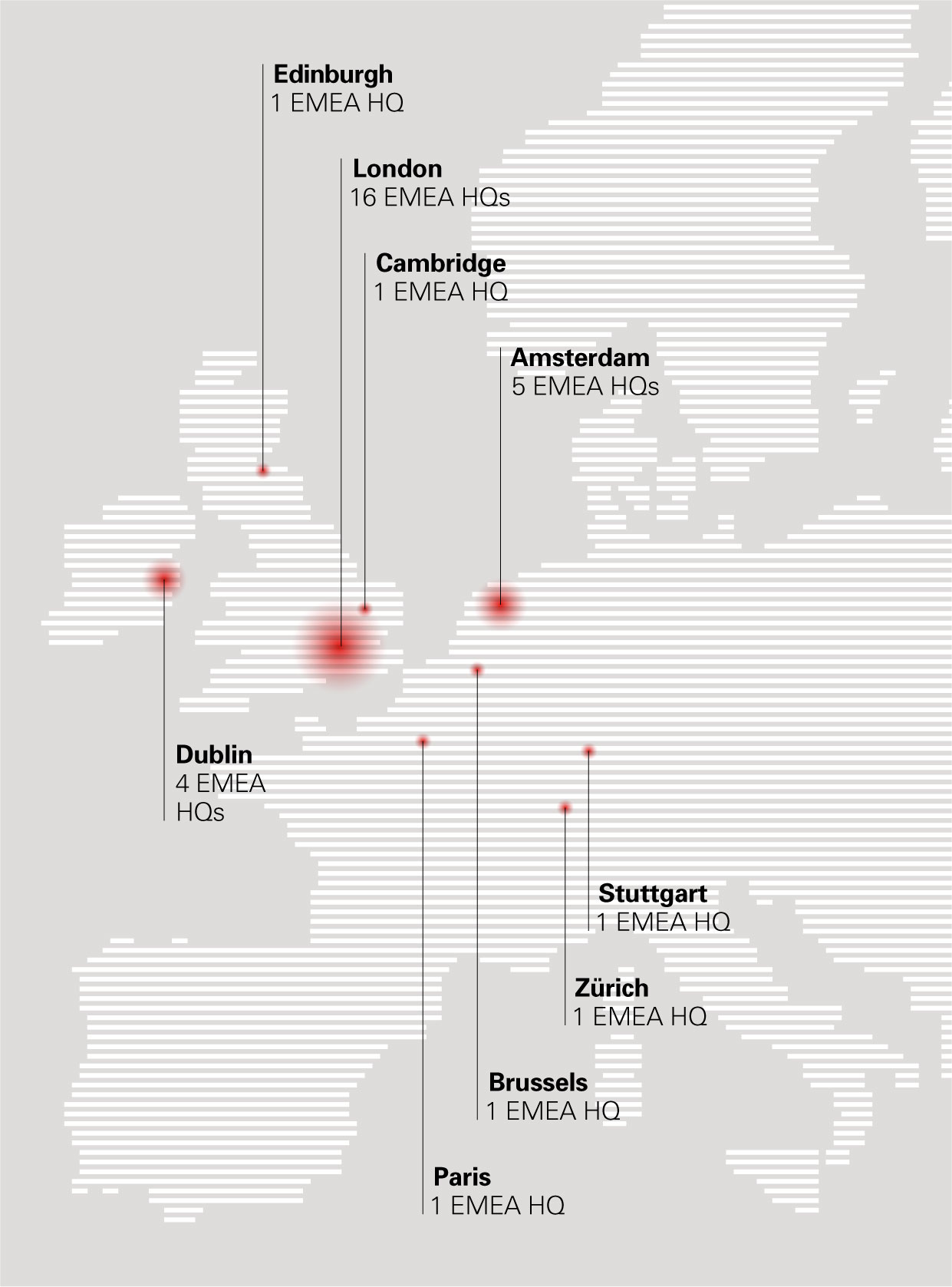

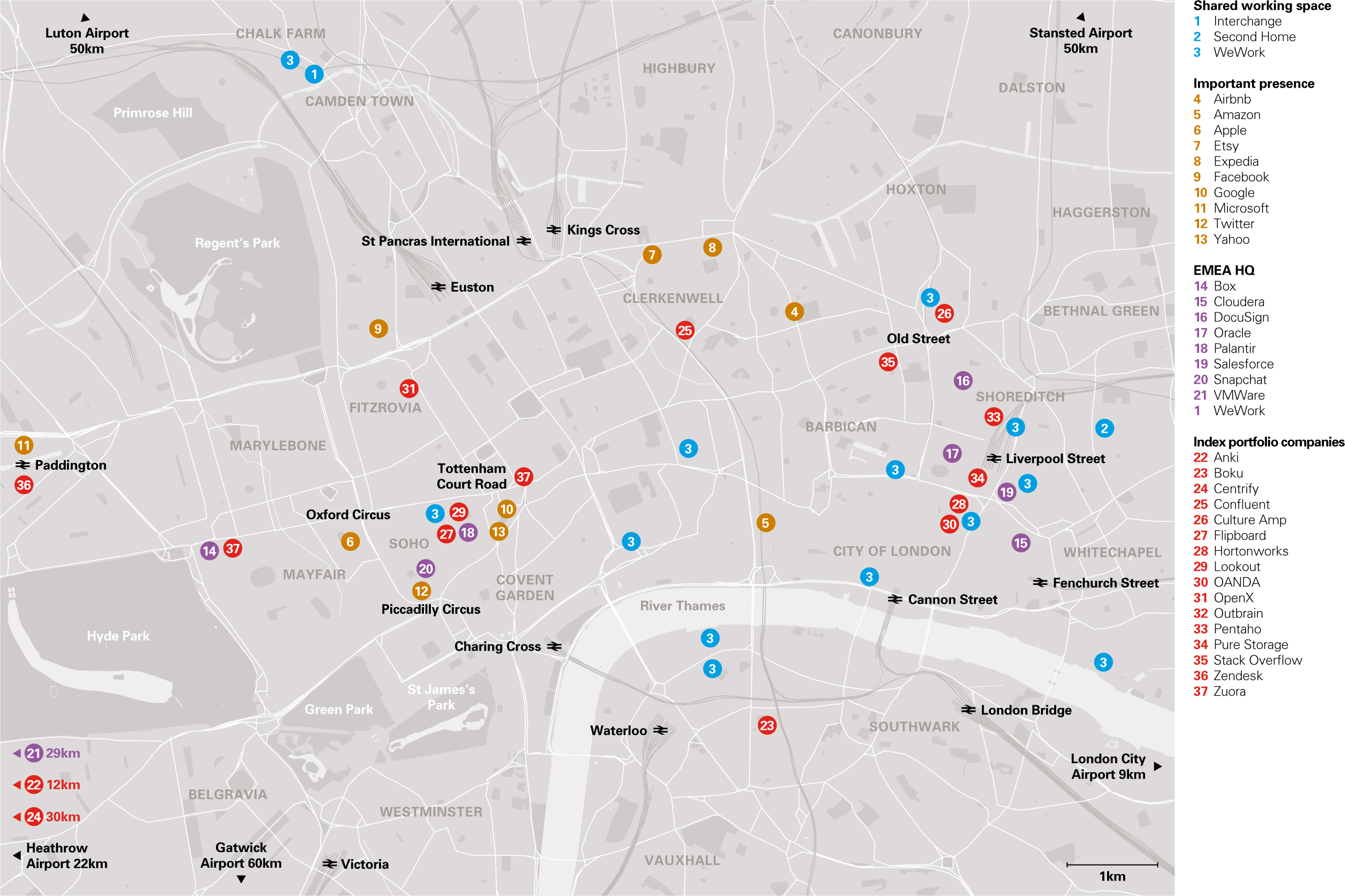

Thirty one Index Ventures backed companies have successfully set up in Europe. 16 have EMEA HQs in London. Five in Amsterdam. Four in Dublin. The other six are based in Zurich, Paris, Brussels, Edinburgh, Stuttgart and Cambridge.

London HQ

Anki

Boku

Centrify

Confluent

Culture Amp

HortonWorks

Lookout

Oanda

OpenX

Outbrain

Pentaho

Pure Storage

Stack overflow

Zendesk

Zuora

Amsterdam HQ

Bitpay

Doubledutch

Elastic

Optimizely

Sonos

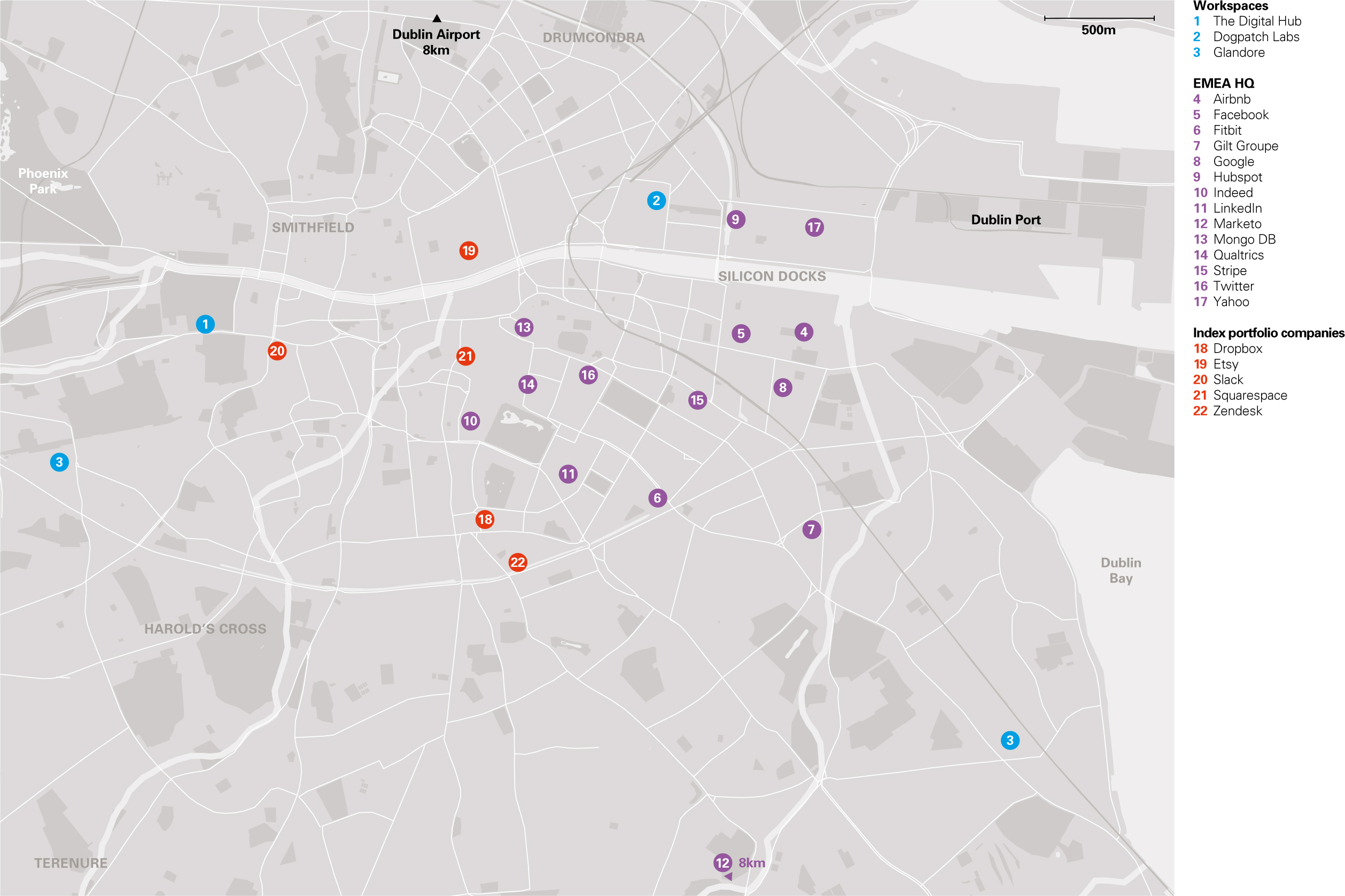

Dublin HQ

Dropbox

Etsy

Slack

Squarespace

Zurich HQ

Novus

Paris HQ

Datadog

Brussels HQ

Collibra

Stuttgart HQ

Zend

Cambridge HQ

1stdibs

Edinburgh HQ

Right Scale

Why Europe?

Europe has 750 million consumers, mature innovation markets, and a love of new technology. There is a tremendous opportunity to do business in Europe and it’s a well-trodden path for US companies.

Timing and opportunity

Mature US tech companies typically make 30% of their revenues from Europe, so expansion is a question of – not if, but when.

Internationalisation most commonly becomes a strategic priority for companies post-B funding rounds. Companies sometimes work backwards from a potential IPO date, allowing three years to build out reasonable European coverage. They will already have European customers serviced out of the US, or a flow of Inbound Sales opportunities, so they need to assess the opportunities and risks of expanding.

Increasing sales

Roll out a successful sales approach across Europe to sustain and extend your revenue growth.

Land grab

Expand quickly to take control of new markets before competitors.

Servicing customers

Take advantage of time differences and offer 24/7 support to international customers.

Paradigms from our portfolio

Etsy

After a $40M fundraise, they expanded to gain a considerable footprint in the UK, Canada and Australia. Etsy’s strategy was to establish international markets by connecting local sellers to local buyers.

Dropbox

When Dropbox decided to focus on Enterprise clients, they already had a huge freemium user base in Europe, and the team knew that their second office would have to be there to continue scaling their customer base.

Elastic

Founded in Amsterdam, raised money in the US, Elastic was a distributed team from the start. They set up a UK entity in their first year of operation because they made a key senior hire in London.

Pure Storage

Pure Storage invested heavily in Europe to scale out fast and to be first-mover building out a network of channel partners. Within a year they grew to 120 employees with $40 million in revenues and opened offices in Paris, Amsterdam, Frankfurt, Munich, Milan, Johannesburg and Moscow.

Squarespace

Squarespace had been operating as a small business in New York for seven years before taking venture capital investment. This changed the scope and scale of the business and in 2013 they expanded to a Dublin office to effectively support customers.

Zendesk

Zendesk first built out a London office for Sales and Customer Support, then set up the Dublin office. The European offices helped service global customers by taking advantage of time differences. Local Account Managers were better able to help prospective customers trial and buy the software.

Stack Overflow

As the Stack Overflow Q&A platform grew, the company launched Stack Overflow Talent (originally named Careers) - a platform designed to fix the broken developer hiring process, and help software engineers find better jobs. Stack Overflow raised Series B funding, and set their sights on international growth; expanding to Europe to enter new markets.

Before making the leap to Europe, make sure that International expansion is a significant long-term company goal.

Nicole Vanderbilt

VP International, Etsy

The significance of International

For some companies, internationalisation is a key part of overall strategy and the Chief Executive Officer, Head of Sales, or Head of International may play a pivotal role in the region. For other companies, International can be seen as a bonus in the first few years.

It can take time for a US HQ to register how meaningful your market is. Once the EMEA revenues become a significant portion of global business, attitudes change.

Stuart Collingwood

GM, EMEA, Anki

At the time Zendesk in the US was focused on scaling, and Europe was seen as a bonus rather than a core part of the strategy.

Matt Price

Former GM EMEA, Zendesk

Hiring: who, when, how?

Making that first key hire

Who you choose to lead your European team will be crucial to the success or failure of your business. They will represent your company, attract the best hires, build a stellar roster of clients, and execute your go-to-market plan. Invest time in finding the right person who can build strong relationships.

Experience or potential?

Hire a Senior Leader. Ideally someone who has built a company or led a European business. He or she will set your hiring bar, and speed up your route to market using existing connections within the industry. There is a definable cohort of a few hundred individuals who have experience expanding US software businesses into Europe, many of them making a career out of doing just this.

Culture fit will be critical. If you can’t find an experienced candidate you feel comfortable with, a rising star could be an alternative. To offset the risk, recruit a senior Board advisor within the country to help with connections, relationships and advice.

How people negotiate their package will give you an indication of their readiness. For instance, if pension is a priority they may be better off at a bigger company.

Kevin Kimber

Former VP EMEA, Zuora

If you hire someone with less experience they will need to be supported with skills and local resources. They don’t know what they don’t know. For example, tackling employment issues in France, or data protection in Germany.

Simon Edelstyn

Former MD Europe, Outbrain

Do you need a captain or a player?

Larger companies with IPO aspirations tend to go for General Managers or Country Managers, while others may prefer a Vice President Sales to execute on a European go-to-market strategy. More cautious or less well-funded companies may take a more incremental approach, hiring a junior individual to test the waters, but hedging your bets in this way simply slows you down.

A General Manager or Country Manager will be given more autonomy and control over part of the strategy and local financials.

The ideal profile

Don’t compromise on entrepreneurialism or culture fit, but you may have to settle for someone without the scale or sector experience because European talent pools are thinner than the US.

It can be tempting to hire candidates from larger companies like Google, Salesforce, Oracle and IBM. However, make sure your candidate has had startup experience and is a hunter - not a farmer. In the beginning, leading Europe involves a lot of hustling and doing the job solo, so your candidate needs to be comfortable with that.

Depending on sector, you may look for a candidate who has lead large Sales teams, or a candidate with more of a product or marketing background. There is no ideal single profile.

Ask yourself – what will the region look like in a year? If you’re testing product market fit, you need a sales person. If your headcount will exceed 30 people, you need a GM.

Daniel Hyde

CEO, Erevena

From the 31 Index Portfolio companies who expanded from US to Europe:

The first hire made for the company had on average 13 years of work experience before joining.

10 companies hired MD/GM/ CM roles from the outset.

The average years of work experience for these candidates was 18, the minimum being 10 and maximum being 26.

6 companies hired senior Sales roles.

The rest of the companies hired for Customer Success, more junior Sales roles, or Marketing.

What can you expect?

Before making the hire, ask candidates to design a business plan. This will give you an idea of their vision and capability. Speak to people who have worked with them. If you have doubts, reach out to us for advice.

Look to your General Manager for European strategy, and input into the broader budget and timelines. Hire for local impact. Find someone who has the profile or the business relationships that will help you succeed.

What will they expect?

An experienced candidate will want chemistry with the Chief Executive Officer. They will want to know how much support they will get from HQ: Is the HQ team aware of ramp up times and budgets? How does the product roadmap relate to Europe? Will European customers be able to speak to security and data teams at HQ? And how many HQ teams will be available during European working hours?

The best GM EMEA candidates in Enterprise Sales are in high demand and get head-hunted every week.

Jerry Maynard

Director, 360 Leaders

Onboarding

Your General Manager should spend as much time as possible ramping up at HQ after being hired. Involve them in the business so they get a feel for your operations and culture, and can build relationships with the rest of your team.

A landing team. Yea or nay?

Sending a landing team over from the US can have several advantages including building shared values, market credibility, and short-term cost savings. However, you may lose out on a regional go-to-market strategy, and will not have the local connections required to build out your business.

We recommend hiring a local European Leader and sending supporting team members from HQ.

Let's talk money

General Manager or Vice President Sales roles are typically $350K for an experienced candidate. The range is $200K-$450K based on experience. Compensation is generally split 65/35 between base and bonus for General Manager roles and 50/50 for Vice President Sales roles. Candidates will expect options and will have a good understanding of them. Offers vary widely, but for post-B the average is 0.3-0.45%. We can talk through your individual circumstances.

The search process

Search within your networks first, then try a European recruiter. Most will be based out of London with access to further markets. Make sure the recruiter maps out the potential candidate pool and be clear about which cities to search in.

A good recruiter will provide calibration candidates within a week, and a shortlist of at least five people within a month to six weeks. This should include three who fit the brief and two wildcards – perhaps a rising star with the ability to step up, or someone without domain expertise.

Take into account negotiation time and notice periods, which are between one and three months in Europe. This means that your hire may not start for four to six months.

It’s unusual for a GM hire to be a purely search hire. More often, it’s someone known through networks.

Stuart Collingwood

GM EMEA, Anki

It’s important that the ultimate decision maker in the US is the person leading the search. This could be the CEO or CRO.

Daniel Hyde

CEO, Erevena

Recommended recruiters

For General Manager and Vice President candidates talk to:

360 Leaders

B2C & B2B: Ben Markland

B2B: Jerry Maynard

Erevena

B2B: Dan Hyde

Fintech: Maria Josife

UP Group

B2C: Clare Johnston

Renaissance Leadership

B2B: Sebastian Kayll or John Smith

True Search

Nick Fairclough

Renovata

B2B: Thomas Jepsen

Natural Selection

Gaming: Julian Lynn Evans

Companies increasingly want to buy from product people – not Sales people. Your Leader should have a deep understanding of the product positioning and roadmap for Europe.

Jerry Maynard

Director, 360 Leaders

Scaling up your team

Who's responsible?

The hiring plan for the rest of the European team should be the responsibility of the General Manager or Local Leader. He or she needs to decide with input from HQ, what roles are needed and how best to hire for them.

Many companies operate a matrix structure, where employees report into Europe but also have a dotted line to HQ. If so, local hires should also be interviewed by their functional Leaders in the US. This will ensure culture fit.

Balancing input from HQ with local autonomy to the European Leader is a tricky task. Ultimately, it depends on building a good relationship, great communication, and frequent travel to and fro.

Speed or caution?

You need to strike the right balance of building momentum without losing control, and the pace of hiring will depend on objectives, sector, levels of funding and commitment to growth.

Pure Storage with Steven Rose at the helm invested heavily to scale fast and grew to 120 people within 18 months.

It depends how much the firm wants to invest. I’ve lead teams where we had to meet $1.5 million targets per region before hiring new people, and other teams where we scaled up faster.

Steven Rose

Former VP EMEA, Pure Storage

Stuart Collingwood leading Anki Europe took another tack, choosing to work solo for the first year while he got to grips with the business and scouted out key hires.

Living with a startup for a period is critical before ramping up. You’ve got to understand the business from end-to-end first.

Stuart Collingwood

GM EMEA, Anki

The recruitment process

Ideally, your General Manager will have number of candidates willing to follow him or her into your company. Rely on networks as much as possible as you did in the US to build out the highest quality, most dedicated talent pool.

It’s all about relationships. I joined the company because I knew Matt the GM EMEA, and he joined because he knew Zac the COO. When expanding into new countries, hiring people you know and trust helps a lot.

Maeve Hurley

VP Finance and Operations, Zendesk

Hiring profiles and playbooks are usually modelled on the US versions with some amendments for local flavour.

Keep in mind that your hires will usually have notice periods and it will take several months before they can begin work. The more senior your hires, the longer their notice periods will be.

It’s difficult to tell your US team that you’ve found this great person, but it will take three or six months to get them in – and that’s the norm!

Stuart Collingwood

GM EMEA, Anki

Order of hires

While this will depend very heavily on your business model and strategy here is a common order of hires we have seen:

Key local hire

Sales

Sales Engineers

Professional Services

Customer Success

Operations/Office Management

Marketing

Companies often regret not investing in marketing resource in Europe earlier.

Values, fit and culture

Remote offices can dilute company culture. Make sure European hiring managers screen candidates with your company values in mind. HQ employees should interview European candidates for cultural fit.

Onboarding, induction and training

Create onboarding programmes, preferably at HQ to give candidates a flavour of the company ethos.

We would fly new European hires to London for training where they would meet department heads and socialise over dinner. This helped everyone feel a part of something bigger than themselves.

Lindsey Dale

HR Consultant, Outbrain

Induction should happen in the US. You are selling the US HQ as much as you are selling your product, so all your employees should live your brand.

Kevin Kimber

Former VP EMEA, Zuora

Human Resources and management

A local Human Resources function gives employees someone to talk to in their office. One-to-one video calls with HQ are not enough to manage personnel problems that inevitably arise. If you don’t tackle these issues early on, they can grow into bigger problems. The local Human Resources manager will also be heavily involved in recruiting, so they should have blended experience. If you cannot justify a full-time or permanent hire, consider hiring a consultant.

Stock Options

Below the Leadership layer there are limited expectations for receiving options, and you rarely need to offer stock to close a hire. Most companies give stock to employees if this is their US policy, but it may be reduced for Europe. This can feel culturally challenging, but it’s a pragmatic solution.

Outbrain was good at understanding geographical nuances and what attracts the right people. You need to account for the benefits European Leaders will expect.

Lindsey Dale

HR Consultant, Outbrain

Experienced candidates have a detailed awareness about stock options especially if they have worked at a US startup before. As companies grow and get closer to IPO, people may join who have more of a financial incentive.

Kevin Kimber

Vice President of EMEA, Zuora

Hiring across geographies

Labour law legalese

Dealing with legal issues across a multitude of European markets can be intimidating, however with the right advice and information you can create high performing teams in all geographies. The table below is a snapshot of the regulations you will encounter.

Don’t let these things stop you running your business, but be cognisant of them!

Simon Edelstyn

Former Managing Director Europe, Outbrain

In the UK, beware of ‘consultants’ ahead of establishing an entity. If they are operating more like employees this can constitute a ‘presence’ before you are ready, and generate employment rights, tax liabilities, and intellectual property ownership issues.

You will need a formal employee contract in Europe which is different from at-will employment in the US.

German holiday entitlements cause shock in Silicon Valley!

Stuart Collingwood

GM EMEA, Anki

The perception is that locating to France is problematic but many of our companies have managed the regulations and offset the risks.

There are particular and real pain-points with stock options in France.

Dominic Jacquesson

Director of Talent, Index Ventures

In France, we have enjoyed great quality and quantity of candidates. Many people complete specialised masters. Often these programmes include work experience so you get well educated candidates who have two internships under their belts.

Lindsey Dale

HR Consultant, Outbrain

On maternity leave

In Europe, maternity leave entitlement can be up to a year, and it’s illegal to ask a woman when she might be returning to work. During this time, employers are required to hold the mother’s position open for them to return (or an equivalent role), and to arrange for maternity cover during the period of absence. Many employers offer significantly enhanced benefits and return-to-work bonuses as opposed to the statutory minimum. Options will be expected to continue vesting during any period of maternity leave

Employment law: UK

| Employer Social Taxes | 14% |

|---|---|

| Statutory Annual Leave | 20 days |

| Public holidays | 8 days |

| Statutory Pension Contributions for Employers | 1% |

| Statutory Healthcare Contributions | Not Statutory |

| Min. Notice Period | 1 week notice for less than 2 years of service Additional week for every year of service up to max of 12 weeks |

| Sick Leave | £88.45 per week (Statutory after 3 days of sickness on no pay) |

| Maternity Leave | 26 weeks (including compulsory first 2 weeks) + 26 weeks additional maternity leave if wanted Up to 39 weeks’ statutory maternity pay at £139.58 per week |

| Paternity Leave | 2 weeks paid (£139.58 per week) plus right to request the sharing of parental leave with mother |

| Unfair Dismissal | Max damages: approx £80,000 plus up to approx £15,000 Employee must have been employed for 2 years or more (£80,000 cap is lifted if there is a successful discrimination or whistleblowing claim) |

| Non Competes | No default legal restriction Possible to include contractual non-competes Maximum possible restricted period will usually be 12 months In practice, can be difficult to enforce |

| Unions and work councils | Vary depending on the industry but are not standard |

Employment law: Ireland

| Employer Social Taxes | 11% |

|---|---|

| Statutory Annual Leave | 20 days |

| Public holidays | 9 days |

| Statutory Pension Contributions for Employers | Not Statutory |

| Statutory Healthcare Contributions | Not Statutory |

| Min. Notice Period | 1 week for less than 2 years of service Goes up to 8 weeks for more than 15 years of service |

| Sick Leave | An employer is not required to pay sick leave to employees |

| Maternity Leave | 26 weeks statutory pay from the Department of Social Protection A further 16 weeks unpaid additional maternity leave can be taken |

| Paternity Leave | Two weeks paternity with benefits |

| Unfair Dismissal | Maximum compensation is 2 years’ gross remuneration Employee must have been employed for 1 year or more |

| Non Competes | Non-competes are used in Ireland but are mostly used for mid-level and senior employees only |

| Unions and work councils | Works Councils are uncommon in Ireland |

Employment law: Netherlands

| Employer Social Taxes | 19% |

|---|---|

| Statutory Annual Leave | 20 days |

| Public holidays | 8 days |

| Statutory Pension Contributions for Employers | Not Statutory |

| Statutory Healthcare Contributions | 7% of salary |

| Min. Notice Period | 1 month for less than 5 years of service Goes up to 4 months for more than 15 years of service |

| Sick Leave | 70% of employee’s salary during the first 2 years of illness |

| Maternity Leave | 16 weeks paid leave (between 4 and 6 weeks before the expected date of delivery and 10 to 12 weeks after) |

| Paternity Leave | 2 days paid leave and 3 unpaid |

| Unfair Dismissal | Fair dismissal max damages EUR 76,000 or one year’s salary if more Unfair is uncapped, but on average in case law 1.3 monthly salaries per year of service |

| Non Competes | Must be agreed upon in writing, including substantial business interests in case of a fixed term contract. In general, max post-contractual period is 1 year |

| Unions and work councils | Works council mandatory at 50 or more employees Has the opportunity to give advice on any strategic decision, and to give consent on decisions concerning collective terms and conditions |

Employment law: Germany

| Employer Social Taxes | 21% |

|---|---|

| Statutory Annual Leave | 20 days |

| Public holidays | 9-13 days |

| Statutory Pension Contributions for Employers | 9% |

| Statutory Healthcare Contributions | 7% employers |

| Min. Notice Period | 1 month for less than 2 years of service Goes up to 5 months for more than 12 years of service |

| Sick Leave | 6 weeks 100% paid leave (Generally 6 weeks per sickness) |

| Maternity Leave | 6 weeks before birth and 8 weeks after, women are prohibited from working and can generally claim full pay from their employer There are additional benefits for further time off |

| Paternity Leave | Employees are entitled to parental leave of up to 3 years per child (not fully paid) and can share some paid benefits with their partner |

| Unfair Dismissal | The Protection Against Dismissal Act (PADA) act applies if the employer employs more than ten employees and the employee has been working for the same employer for more than six months (Once PADA applies, every dismissal needs to be justified by the employer. The employer has the burden of proof in this context. Roughly 90% of the German protection against dismissal lawsuits end by mutual settlement agreement. Severance is usually between 0.5 and 1.0 gross monthly salary per year of service) |

| Non Competes | Statutory non-compete during the term of the employment relationship Post-contractual non- compete restrictions can only be agreed in writing for a maximum term of 2 years Compensation of at least 50% of salary (including variable remuneration) must be paid for the entire term |

| Unions and work councils | Vary depending on the industry Unions and works councils are very powerful in Germany |

Employment law: France

| Employer Social Taxes | 45% |

|---|---|

| Statutory Annual Leave | 25 days |

| Public holidays | 8 days |

| Statutory Pension Contributions for Employers | 16-22% |

| Statutory Healthcare Contributions | 13% + Health Insurance |

| Min. Notice Period | Between 1 and 3 months in most cases |

| Sick Leave | Variable |

| Maternity Leave | 16 weeks for the 1st and the 2nd child, 26 weeks for the 3rd child More weeks in case of specific circumstances (twins, illness, etc.) An allowance is paid for maternity leave |

| Paternity Leave | 11 consecutive days with daily compensation |

| Unfair Dismissal | Damages depending on the prejudice suffered, and at least equal to 6 months’ gross remuneration in case of dismissal of an employee having at least 2 years’ seniority with a company of at least 11 employees |

| Non Competes | Must be limited in time and duration, justified by the interest of the firm and must not prevent the employee from finding another job. Mandatory financial remuneration of at least 30% of the gross monthly salary |

| Unions and work councils | Employee delegates must be elected once a company has 11+ employees A Works Council and a Health and Safety Committee (“CHSCT”) must be elected from 50+ employees |

Where to set up

Where and why?

It’s no coincidence that the best places to set up are four of the most vibrant cities in Europe. London, Dublin, Amsterdam and Berlin are magnets for highly motivated and ambitious people.

London is the top choice for Fintech and Enterprise. Dublin best for Inside Sales, back office and support functions. Amsterdam is good for Inside or Enterprise Sales. Berlin is unlikely but up and coming - particularly post Brexit.

Deciding factors will be the location of your Europe Leader, location of clients and customers, and availability of talent profile. If you find somebody you really believe in, let them drive the decision, but be cautious about building your HQ in a city other than these four.

Our biggest trigger in deciding where to establish was where we wanted to sell. We needed feet on the ground.

Nick White

Chief Financial Officer, Elastic

Target companies to hire from

London has by far the largest pool of about two hundred serial General Managers who have built out US software companies. It also has the deepest pool of B2C General Managers, with marketing and community-building expertise. London is the easiest European city to relocate people because of its language, culture, and schooling.

Dublin has talent from Salesforce, Google, Facebook, Microsoft, Oracle and LinkedIn networks, representing a growing pool of Inside Sales and Customer Success Leaders.

Amsterdam has a smaller pool of B2B Sales tech companies that you can draw from.

Berlin has strong B2C talent, often young but aggressive Leaders - particularly from Rocket Internet companies.

Our companies that located to Ireland and the UK chose Dublin and London. The preference is to be in the hub-for talent attraction, travel connections, and proximity to other startups.

Dominic Jacquesson

Director of Talent, Index Ventures

Who can help?

Cities are keen to provide information on setting-up and overviews of tech activity, neighbourhoods, office space and market conditions. They also give advice on tax breaks, investment schemes, visas, business support networks and trade organisations.

London

London and Partners is the official promotional company for London.

londonandpartners.com

Tech City UK is responsible for the Exceptional Tech Talent Visa.

techcityuk.com

Dublin

IDA Ireland is Ireland’s state agency with responsibility for inward investment support and development.

idaireland.com

Amsterdam

Amsterdam inbusiness or StartupAmsterdam for the official foreign investment agency of the Amsterdam Metropolitan Area.

iamamsterdam.com

Netherlands

Netherlands Foreign Investment Agency is an operational unit of the Dutch Ministry of Economic Affairs.

investinholland.com

Berlin

Germany Trade and Invest is the economic development agency for Germany.

gtai.de

Berlin Partner is responsible for marketing Berlin to the world.

berlin-partner.de

The political climate: In the wake of Brexit

Europe is experiencing political uncertainty, including the UK’s vote to leave the European Union in June 2016 (Brexit), but the situation is moving too fast for specific advice. When you’re ready to expand, please reach out to the Index Ventures team for the latest state of play.

There are no immediate changes to the way you do business in Europe. London retains its role as a key tech hub. The importance of London may diminish over time (especially in financial services), but if this happens, it will happen gradually. Tellingly, in the months following the Brexit vote, Google, Facebook, Apple and Snap all announced major investments and headcount increases in London.

For the foreseeable future London will remain the leading European base for startups and for US startups expanding into Europe.

Clustering significance

| Clustering Significance | EMEA HQ |

Important Presence (Beyond country operations) |

|---|---|---|

| London / UK |

Box |

Airbnb |

| Dublin / Ireland |

Airbnb |

Amazon |

| Amsterdam / Netherlands |

Adyen | Microsoft |

Location rankings

|

Location Rankings 1=best | London | Dublin | Amsterdam | |

|---|---|---|---|---|

| Ease of set up | London and Dublin are the most comparable to the US. | 1 | 1 | 3 |

| English Language | German and French skills will be required if you set up in Berlin or Paris. | 1 | 1 | 3 |

| Enterprise Customer | The UK, France and Germany are the biggest markets to consider. | 1 | 3 | 2 |

| Availability of Senior Talent | Greatest availability of senior talent in London, followed by Amsterdam and Dublin - you may be able to get senior leaders to relocate. | 1 | 3 | 2 |

| Availability of Junior hires | There are deep multilingual talent pools in London and Dublin. | 1 | 1 | 3 |

| Salaries | Salaries will be highest in London. | 3 | 1 | 2 |

| Cost | Dublin and Berlin will be the cheapest cities to operate in. | 3 | 1 | 2 |

| Corporation Tax | Corporation tax ranges from 12.5% (Ireland) to 33.3% (France). | 2 | 1 | 3 |

| Air links to US & Europe | London and Amsterdam have the most connected airports. | 1 | 3 | 2 |

London

Why London?

Lots of factors in its favour. English language, cultural parallels with US, travel hub, deep talent pools, multilingual, packed with Enterprise-grade prospects and partners, particularly in financial services. Many US companies have built up a UK audience and clients ahead of formally launching in Europe.

The major US tech companies have major hubs in London - even if they retain their formal European HQ in Ireland for tax reasons. Google, Facebook, and Amazon have large engineering teams in London, as well as key Account Sales, and Business Development teams.

Salaries and cost of living are high and Brexit is generating political uncertainty – particularly for fintech companies.

London is great. It’s not hard to convince twentysomethings to move to a big city.

Matt Price

GM EMEA, Zendesk

Where in London

Locate your offices in central London. No question. It’s just a question of neighbourhood. There is an Enterprise talent pool outside London near the M4 corridor but central London is the tech hub. Consider your proximity to customers and whether your office should be a destination.

If it‘s near Heathrow, everyone drives in and drives out, and that doesn’t create a cohesive workplace culture.

If you are an enterprise company the typical route is London because the people who buy your software are there. You could set up elsewhere but spend a lot of time travelling to the UK to build your brand.

Daniel Hyde

CEO, Erevena

Office space neighbourhoods

East London

The East End is London’s rapidly growing creative community on the edge of The City with many young businesses attracted by the vibrant mix of clubs, restaurants, bars and cafés. Clerkenwell, Shoreditch and Hoxton good for a consumer startup, or if targeting the startup or developer communities.

- Average £35-£65 per square foot

West End

The West End is London’s cultural and retail centre with many established HQs of global businesses. All the media and ad agencies are here, and the influx of new technology and gentrification is changing traditional neighbourhoods.

- Soho, Fitzrovia or Covent Garden

- Good for adtech

- Average £50-£90 per square foot

City of London

The City of London is the commercial heart. Almost a city state that has its own regulations and laws. It is the powerhouse of the UK economy attracting international corporate giants that sit alongside the ancient guilds and historic monuments.

- Good for financial services sector

- Average £40- £90 per square foot

West London

Close to M4 corridor out to the West. Massive regeneration is attracting head offices of major brands with high quality space and a wealth of places to socialise and chill out.

- Paddington

- Commuter links for sales people working in established software incumbents located in the Thames valley

- Average £55 - £80 per square foot

US companies come to London because there is a great talent pool with an international perspective.

John Smith

Partner, Gillamor Stephens

Recommended realtors

Colliers

DeVono Cresa

Gale Priggen

Hanlon Bennett

Dublin

Why Dublin?

The Irish government loves US companies. Ireland is Europe’s fastest growing economy and Dublin is a global services hub with a highly educated workforce of home grown and international talent. It also has the lowest corporate tax rates in Europe at 12.5%.

If you’re looking to build a large Customer Support or Inside Sales team, then economics favour Dublin due to its lower cost. Ireland has big talent pools thanks to Microsoft, Oracle, Apple, Salesforce, Google, Facebook, Twitter and LinkedIn.

When startups kick-off in London and get to scale in Europe, they often choose to open in Dublin and shift back-office functions there.

If you have a highly scalable business, Dublin has some great advantages, but tax must not be the primary driver of where you locate your office.

Johann Butting

Head of Sales EMEA, Slack

Paradigms from our portfolio

Dropbox sent a three person landing team from San Francisco to support the Head of EMEA. The team grew to 50 with Inside Sales and Support, before hiring a UK Enterprise and Marketing team, followed by French and German country managers.

In 2015 Slack sent James Sherrett from West Coast to grow the team to 30 Inside Sales and Customer Support employees. Then they hired an Enterprise team in London which grew to eight in five months.

Workspaces

If you’re bringing less than five people consider workspaces like The Digital Hub or Dogpatch Labs. Slack first housed a hundred people in The Digital Hub until they opened their European HQ in Dublin. Etsy started here as well. Highly recommended for the atmosphere, networking, flexibility of space and events.

If you’ve got the budget consider Glandore providing 5-star unbranded office facilities in the city centre. Twitter and LinkedIn started here before moving to permanent homes.

We found lots of young talent in Dublin well suited to Customer Support and Sales teams.

Maeve Hurley

VP Finance and Operations, Zendesk

Neighbourhoods

Dublin isn’t divided into distinct neighbourhoods by tech industry. The city is small and walkable.

Silicon Docks

The South Docks are prime real estate. This is where the big tech giants and leading law firms cluster. Facebook, Google, Zalando, Airbnb have offices here, so space is tight and expensive. Upwards of €50 per square foot.

Sandyford – South Dublin

South Dublin is more affordable, and has a good transport network to the rest of the city. Microsoft has extensive operations ranging from R&D to Sales and Marketing. Vodafone has a large office in a business park with an expansive Customer Experience Centre.

Smithfield – North Dublin

Zendesk is here. Expect to pay €15-25 per square metre on the ring road, near the airport and 30 minutes from city centre. Ideal if your team will be frequent travellers.

Support for research, development and innovation

Two major supports available for multinational companies. A 25% tax credit achieved through scientific or technical advancement. And the Ireland Research, Development and Innovation Programme offers grants depending on project size, scope and strategic value.

Amsterdam

Pros and cons

Amsterdam is an intimate city with international outlook. Almost all residents speak English and it’s strong on quality of life. Schiphol Airport is a global hub and road / rail connections to the rest of Europe are effortless.

It’s a viable choice for Inside Sales driven businesses. Atlassian and Optimizely are creating a talent pool there. It’s attractive to junior hires, if you’re happy to build skills as opposed to hiring experience. It’s well placed for North European coverage because salary parity makes it more attractive to Germans and Nordics compared to Dublin.

It’s closer – culturally and geographically – to Germany and France than London so could be better placed to establish your European HQ. However there is less senior talent available.

The Netherlands has a special tax regime for expatriates, which provides a substantial income tax exemption of up to 30%. However, there is a distance requirement where incoming employees must have lived more than 150 km from the Dutch border before work in the Netherlands commences.

Berlin

Berlin buzzes with innovation and regeneration. It’s a magnet for creative thinkers and entrepreneurs. The city is still finding its feet post-reunification, but is driven by an upbeat and optimistic energy.

There is no central city hub in Germany. We had a number of developers in Berlin due to a strong startup scene there, but our customers were all over the country in Frankfurt, Cologne, Munich, Hamburg and Düsseldorf.

Robin Sharpe

Vice President of Operations, Elastic

Berlin has no big industry such as banks, pharmaceutical and automotive, but there are lots of startups in the B2C and adtech space. The cost of living and office space is cheaper than other major cities. Berlin attracts a young international talent pool. The co-working scene is very active and many companies begin in a shared space such as WeWork before leasing long-term.

However, it has been much less successful to date in attracting the major US tech companies. It has less talent in B2B Software and Sales. It’s still the outlier as a choice for EMEA HQ, relative to our other three city recommendations.

Locations

Many of Berlin’s startups are in former East Berlin around Torstrasse, otherwise known as Silicon Allee. Pockets of startups are huddled around Mitte, Prenzlauer Berg and Friedrichshain and Kreuzberg.

Rents

Median rents paid by startups are currently around €13 monthly per square metre and only just below rents paid by traditional office tenants averaging €14 per square metre.

Talent

Berlin has many young Leaders with Rocket Internet experience. Management levels of successful startups are setting up their own companies. Salaries can be lower than in other parts of the world.

Selling

Strategy and segmentation

Before landing, work with your European Leader to highlight key accounts and sectors to sell into. This may be straightforward – or if your offering is for multiple industries – can be more complicated. Try to leverage existing customers and networks as much as possible.

Evaluate which industries will be most receptive as you land in new markets. Identify your profile of target EMEA customers and the ten killer accounts you want to reach before setting up office.

Kevin Kimber

Former VP EMEA, Zuora

Trying to sell into the whole of Europe is not practical. Europe is generally segmented into key regions because they have different purchasing behaviours and business cultures. Grouping territories maximises efficiency.

NEMEA

UK, Ireland, Nordics, Netherlands

SEMEA

France, Spain, Italy

DACH

Germany, Austria, Switzerland

CEE

Poland, Czech, Slovakia, Hungary, Baltics

Language: Is English enough?

You can sell to Europe in English but will do better with local language skills. Hiring people who speak several languages in your centralised hub will broaden your reach.

Most US startups begin with English speaking countries, and many use English to sell to early adopters in other markets. Scandinavia and the Netherlands in particular are comfortable with English language products and marketing. This will work up to a point but it does limit your audience, so expect to transition to local languages as you grow.

Scandinavia is a huge market for early adopters but you get big points if you speak their language.

Johann Butting

Head of EMEA Sales, Slack

Compensation and ramp up

Compensation for Sales roles is broadly comparable to the US, but Enterprise Sales people may expect benefits or cash compensation in lieu of pension, healthcare, life insurance and car allowance. They will generally be less concerned about options.

Enterprise Salesperson compensation will be about $200K, 50/50 split base/ commission, for five to seven years of experience. Quotas will be comparable to the US, but getting up to speed in a new territory could take between three to six months. For a new Sales person, expect six months minimal revenue and build this into your compensation plan.

What's different in Europe?

Business cycles

There are major summer and winter slowdowns in business activity so forecast accordingly.

Cultural expectation

Britain and America are two nations divided by a common language, but the similarities outweigh the differences.

Traction peaks and troughs

Entering new markets can generate significant initial traction from early adopters. Since this layer is thinner in Europe than the US, you may experience a slowdown before regaining traction as you build localisation, brand and outbound activity.

In the US a Chief Information Officer will ask: ‘What can you do for me?’ In Europe it may be ‘What do you want from me?’

Mark Simon

CEO, The Chemistry Club

Implementation partners and distribution channels in Europe

Europe has a larger number of potential implementation partners and indirect distribution channels than the US. This is particularly true in infrastructure and hardware. Vice Presidents of Customer Success may find it uncomfortable to outsource this part of the business, but your General Manager in Europe should be able to guide you and find the right partners. As a result, the shape of your team may look quite different to the US, with dedicated resource in channel Sales and Marketing and in smaller, non- English speaking markets in Eastern and Southern Europe.

Average order value

These may be smaller in Europe so look at them in aggregate.

Remote implementation

You may have to spend more time on site in Europe than in the US, based on client expectations and levels of internal expertise.

I typically do a six to nine month test with partners in a market or work with them on three projects before signing up. You want partners who feel that your business is important to them.

Kevin Kimber

Former VP EMEA, Zuora

Paradigms from our portfolio

Zendesk

Zendesk was receiving inbound interest from across Europe with 70 - 80% of new business arriving organically. They built a multilingual, multinational Sales team out of their London offices, hiring Sales and Account Management and staffed up two people per quarter. The hiring profile was foreign nationals who were fluent in English plus their native language. The hires were typically entrepreneurially minded, a few years out of college with a little sales experience. Half the total hires had relocated to London to join Zendesk. Hires were sent to the US for an onboarding programme.

As time went on, the company began to see larger deals with more complex procurement processes coming through the pipeline. The Head of Europe handled these deals initially before hiring a specialist and building out a strategic accounts unit.

Elastic

In US Elastic built up a core hub in San Francisco, whereas in Europe they divided their Sales structure into North EMEA based in London and South EMEA based in Amsterdam. Pre-sales is essential because it’s a technical product so there is a 1:2.3 ratio of pre-sales to sales staff. In Europe, the deal sizes were significantly less than the size of the US in terms of annual contract value. Elastic found that the very largest customers required reps to engage face- to-face, whereas smaller customer could be transacted via video-conferencing and screen sharing. The team also runs public developer meet-ups and bespoke marketing events for individual enterprises.

Getting to grips: Germany, France, Spain

Show clients that you are serious about their market. Provide them with local language support or take a large group of people to your meetings.

Germany

In Germany, we needed to engage with external recruiters to find experienced Sales people. There is a lot of competition and working for a US based startup may not appeal to someone who is risk averse.

Lindsey Dale

HR Consultant, Outbrain

France

In France, you can fly in and out for business deals, whereas in Germany you need significant local presence to be taken seriously. This also depends on what stage your market is at.

Simon Edelstyn

Former MD Europe, Outbrain

Spain

People in Spain want to know you and get comfortable before doing business. Often foreigners doing deals in Spain or Italy can come across as too aggressive.

Simon Edelstyn

Former MD Europe, Outbrain

Localisation

What does localisation mean?

Localisation extends well beyond the language of your user interface. For some companies it involves translating a core product offering. For others it’s a landing page in local language. It also encompasses payments, pricing, contracts and payroll. You need to assess what localisation means for your company, and to what level to invest.

How to get local

You can get going in Europe with minimal localisation, but full localisation to maximise your addressable market will take years to achieve.

- Core product / user interface (UI)

- VAT compatibility

- Marketing collateral

- Customer Support

- Pricing and go to market strategy

- Local market Search Engine Optimisation (SEO)

- Customer contracts – US or English law generally accepted

- Multi-currency (£ and €)

- Local payment methods

- Data centres – model contract clauses still generally accepted

If your audience requires a strong local presence create a local language website and support team. First-line Customer Support from the US isn’t sustainable beyond the short-term due to time zone and language differences.

Translation terrors

Translation is as much about culture as language. Beware of web translations and translation service businesses which tend to translate word for word. Have your materials checked by a native speaker before release, either internally or crowd sourced from customers.

Some of our portfolio companies have used in-house employees for first translations and created tone of voice guidelines with glossaries for external agencies such as Sajan and Beluga Linguistics.

As International expansion gathers pace, shift to a user interface Content Management Systems layer, where changes are possible by local teams.

Complex deals can take much longer with remote lawyers so make sure everyone is talking to each other to keep things moving.

Matt Price

Former GM EMEA, Zendesk

Processing payments

You can begin by accepting dollar payments but may have to make exceptions for larger clients. Eventually you will have to bear the cost of processing payments in Euros and sterling.

Contracts

You can operate through your US entity and forward contracts via the parent company. We can guide you to the right service provider for more advice. However, timeliness of response can become an issue and frustration for local Sales teams, so agree standards for internal response time. Once you have hired a European finance lead, they will generally monitor contract issues more autonomously.

We have found that US or English Law is generally accepted for customer contracts.

Simon Edelstyn

Former Managing Director Europe, Outbrain

In hindsight, one thing we could have done better was to provide local marketing support earlier, especially outside the UK, what with language differences requiring marketing collateral to be translated and generally ‘localised’.

Lindsey Dale

HR Consultant, Outbrain

I like to test different things in different markets and this is an advantage in EMEA as it’s not a single market. You can share lots of learning with the US team this way.

Stuart Collingwood

GM EMEA, Anki

Marketing

Central or distributed?

Balancing centralised marketing versus localised marketing can be tricky. The European office will want marketing flexibility but your global branding and messaging must be standardised.

Many well established US companies are unknown to European consumers. To break through will require a mix of PR, online, above-the-line, events, content, and Sales collateral, depending on your go-to-market plan. Much of this advertising will have to be developed for local markets.

It’s essential to have strong standardised corporate branding and messaging overarching all marketing activities. But it’s important to have localised marketing to ensure that messaging and collateral is relevant.

Simon Edelstyn

Former MD Europe, Outbrain

We allocate European marketing budgets 70% to global campaigns and 30% to local ones.

Nicole Vanderbilt

VP International, Etsy

Adoption of our open source product was widespread. The biggest challenge was helping users realise that behind the Elasticsearch project is a company with other great products!

Robin Sharpe

Vice President of Operations, Elastic

Marketing collateral

Initially English speaking consumers will be okay with US collateral but increased market share will require empathetic translation. Adapt 50% of existing content and create 50% new content. Of particular importance is the creation of local case studies using local client logos.

If you are building an Inbound Sales funnel, strong local marketing is important to drive awareness and demand.

Driving inbound needs real marketing support. Ten years ago everyone would have been doing outbound but today that just isn’t the right approach. You need too many touchpoints.

Johann Butting

Head of Sales EMEA, Slack

Online marketing

Determine a few key metrics early on and segment by country. Compare to your US markets to get a baseline. Online marketing should be run from a single hub. Decide whether you need a local market social feed or one for all your European operations. Social feeds will need regular updating. Paid digital channels can be managed centrally for the UK or if in English, but local pay-per- click (PPC) agencies or internal resource will be needed for running non-English campaigns.

PR and launch

Start with a freelancer or small agency. Scale-up by hiring a local internal marketer. Your PR agency can liaise with the US HQ or with the European Marketing Lead. Balance an agency’s experience with their hunger to prioritise you.

Relationships with journalists are crucial. European media is trends and insights led. Your company may get featured as part of a larger story but there could be less Forbes-style front page opportunities. Create a narrative that your target audience can relate to. Keep in mind that it can be difficult to get good press coverage with only a marketing/sales local spokesperson.

The media landscape across Germany, Switzerland and Austria can be treated as a single market, but adjust for local variation.

I’m not a fan of global agencies. Their internal offices often compete, and your opportunity might be too small for them to focus on. I prefer to find good local freelancers.

Nicole Vanderbilt

VP International, Etsy

Events

Hold launches when you have already established a network of local Customer Advocates. Tie in your launch story with larger company milestones. Disrupt existing markets with road-show events that build awareness and close deals.

We ran lightweight low maintenance two-day marketing events across European cities where we held boot camps and training seminars for prospective clients followed by a party in the evening. We also set up local press interviews.

Matt Price

Former GM EMEA, Zendesk

Hires

High profile hires generate publicity. Hiring from a competitor tells the market you have arrived and this will attract a bigger talent pool.

It’s crucial when entering a new market to have some marquee names joining from industry. This signals your intent to the talent market.

Stuart Collingwood

GM EMEA, Anki

Who can help and how?

If using an agency, test the waters with a three to six month project. Following on, pay a retainer fee which could be an entry point of around €5,000. This should cover a press office, media and analyst relations and some additional support.

Product and Engineering

The European role in product

Your International Office can be used as a testing ground for new ideas.

Anki tested different advertising models. For example, they found TV advertising on The Simpsons was particularly successful because the audience drew in children and parents, who were both critical to the buying cycle. This learning has proved useful for the US.

We have seen multiple models of team structures. Some companies allocate dedicated resource to International. However, Etsy found after trialling both models it was more efficient to share resource because isolated engineering teams may not have the specialist expertise required across all aspects of the business.

The trajectory has been a little like mobile. Many companies used to have dedicated mobile teams and now mobile is part of everyone’s responsibility. We’ve tried to move in this direction with our approach to international as well.

Nicole Vanderbilt

VP International, Etsy

Some European Leaders like to be involved with overall product decisions, while others prefer to focus on Sales. Irrespective of the strategy you adopt, make sure the product is good enough for Europe’s diverse markets.

EMEA doesn’t need to be involved locally in product until it is really established because it can become a distraction.

Stuart Collingwood

GM EMEA, Anki

Engineering teams in Europe

Companies may have remote engineers in Europe but this is very different to setting up a separate engineering team, which requires more infrastructure and support. Whether to have engineering teams in Europe is usually a separate consideration to setting up a Sales or Commercial Office as the locations may be different.

Commercial hubs are generally in Western Europe while engineering centres may be in Eastern Europe due to lower costs and availability of talent. However, Google, Facebook and Amazon have built engineering hubs in London, and Dropbox and Zendesk have engineering teams in Dublin.

Offshored engineering centres should own a definable product or set of features. For example, Amazon’s engineering team in London takes the lead on video, and Zendesk’s team in Dublin is focused on mobile and live chat.

Where next?

A single hub or multiple offices?

Inside Sales

You can effectively service 80% of Europe from a single multi-lingual hub in Dublin, London or Amsterdam.

Field Sales

You can start with a hub and some remote Sales people, but scaling-up will require feet on the ground.

B2C

You can run digital marketing and staff multilingual talent out of a single hub. If you are building a marketplace or need to build community establish local presence.

Strategy and timeline

The three primary markets in Europe are the UK, Germany and France.

You can achieve 80% penetration of Europe from these locations. The UK can service Netherlands and the Nordics, and Germany can service Switzerland and Austria.

Only at significantly greater scale does it make sense to establish further local offices. If you do, the market presence order is generally Netherlands, Nordics, Spain. Very few companies go beyond this.

If starting in London, you might build some operations out of Dublin as you scale but will need to have over 50+ headcount for cost-effectiveness.

The art of strategy is understanding where to get the business without putting in any effort – versus where you need to invest to grow your markets.

Nicole Vanderbilt

VP International, Etsy

If you go into a new market, ring fence the investment then measure that market’s performance against the investment plan.

Simon Edelystn

Former MD Europe, Outbrain

Almost everyone underestimates the time it takes to enter and grow presence in a new market. Cracking Germany is a three to five year project.

Matt Price

Former GM EMEA, Zendesk

For some companies, scaling to new locations will not make sense.

We are a Customer Service, marketing- driven company, so we don’t need multiple Sales Offices in different territories.

Raphael Fontes

Director EMEA Operations, Squarespace

How fast is too fast?

If you expand too fast and need to unplug, it can be a huge drain on management resources. Don’t grow faster than you can handle. You may need coaching as Board members may not have International experience to guide you. The Head of International must add depth to this discussion. It’s critical to gauge market sentiment and closely monitor customer and Sales team feedback, and to build deep confidence in your product readiness.

Find your true north. Set a focused strategy and then be brave in your pursuit of it.

Nicole Vanderbilt

VP International, Etsy

Team culture

Keeping your team connected

Allow extra time and effort to make sure remote teams are cohesive and connected. Build relationships early and strengthen them through video calls, joint projects, and face-to-face visits.

Ensure your European team have access to the wider business through training and exchange programmes.

The GM EMEA needs to be in the US HQ every six weeks or they will forget what you look like!

Stuart Collingwood

GM EMEA, Anki

All-hands meetings help everyone to connect. Time differences can make global calls difficult. Afternoon calls US time can be too late in the day for Europe so keep this in mind when scheduling.

Avoid taking calls in the evening but I checked emails regularly and prompted US team members if I needed a response for customers.

Matt Price

Former GM EMEA, Zendesk

Video conferencing is better than phoning. You can sync up a video conferencing tool to calendars and screens in meeting rooms. Slack is especially good for global communication and onboarding.

Don’t overly rely on emails when addressing conflicts. A video conference or phone call can significantly minimise misunderstandings.

Raphael Fontes

Director EMEA Operations, Squarespace

You cannot underestimate the human issues that will arise from running a global team. Developing and communicating with Leaders outside HQ can be a challenge. Establish appropriate levels of autonomy and avoid fluctuating policies as this can create local frustration.

Decisions and reporting

Things change fast at a startup so a champion for International at HQ helps with communication and prioritisation prevents your International Office falling off the map. This may be the Chief Executive Officer, Chief Revenue Officer or a dedicated Vice President of International. Ideally this individual should have a cross functional remit, rather than it falling to the Vice President of Sales.

Decide whether the European office is a satellite office executing on US decisions, or if local teams have autonomy. Whatever you decide, communicate often and consistently.

In the early stages your EMEA Leader should report directly into the CEO to avoid filtering.

Stuart Collingwood

GM, EMEA, Anki

Maintaining culture across continents

Don’t try to create identical companies but make sure everyone understands your values, and decide what qualities you want to see driven through your company. Hire for cultural fit and carry the brand identity through all office fit-outs. Dropbox sent over a Head Chef from San Francisco for the European operation in Dublin.

Embrace new cultures. For instance, there is more of a drinking culture in Europe than US, and Christmas parties are a major focal point to end the year.

The nuts and bolts of legal

Data and privacy

This is a sensitive and unsettled issue in Europe and can turn into a problem as you become successful. For the early stages, getting legal advice and including model clauses in your contract should suffice.

Without model clauses, it is illegal to transfer European data to the US. Even if you are using Amazon Web Services and Google Cloud check compliance with lawyers. Data residency (where data centre is located) and data access (who can access it) are the two key issues.

Regardless of what you do elsewhere in Europe there are particular sensitivities and legislation in Germany, where you should get specific local counsel. Likewise, there are particular legal issues regarding data touching on health or children.

It’s so easy to get beaten up on this – not by consumers, but by competitors! In Germany they’ll file injunctions against you if you’re not compliant.

Stuart Collingwood

GM EMEA, Anki

Many companies in Europe have their version of boilerplate contracts which may put additional liabilities on you. As a startup you need to consider: What would you be willing to sign up for? What would you change for a customer?

Kevin Kimber

Former VP EMEA, Zuora

The state of affairs in Europe

Safe Harbor was an agreement between the United States Department of Commerce and the European Union to regulate the use of European citizens’ personal data.

In October 2015 the European Court of Justice declared the Safe Harbor provisions invalid. The European Commission published a new set of reforms in May 2016 which will enter into force May 2018.

In February 2016 the EU Commission and the United States agreed a new framework called the EU-US Privacy Shield. This is currently facing its first legal challenge.

Regulation

The first consideration is whether your business is in a sector that needs to be regulated. If you are a financial services, sharing economy or gig economy company there will be some key issues to consider.

Applying for a licence is fairly straightforward, but things may get complicated if your business is a fringe case.

Early Days...

Work with your lawyers to assess what licences you need and what regulation you will be subject to. You will need to start from scratch unless you can piggy back on someone else’s regulation. Obtaining a financial services licence can take six months.

Later days...

As you become successful you may encounter more regulatory friction, driven by consumer groups or traditional competitors. In the UK we have seen high profile and damaging cases with Wonga (sub-prime lending) and Uber (employee versus contractor status) to name a few.

Regulatory problems may arise not by doing things that are illegal, but by doing things that test legal boundaries in Europe. With success comes opposition, and some of that will come through the regulatory systems.

John Fingleton

CEO, Fingleton Associates

To analyse your risk assess your pricing and business model to see if it could be considered anti-competitive, or if it relies on legal or ethical/social ambiguity.

When you wear the armour of an entrant you have protection, but over time people start seeing you as the responsible established player.

David Stallibrass

Director, Fingleton Associates

People are surprised by the margin of discretion that regulators have in the EU. Establish links with regulators, not to influence them but to understand what’s coming down the line.

David Stallibrass

Director, Fingleton Associates

There are major differences across Europe in how close incumbents are to politicians. Try to understand the landscape and your levels of risk. For example, in Germany industrial companies and car makers are close to politicians so if you are doing something that upsets them, watch out.

Stock option planning

In the UK an Enterprise Management Incentive (EMI) scheme is extremely tax efficient and applies if you have less than 250 staff worldwide. It will cost $5-10K to set up, and is worthwhile if you are below this threshold. In other geographies, companies issue options out of their US or UK option plan.

Outside the UK, stock options are not as attractive as they are in the US. They are taxed as income in Germany, Spain and the Nordics. They are particularly difficult to issue in France, and we have seen several companies choosing to forego them entirely.

Office space

Keep it simple for as long as you can. Set up in a co-working space such as WeWork. When you have more than twelve in the team commit to a leased space. It is also possible to sublet or re- assign a lease from another startup which has outgrown its offices. This will shorten your term commitment.

The right advice

Be prepared to spend for good advice on finance, tax and employment law. It’s worth its weight in gold and easy to get wrong. This needs budget, especially if you haven’t done it before.

Stuart Collingwood

GM EMEA, Anki

Radius Worldwide can help with back office expansion, but you will pay a premium for the single point of contact.

Legal

Go for International coverage. Engage a full service law firm who can advise you across multiple geographies. Your existing US law firm might have European coverage or partners in Europe. We also recommend Taylor Wessing (talk to Adrian Rainey), who offer a $10K starter package for all the basics plus six hours free advisory. They have advised numerous startups and US companies expanding into Europe, and have offices in the UK, France, Germany, Netherlands and elsewhere.

You will need to cover:

- Immigration

- Contracts

- Terms and conditions

- Data and privacy law

- Domain registration

- Stock option planning

- Regulation

- Trademarks and intellectual property

Visas

Visa rules change frequently so check with the appropriate authorities before making plans.

UK

If you want to bring across an existing employee who doesn’t hold an EU passport and has no employment rights in the UK, you can get a ‘sole representative’ visa quickly and easily. But apply before creating a subsidiary, otherwise it’s harder to do.

US passport holders can travel to the UK without a visa, but no longer than six months in twelve-month period. Watch out for fuzzy rules about what you’re allowed or not allowed to do.

Once you’ve established the UK office, apply for a sponsor licence to transfer employees to the UK under Tier 2 ICT work permits.

Look into the Tier 1 Exceptional Talent Visa for Digital Technology to see if any of your employees are applicable.

You can get visa support from TechCityUK (Maria Palmieri).

Germany

Citizens of the European Economic Area (EEA) and Switzerland have the right to work in Germany.

Citizens of the USA and Canada may enter Germany without a visa and then apply for a residence permit within three months.

Citizens of all other countries must apply for a visa to enter Germany.

Look into whether you/your employees qualify for an EU Blue Card which can be processed more quickly and also allows family members to work.

Netherlands

You may need a Schengen visa to stay in the Netherlands for a maximum 90-days in any 180-day period (short stay visa). If you wish to stay longer than 90-days you need an authorization for temporary stay.

Ireland

Nationals of states outside the European Economic Area need either a Critical Skills Employment Permit or Work Permit in order to work in Ireland.

Intra-Company Transfer Visas allow for the temporary assignment of senior management, key personnel with specialist knowledge or trainees to the Irish operation.

Accounting

Different firms are good for different purposes. Engage a large firm for upfront tax planning and corporate structure. A local firm for ongoing payroll, VAT and accounts. Natalie Langley at PwC can provide accounting guidance. iHorizons is a good local London accounting firm who specialise in startups.

You will need to cover:

- Corporate setup

- Tax relief programs

- Options programs

- Transfer pricing

- Cross-Europe VAT registration

- Client Contracts, adjusting T&Cs for International markets

- Employee relocations - tax, compensation & options adjustments

Most US startups establish a Limited Company in the UK rather than a branch office. There are extra disclosure requirements and liabilities for branches.

Many US startups use their UK Limited subsidiary as the holding company for all other European or Worldwide subsidiaries they subsequently create. However, this approach may change depending on the outcome of Brexit negotiations.

Banking

If you are setting up in the UK we recommend banking with Silicon Valley Bank if you already have an account with them in the US. They offer discounted rates to Index Ventures companies, but do not have a banking licence elsewhere in Europe. Alex McCracken can provide guidance. Otherwise, consider Barclays, HSBC or a new hungry entrant such as Metro Bank.

When opening UK accounts consider that client due diligence is potentially more onerous than the US. You may have to verify details of the business beyond simply identity - notarised address proof for owners. Requirements elsewhere in Europe will vary but are generally more onerous than in the UK.

Case studies from the Index family

Anki

Employees at expansion: 65

Total funding at expansion: $50M

Founded: 2010

Company headquarters: San Francisco

Expanded to Europe: 2014

EMEA headquarters: London

Last funding round before expansion (June 2013): $40M Series B

Anki is harnessing robotics and artificial intelligence to deliver magical experiences that push the boundaries of the human experience. Founded in 2010 by three Carnegie Mellon Robotics institute graduates, Anki creates consumer experiences using cutting edge technology that was once confined to robotics labs and research institutes.

Snapshot 2016

- 150 employees

- 12 EMEA employees

- Offices in UK, Germany, France

Current UK team

- UK Sales Director

- European Marketing Director

- UK Marketing Director

- Key Account Manager

- UK Channel Marketing Manager · Customer Care Manager

- Operations Manager

- Office Manager

Expansion objectives

Anki launched its first product in the US in October 2013 and started thinking about International expansion for the following year.

Key local hire

Co-founder and Chief Executive Officer of Anki Boris Sofman began discussions with Stuart Collingwood in 2013. Stuart had previously worked with Anki’s then Marketing Director and was invited to join the team in 2014. Stuart had previously held Vice President EMEA and Principal roles at a number of technology companies.

The Anki team spoke to people who had worked with Stuart and invited him to HQ before hiring him. Stuart had also submitted a five-page mini business plan before taking the job.

All quotes:

Stuart Collingwood

GM EMEA, Anki

It’s unusual for a GM hire to be a purely search hire. More often, it’s someone known through networks.

Organisational structure

Stuart’s reporting line has changed from the Global Head of Sales, to the Chief Executive Officer, to the Chief Revenue Officer as the company has grown.

In the early stages your EMEA Leader should report directly into the CEO to avoid any filtering.

Profit and loss is managed centrally and the UK team is a matrix structure with all Sales reporting directly into Stuart.

Revenue is the most important part of any early expansion and essential for the EMEA Leader to manage.

Go-to-market

Anki started selling in Europe in a limited capacity 2014. For the first year the Anki London team comprised of Stuart and one Customer Care hire. The strategy was to work with a few key retailers rather than trying to satisfy the whole market.

Living with a startup for a period is critical before ramping up. You need to understand the business from end-to-end.

Further hiring

Stuart attributes hiring slowly and hiring right to be fundamental to Anki’s success. The Marketing Director who joined from Nintendo was the first critical hire. Her joining was considered so important, the company announced it in a press release. Further hires included senior individuals from Lego and Activision.

It’s crucial when entering a new market to have some marquee names joining from the industry. This signals your intent to the talent market.

In a retail business, you have to build the brand and hiring is critical. To know what skills to hire, sometimes you need to do the job yourself first.

The US has been frustrated by the slow pace of hiring, and one big learning for the team was the notice period for senior staff in Europe. The Anki team has worked around this by starting to hire well in advance.

It’s difficult to tell your US team that you’ve found this great person, but it will take three or six months to get them in – and that’s the norm!

Three years into operation, the team is considering hiring a European Finance Manager. Up to now, invoicing, wholesaling deals and more have been done in the US.

Location: London

The UK team worked from home before setting up in a Regus office space in Chiswick Business Park in between the West End and London Heathrow Airport. Although Regus was expensive per-person, this was a safer option than taking on a lease. The team may lease space in 2017 or 2018 when headcount exceeds 18 people.