Israel’s Startup Velocity

Why Israel’s tech ecosystem became a world leader.

Downtown Tel Aviv on a Friday evening. The restaurants and bars are packed, the streets thick with people. Cars are circling the city looking for somewhere, anywhere, to park. For those used to the orderly parking of American cities or in Western Europe, Israeli car-parks are an eye-opener; a study in creative chaos. Sidewalks are rammed with vehicles. Pairs of cars wedged into single spaces. Wheels on kerbs, everywhere you look.

According to Gilad Japhet, Founder and CEO of MyHeritage – with 75m registered users, the most popular family network on the Internet – they also serve as the best way to explain the sheer density of startups in the country. “There is something in the Israeli character best defined by the term ‘chutzpah’,” he says, speaking at his office in Or Yehuda, near Tel Aviv.

“Chutzpah in Hebrew and Yiddish is that feeling that I can do something, even if you tell me that I can’t. Israelis are very creative problem-solvers, and the best way to look at it is in an average parking-lot. Go to a parking-lot in the U.S. and see how the cars are parked. They are all same distance from the dividing line and their tyres are usually straight. Then visit an Israeli parking-lot. It’s a big mess. Everyone improvises, people will go into spaces diagonally, and over the sidewalk and into patches of mud.

“Israelis just improvise and break the rules, and breaking the rules means you don’t follow protocol. If the standards and norms are blocking your growth you invent new ones. Chutzpah, I think, really characterises Israeli entrepreneurs. They never take ‘no’ for an answer. If something seems impossible, they just find a loophole and solve it that way.”

The highest density

Whatever the theory (and there are a bunch of them) behind Israel’s astonishing success at tech startups and high-tech more generally, 2013 was a standout year, with highlights including Google’s $1bn acquisition of mapping service Waze, website builder Wix’s IPO and Moovit raising $28m, in a round led by Sequoia, to revolutionise the way we use public transport.

A tiny country with a population of just 7.9m, Israel -- which has more companies listed on the NASDAQ than Europe, Japan, Korea, India and China combined -- was ranked in 14th place (out of 142 countries) by Cornell University’s Global Innovation Index 2013, and in second spot, behind Silicon Valley, as a startup ecosystem. Meanwhile, Tel Aviv was ranked #2 in the world for startups by Startup Genome, with the city believed to have the highest density of such companies anywhere in the world.

In his acclaimed 2009 book Start-up Nation, Saul Singer, (and co-author Dan Senor), pinpointed a number of key factors behind Israel’s startup phenomenon, including the lack of hierarchy and emphasis on problem-solving in Israel’s (conscription) military and the ‘nothing to lose’ immigrant mind-set of many of its population.

Sitting at the dining-room table in his Jerusalem apartment, Singer reflects on the five years since his book’s publication and says the underlying reasons for Israel’s unmatched success at innovation hold equally true today. There’s no evidence that Israel is any better at generating great ideas than anywhere else, he argues, but what there seems to be “a bit more of” are the added extras which transform ideas into innovation and, ultimately, businesses.

Echoing Japhet’s analysis, Singer says the first of these are copious amounts of drive and determination. “We talk about chutzpah, audacity and a whole basket of things which lead Israelis to be very driven, not to give up and take on very large problems,” he says. “The other thing is a willingness to take risks.

“If you don’t have those two extra ingredients to add to ideas, then they won’t turn into startups and innovation. So really what the book ends up being about is ‘Where did Israel get a bit more of those two things?’ From there, we talk about how the whole country is a startup and how it took a lot of drive and determination, and willingness to take risks, for it to come into existence.”

21st century skills

The second major factor that is still true today is the military, says Singer. Not so much as a source of technology or even of immersive technological training, though both of those are significant, but rather for the way military service imbues young Israelis with what has come to be known in the education world as ‘21st century skills’, he explains.

“People are realising there’s a huge mismatch between education and work. Schools aren’t really producing people with the skills that companies are looking for. So what are companies looking for? It turns out they want things like leadership, teamwork, strategic thinking, decision-making, emotional intelligence and all these things we don’t teach in school.

“But Israelis ended up picking this stuff up in the army. Not all those things, but particularly those things around leadership, teamwork and sacrifice. I think sacrifice is actually an important value for startups and entrepreneurship, because there’s usually an easier way to make a living than to do something as difficult and risky as starting your own business.”

But the single most important skill learned during national service is ‘mission orientation’, continues Singer. “The main thing the military tries to teach you is what a mission is. How do you balance the need for success with the need to take risks? This turns out to be absolutely critical for startups.”

The final and oft-quoted ‘X factor’ is that Israel is a country of immigrants, who by definition were driven enough to move from one place to another, taking risks to life and limb along the way. Japhet points to his grandparents on both sides of his family, who emigrated from Europe to Israel before the Holocaust.

“I’ve been bred by these four grandparents and a lot of Israelis living today have a similar background to them,” he says. “Israel is the startup nation because its founders were risk-takers which is exactly the characteristic of entrepreneurs.”

Tech giants

In his office at IDC Herzliya -- Israel’s first and only private university, which was established in 1995 and based on the American Ivy League model – Shimon Shocken is rattling through the instantly recognisable logos on his screen. They include those of Google, Microsoft, eBay, Intel, Apple, Cisco, AOL, CA, Facebook and Salesforce.

Anyone passing by his door would be forgiven for thinking that the founding dean of IDC’s Efi Arazi School of Computer Science was proudly listing the tech giants now employing his former students, but Schocken is making a quite different point. “We’re very proud that every one of these famous companies acquired a company that was started up by our students or faculty members,” he announces, with a disarming smile. “Actually, Google bought two of them.”

Schocken, who resigned a tenured position at a leading American university and returned to Israel twenty years ago to help found IDC, is well-positioned to discuss the scale of entrepreneurial activity in Israel – and compare attitudes among Israeli students with those in the U.S.

“There are many explanations [for Israel’s success], but one of them is simply momentum,” he shrugs. “I taught in several universities in America, very fancy places like Harvard and Stanford and so on. Stanford is unique in terms of its entrepreneurial DNA. But at Harvard, for example, when you ask a student what they want to do when they grow up, they invariably tell you something like ‘I want to be a Senator’ or ‘I want to be a CEO’ or ‘I want to go into investment banking’.

“Very few students will tell you ‘I want to start up my own company’,” he says. “It’s not something which is expected, whereas in Israel it somehow became almost the normal thing to do. The Jewish mother who wanted her son to become a doctor or a lawyer, now wants him to become an entrepreneur.”

Schocken also identifies Israeli students’ willingness to talk back and question their professors as reflecting a ‘disruptive’ attitude to authority, typical in entrepreneurs. When he taught in the U.S., he says students would ask questions and then dutifully write down his answers. In Israel, he’s grown used to a quite different reaction.

“I’ll teach something which is a very established result in mathematics or computer science and when I write it on the board, some schmuck raises his hand and says ‘But this cannot be true!’. At the beginning, I was shocked and didn’t know how to react.

“So there’s this mentality, which sounds like disrespect, but I don’t think it’s disrespect, which I see as more like extreme scepticism. They don’t take things for granted, which we think is very good here, because that is one of the secrets of entrepreneurship.”

Schocken also cites the close synergy between the IDF and the startup community as a key influence in shaping Israel’s startup scene, particularly in the area of cyber security. “There are intelligence units in the army, especially Unit 8200, which have superb R&D centres and recruit the best and brightest high schools students,” he explains.

“They have their own ways to identify the best recruits. So many youngsters in high schools are trying very hard to get into these units, as these are the best places to acquire critical experience in systems development, because they are working on some of the most interesting problems you can think of in security and artificial intelligence, image processing and so on.”

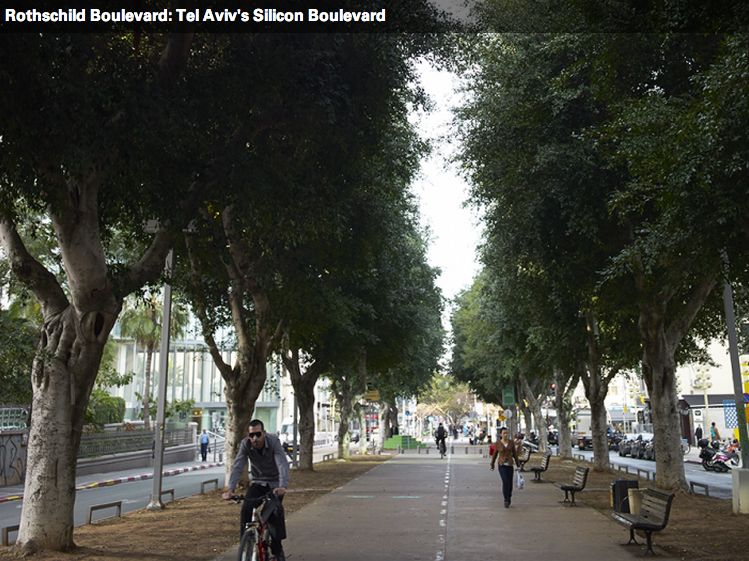

Silicon Boulevard.

There’s another way the military helps feed Israel’s startup ecosystem.

Tree-lined Rothschild Boulevard is one of Tel Aviv’s most beautiful streets and home to myriad tech firms including The Gifts Project, a social e-commerce platform for group gifting which was acquired by eBay in 2011. Founder Ron Gura, who now runs eBay’s Innovation Center from the same location, says much has been written about the influence of the IDF, particularly in the area of cyber security and fraud, but one of the most pertinent aspects is frequently overlooked.

“My personal two cents worth is something that I see in our team [at eBay Innovation], 80% of whom originate from the same unit in the army,” he says. “For me, that’s where the advantage kicks in. Let’s say you hire a 21-year-old and he was in the best possible unit in the best army in the world. At that stage, he has just three years grown-up experience, even if he was coding before that. That makes him worth something to a company. But what if I were to tell you that this guy worked back-to-back, in the same room, with two other guys in your company, your dev lead and your product manager, for three years? That becomes the holy grail!

“Getting a self-contained team that you can just deploy as is -- it already has the hierarchy, the self-esteem, the awareness of each other, the trust, the knowhow of how to cooperate with one another, all learned from working back-to-back for three years in a team – that’s the key. Especially when you think the alternative to this group is probably hiring five or six different people, all strangers, and just telling them to collaborate, when they probably won’t even get along.”

Yet for all the plaudits and acclaim, Gura sees a flipside in Israel’s startup density and wants to voice his concerns. There are hidden dangers, he says, in the glittering success, such as the way the ecosystem feeds off itself, breeding exit-focused entrepreneurs and an M&A culture. “The fact that there’s more VC money in Israel, second only to the Valley, not just per capita, but in absolute numbers -- that alone explains why you see so many startups, here, because there’s demand on both sides,” he says.

“I’d argue that that’s not necessarily a good thing. We have so many people opening businesses, that maybe we’ve crossed a line and now there are too many. Exits, in themselves, should never be the goal, and in my short experience, I don’t know anyone yet who had a successful exit when that was their goal in the first place.”

Miracle on the Med

Nevertheless, Israel’s high tech ‘miracle on the Med’ remains the envy of technology hubs and governments across the world. The Wall Street Journal reported that, according to IVC Research, acquisitions and IPOs of Israeli companies totalled $6.6bn in 2013, with startups raising $2.3bn in venture funding – a ten year high. Start-up Nation author Saul Singer predicts the country’s success surge has yet to peak.

“The people I’m talking to think 2014 is going to be even bigger than last year,” he says. “There are going to be more IPOs -- the Wix IPO broke the ice, I think -- and more M&As, and the ecosystem here is doing well generally. What you’re seeing is it’s getting more mature in the sense that the exits and the companies are getting bigger, because the entrepreneurs are more experienced. They’ve already done a few startups and then they get to the point where they have to decide ‘Do I want to take this one all the way to being a big company?’”

There continues to be a debate in Israel, says Singer, over why the country has so far failed to create tech giants with global reach on a par with Facebook and Google. “The implication of that is that startups are not that significant, only big global companies are,” he says. “I kind of differ with that perspective.

“Yes it would be great if we could produce a Facebook or a Google, but I don’t think that should be necessarily our measure of success, because our comparative advantage is startups and what we’re seeing around the world is that that’s not such an easy thing to do. Startups are something everyone is trying to figure out now, and the fact that we’re good at it, is something we should be building on and not complaining about.”

He adds: “If we’re going to produce a Facebook or a Google, it’s going to come from a startup. The most important thing for us as an ecosystem is to raise the quality and quantity of our startups and, then, the rest will certainly follow.”

Posted on 15 May 2014

Published — May 15, 2014