Innovation vs Optimization

Many insightful books and articles have been written about innovation and entrepreneurship. They are the two most important ingredients that have shaped Silicon Valley as we know it. Yet, as Silicon Valley has evolved over the last decade, the start-up process has transformed by professionalization. Entrepreneurship and venture capital were more craftsman-like endeavors when I got my start in Silicon Valley in the 90s. There were few venture capital firms, and at the time they were, for the most part, a collection of experienced entrepreneurs and operators. Start-ups were unpredictable and ad-libbed adventures - kind of a Lewis & Clark-ish journey to the west - rather than well-trodden pathways to success.

In contrast to that, today’s entrepreneurship is much more structured and planned. There is a lot more pattern recognition and we follow well-understood formulas for business creation. Not surprisingly, modern businesses are being managed much more through the optimization of metrics and analytics. There is no surprise here, this is the way you would expect any excellent business to run.

Yet, innovation and optimization are strange bedfellows. Every CEO would like to have both, but, in practice, they are forces that pull against each other - a bit like antagonists. The pursuit of business optimization can suck creativity and innovation out of the air. The blind pursuit of innovation can bankrupt a company by leaving behind a strew of creative but half-finished projects. So, if you had to pick one. Do you choose innovation as your core value, or do you choose optimization?

What is Innovation?

There are many ways to innovate, it is important to embrace the concept of innovation in its broadest definition. Innovation is any process that creates and expands new business opportunities for a company. It can originate from individual genius, collective effort, or even expanding and improving on someone else's existing idea. True innovation comes to market: it’s not just an exercise in the lab. Innovation cannot be just an extension of the existing business or a feature that enhances the capabilities of an existing product. But, innovation can definitely take advantage of the pre-existing technology or business assets that exist within a company.

When you survey the landscape of Silicon Valley, there are many different approaches to innovation. Some of the classics include:

1) Allocating portions of employees’ time to creative ideas and exploits.

In their famous 2004 IPO letter, Larry Page and Sergey Brin wrote:

"We encourage our employees, in addition to their regular projects, to spend 20% of their time working on what they think will most benefit Google. This empowers them to be more creative and innovative. Many of our significant advances have happened in this manner."

A number of significant products were born of this approach including Gmail, Adsense, and many others. Whether employees really have an extra 20% of their time is somewhat questionable, but the important concept here is that Larry & Sergey were promoting the role of innovation as central to Google’s success and very much a shared responsibility across the entire organization.

2) The creation of entirely separate organizations with the sole focus on innovating.

Whether urban myth or not, the pirate flags and separate buildings of the group that created the Macintosh at Apple come to mind with this approach. The idea of a small crack team, totally undistracted by the everyday nuances of running a business also holds a lot of appeal. This approach can create internal boundaries often associated with friction and strife. Sometimes it can generate notions of first-class- vs second-class citizens. But, clearly, the approach has produced innovation successfully for some.

3) Innovation through mergers and acquisitions.

Cisco’s string of nearly 100 acquisitions in the mid- to late-90s created immense value. It transformed Cisco from one of several players in the router business to the 600-lb gorilla in the networking business. Some would argue that acquisitions are anathema to the culture of innovation. In fact, they are a perfectly legitimate tool to use for the management team to infuse their businesses with innovative new products & technology. Case in point, both Google and Facebook have taken a page out of the Cisco playbook to make successful acquisitions like Instagram, WhatsApp, Android, and YouTube.

Whatever the chosen approach to innovation, it is important to recognize that innovation opens enormous new markets and strategic value to the parent company. Many of these innovations do benefit from a company’s existing core competencies, but they are premeditated and deliberate initiatives from the leaders to create value.

In order to succeed, important conditions must be cultivated inside companies. The first is the culture of risk-taking. Unless a business is willing to take a risk, it is very hard to be innovative. Innovation, by definition, involves trying projects that are not guaranteed to succeed. In fact, if projects work all the time without fail, there probably isn’t enough risk being taken. Innovation and failure are two sides of the same coin. The good news is when a company invests $1 in innovation and fails, it can only lose $1. But, when innovation succeeds, the business can reach $10s in return. It is the asymmetric nature of risk & reward that is so unique to the technology business (and foreign to human nature) that have made the tech industry so proficient in creating great businesses. Great leaders infuse a culture of risk-taking in their businesses in order to foster innovation.

Second, and in parallel to the culture of innovation are the rewards for risk-taking. It is obvious that we should reward people involved with projects that succeed, but it is less obvious that we would also reward people involved with failures. This is especially true when failure occurs because of uncontrolled and external factors. Amazon famously rewards leaders of projects that fail by recognizing their innovativeness and provides them with opportunities to re-attempt innovation. Venture capitalists often fund entrepreneurs who have failed before. Precisely to reinforce the need for intelligent risk-taking and innovation.

Lastly, considerate time horizons are important pre-conditions to innovation. Innovation doesn’t happen overnight and it is based on a series of nested successes that play out one after another. Judging projects too early can kill them prematurely. However, some incubations go on forever - especially when housed in a wealthy corporate parent. David Packard once visited my division of HP (my first full-time job) and declared presciently that “engineering projects never die of starvation, they die of overfeeding”. A responsible leader must balance the inherent long term nature of innovation, yet not let projects linger forever in development. After all, innovation comes to life only when it meets a customer.

What is Optimization?

In an increasingly data-driven business world, optimization has become a critical process to create shareholder value. In my board meetings, discussions around improving metrics are increasingly prevalent. And why not? if you can measure something, you can improve it and incrementally run the business better. Operational excellence is clearly a virtue and it should be encouraged.

The tricky part of optimization is that it’s easy to optimize when metrics are clearly measurable. But, some projects are challenging to put metrics around. In fact, in a desperate effort to apply metrics to everything, we often pick the wrong things to measure. The feedback loop for innovation, in particular, is long and hard to optimize.

That said, many other things can be measured and improved. In the tech industry, we have implemented great metrics for GTM efficiency. Whether it’s measuring a sales organization, a customer’s engagement with a product, or a marketing funnel, we have a rich set of analytics that provide us with telemetry. We know what is working in a business and we can focus on improving lagging performance. In fact, with Cloud and SaaS, products and their usage can be easily tracked. Even changing the color of a tab on a webpage can be measured and optimized.

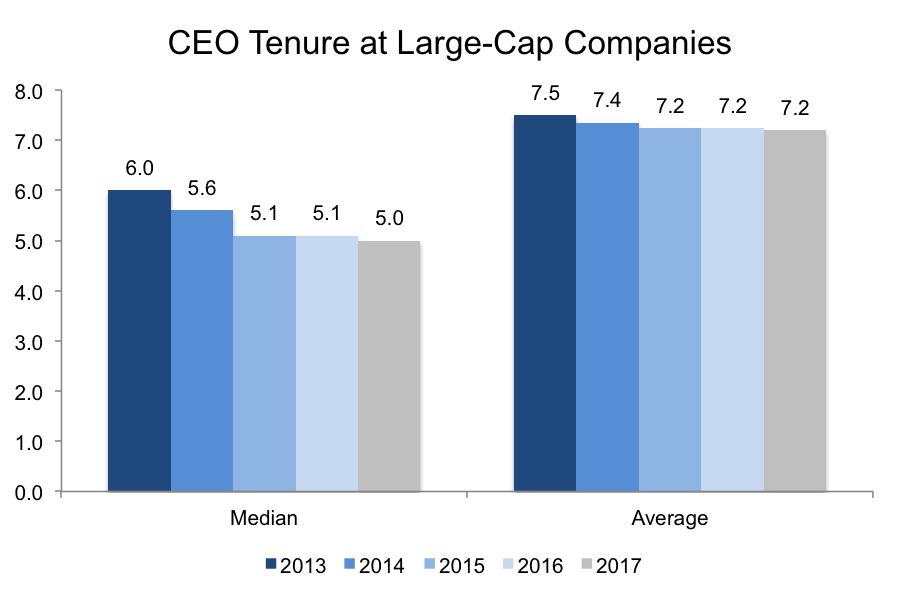

New product development, though, remains elusive. R&D organization can be measured in various ways, but few of the metrics actually translate to innovation. Lines of code? Adherence to schedules? Engineering pulse surveys? Clearly you can identify innovation post facto, but while it’s happening, that is much tougher. To add fuel to this fire, the world around us is becoming much more short-term in nature. As you can see from the chart below, the average tenure of leaders is getting shorter.

Not surprisingly, this yields incentives for these CEOs to focus on what can be optimized. Management teams thus focus on gross margin improvements, on sales efficiency, on squeezing some extra dollars from a customer.

Driving towards operational excellence is clearly a net positive, but leaders have to also understand the collateral damage that can happen if the process is taken too far. Short term optimization in excess distracts from the innovation cycle. A company that is too focused on optimization will reward people and projects that can increase market share by a few percentage points, or perhaps postpone an investment by a couple years. In addition, the incentive to optimize will drive the best people in a company to focus on the core business and not divert their career on gambles that might open new markets or invent new products.

The underlying challenge is pretty obvious. Business must optimize their operations, but doing so in excess, can actually stifle innovation and potentially damage the long term prospects of the company.

These concepts make sense in the abstract, but, let’s look at a couple of cases in recent history that evidence the contrast between innovation and optimization.

Amazon vs eBay in the 2000s

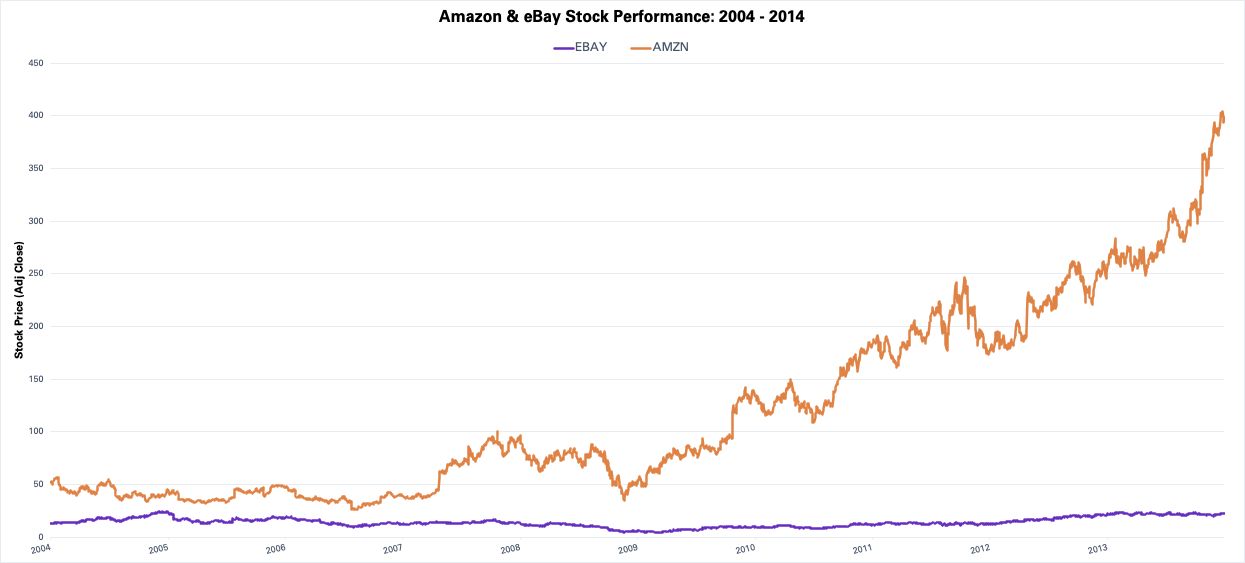

It is almost hard to think that these companies were of comparable vintage and value for the first decade of their existence. In fact, for a good portion of the first decade, eBay was largely considered the better of the two businesses. eBay had no inventory, a broader selection, (by far) better margins, and, overall, much tighter control of its core metrics. Amazon was a bit all over the place. Started by being an inventory-carrying books store, Amazon had gradually added a few categories like electronics and music but clearly had the “inferior” business model. But, as the stock charts below reveal, Amazon completely outstripped eBay in the decade from 2004 to 2014.

Amazon’s innovation engine as a propellant

Amazon’s success cannot be synthesized to one factor. But, it is clear that Amazon’s ability to innovate has created enormous shareholder value for the last 15 years. Think of the products that Amazon has invented. In its core business, it has transformed itself from a bookseller to the “Everything Store”. But, along the way it has introduced revolutionary concepts like Prime & One-click purchasing. Outside of the eCommerce space, AWS, Alexa, and Kindle headline their list of innovations. Amazon is no slouch when it comes to optimization, their ability to fine-tune massive complexity is well-advertised. However, there is no doubt that their ability to innovate has created a substantial portion of its trillion-dollar market capitalization.

Not surprisingly, Amazon has wielded every part of the innovation playbook. They’ve capitalized on internal creativity (Prime); they have launched separate business units to enter completely new markets (AWS) while taking advantage of corporate assets (Amazon’s internal computing infrastructure); and, they have made key acquisitions like Twitch and Whole Foods as catalysts for innovation (AmazonFresh, Prime Video).

Clearly, Jeff Bezos’s leadership and their culture have created the fertile ground upon which all this innovation grows. Jeff notoriously spends disproportionate amounts of his time focused on innovation and leaves a lot of the optimization to the talented top lieutenants. They have their failures for sure, the Fire Phone is a prime example. But, at Amazon failure isn’t just accepted, it’s embraced. Experiments that fail are not considered a hindrance to careers, rather they are a stepping stone for the next innovative project. They have manufactured an environment where it is “safe to fail.”

What happened at eBay?

eBay is not a failure. It’s a company worth about $30B after having spun out both PayPal and Skype - which is still 2x their market capitalization from 2004. But, in comparing eBay to Amazon, it’s clear that there is a narrative of missed opportunity there. What happened? eBay was a well-managed company. In the late 90s, they received accolades for the elegance of the inventory-less auction-based business model. In the early 2000s, eBay survived the .com bust gracefully while Amazon had to issue $672M in convertible bonds to overseas investors to survive. eBay continuously optimized its take rate in order to improve the profitability of the business: in 1998, the take rate was 6%, but by 2008, eBay’s take rate had ballooned to 14%. Similarly, by creating efficiency in cost structures, eBay improved its operating margins from 13% to 24% over the same period of time. Once again, this contrasts with Amazon where profits were not a priority over those years. Rather the company maintained its focus on customer-obsession, growth, and innovation. Today, Amazon is valued at $1.2 Trillion.

Indeed, eBay did make some valuable acquisitions in order to stimulate innovation. Stubhub, Skype, and Paypal are all good examples. But, as has been evidenced by the eventual divestiture of all three of these gems, eBay never integrated the companies and did not leverage its internal assets to scale and expand upon these seedlings of growth.

Fast forward to today and the market capitalization of the two companies tell a dramatic story. Amazon is one of the most valuable companies in the world, and eBay is a solid, but undistinguished technology company. Undoubtedly, there are many factors that brought about this outcome, but the capability to harness innovation as a core corporate asset is a pillar of Amazon’s success.

Innovation is the x-factor

The comparison between Amazon and eBay is an illustrative example of the impact that innovation can have on the long term prospects of a business. But, the examples of the power of innovation abound. Think about Apple and its epic innovation engine versus a myriad of other computer-makers. Adobe’s transformation from perpetual license-based desktop publisher to the SaaS juggernaut today. Salesforce’s transition from a cloud-based CRM tool to the full-service provider of enterprise software. Each one uses a different narrative to innovation. In fact, there is no blueprint for how to innovate. Each company can define its own depending on its market, its culture, and its technology. But, it is clear that in every case, institutionalized innovation created great value.

It is important to emphasize that this conclusion does undermine the need for operational excellence and optimization. Without a doubt, these are desirable attributes for any organization. But, in the extreme, optimization and innovation do juxtapose themselves and modern leaders need to ensure that they do not stymie their business’s innovation engine by the excessive imposition of optimization mechanisms.

Published — June 22, 2020