From Seed to A: Robinhood's Aim is Right on Target

Often at Index, we’re asked about how we build conviction; how do we know, or at least have a strong gut feeling, that we’re backing the right entrepreneurs with the right idea, the right platform, at the right time. The question has extra resonance at seed stage, when there’s little for potential investors to go on, other than a minimum viable product (MVP) and hopefully a captivating, well-honed pitch.

Today, as Robinhood announces its Series A, where we had strong enough conviction to double-down on our seed investment to lead the $13M round, it struck me that this particular investment’s story might cast some light on the key factors which help us build that conviction. While, on the surface it’s a narrative of how a relationship between founders and investors evolved from an initial seed discussion to full blown Series A, it also highlights how critical certain factors in its development can be.

Generate Buzz from Day 1

It’s generally a good sign when we hear about a team or product from multiple sources. In the early stages, when the opportunities for founders to create buzz about an MVP are scarce, attracting any meaningful attention is a clue that something special is in the works.

Such was the case with Robinhood. As someone who’s been trading shares since before I can remember, I was the obvious person to whom to recommend a new social trading app. A number of my US friends told me that I just had to join Robinhood, which at the time, was primarily a community for sharing opinions about stocks. Around the same time, Terrence, a colleague on the West Coast, called me raving about the stellar quality of its founders. By then, a few tips from friends were beginning to feel a lot like buzz.

Deliver a Killer Pitch

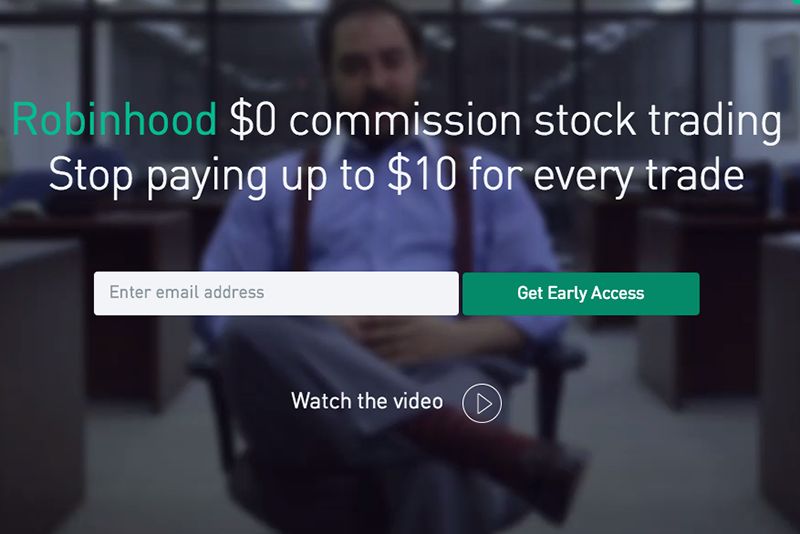

A social network around trading was enough to get me excited, but when we heard the pitch on a new trading app which enables zero commission trades, we were blown away. Millennials make up a mass-market largely overlooked by incumbent online brokerages and it was instantly obvious that Robinhood cofounders Baiju Bhatt and Vlad Tenev understood exactly how to solve this generation’s trading needs. They were designing a product for themselves and their peers.

With the financial services sector transforming at Internet scale and speed, and the shift to mobile gathering pace, they too had felt the frustration and knew exactly where the pain-points lay. For the proof that they understood it so instinctively, look no further than the 450k sign-ups they received when they first announced the app.

Their pitch was as simple and elegant as the app they went on to build: a mobile-first brokerage that would offer generation Y the flexibility and convenience they demand in all aspects of financial management. In addition, and most crucially, all trades would be free of commission.

At that point, we were ready to give them initial seed money. Fortunately for us they were ready to accept, and even increased the size of the seed round so that Index ended up being Robinhood’s largest investor.

It was a huge leap of faith at the time – the team hadn’t even acquired FINRA approval to be a fully-fledged brokerage yet, nor had they even a mock-up of what the app would eventually look like. But we knew from our existing investment in Wealthfront and years of studying the market, that this was a team to back.

Focus on the Product

Over the last 12 months, Vlad and Baiju have obtained FINRA approval and delivered on product beyond expectations – you only need to download the app to see that they’ve created something quite special and unique. Robinhood has been designed for effortless user experience; the ability to trade with a tap, on a clutter-free screen.

Its beauty is in its seamlessness and simplicity; the trading world brought to your fingertips. Above all, it’s easy to use on the move, as Baiju explained recently to CNN: “Our one design principle was building an interface so it’s useful in 15 or 30 second bursts, like when you’re standing in line to order to coffee.”

Keep Iterating

If today’s product looks very different from when we first met the team 18 months ago, we promise that there are many more new features yet to come, over the next 12 to 24 months. These founders constantly strive to improve the experience and always keep the user top of mind. Most importantly, they’ve proven to us that they excel at turning ideas into reality – their ability to execute is outstanding.

Robinhood began with the notion that a lean and agile, technology-driven brokerage could strip out the fixed costs of incumbents to offer zero commission trades on smartphones and tablets. Today, the team is close to delivering on their vision – and from the day we met, it was a conviction that we shared.

Over the past year, Vlad and Baiju have shown every day their ability to execute and deliver to plan. It’s been a great pleasure getting to know them, while hanging out at Antonio’s Nut House – a favorite Palo Alto haunt of their student days at Stanford. We are thrilled the team is part of the Index family and are now plugged into the entire firm and network of entrepreneurs across the world.

Published — Sept. 23, 2014