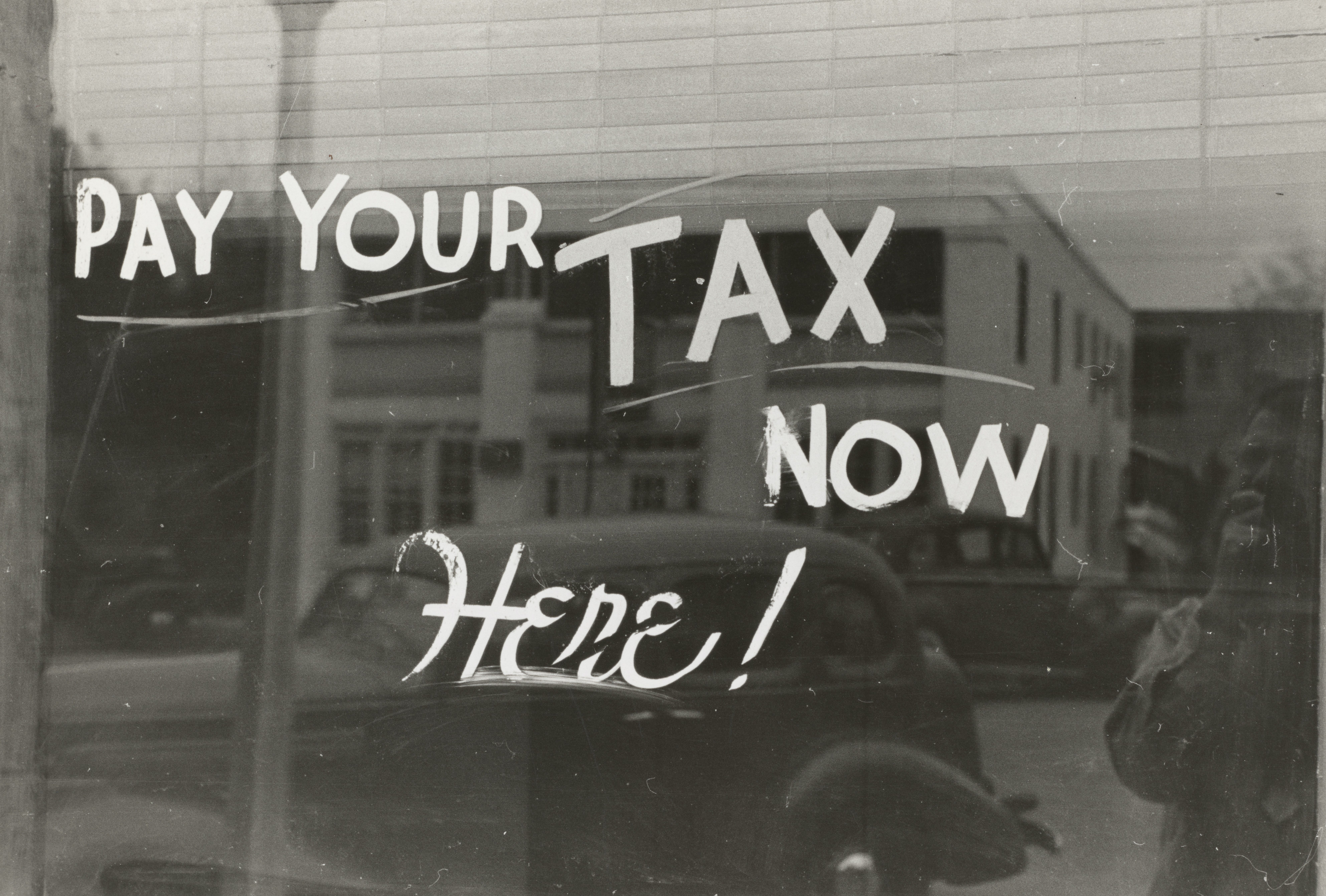

A 50-Year-Old Tax Code Wasn't Built for SaaS Companies

There's a major court case that impacts you every time you swipe a credit card online, even if you don't realize it. And it involves the internet's biggest seller of cute cow mugs.

"SaaS companies are being forced to fit into a 50-year-old mold in the tax code that was created decades before the birth of the Internet."

— Mark Goldberg, Index Ventures

South Dakota passed a law in 2016 requiring online sellers with no physical presence in the state to collect sales taxes. This law was upheld by the Supreme Court in 2018 in South Dakota vs. Wayfair, a decision that made it clear online businesses were responsible for sales tax anywhere they were doing business. In short order, nearly every other state followed South Dakota's lead and began reaping the tax benefits of a booming internet business economy.

All online businesses now have an enormous challenge of complying with a patchwork of local tax rules where rates vary based on what you sell and where your buyer resides. Businesses that don't pay attention to these complicated tax laws can face huge penalties and interest on top of uncollected taxes. The problem is most acute for enterprise software businesses, where dynamic pricing and usage-based billing make accounting for sales even more complex. SaaS companies are being forced to fit into a 50-year-old mold in the tax code that was created decades before the birth of the Internet.

Michelle and the Index team, March 2018

"Businesses should focus on building great products and companies — not becoming tax experts."

— Mark Goldberg, Index Ventures

I learned about this problem space from Michelle Valentine, a former colleague of mine at Index Ventures who went on to become an early employee at Airtable. Michelle started noticing a pattern amongst friends that worked within finance orgs at startups - they were all worried and lost about what to do with the new burden of sales tax on software. As she spoke to more founders in the tech ecosystem, she realized this was a universal challenge. Partnering up with a star engineer at Airtable (and former Dropbox alumni), Kannan Goundan, the two created Anrok.

Businesses should focus on building great products and companies — not becoming tax experts. I'm thrilled to co-lead Anrok's $4.3M seed round alongside Bryan Schreier at Sequoia (a board member at Dropbox during my time there). As online markets get bigger and more diverse, companies need solutions tailor-made for their needs so they can spend more time on the priorities that matter most... and less time calculating sales tax.

Published — June 14, 2021

-

-