Julie Bornstein. Weekend mallrat. Champion of women. Retail’s digital pioneer.

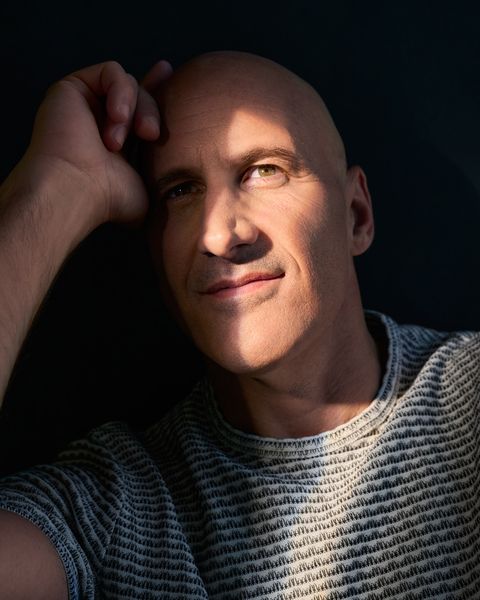

Aaron Katz. Silicon Valley roots. Fierce competitor. Real-time CEO.

Vlad Tenev. Democratizer of finance. Iron-willed operator. Math architect.

Chris Urmson. Science-fair kid. Robotics wizard. Self-driving pioneer.

Assaf Rappaport. Global tech advocate. Team curator. Software’s fastest pace-setter.

Anine Bing. Style trailblazer. Serial entrepreneur. Fashion dream-team.

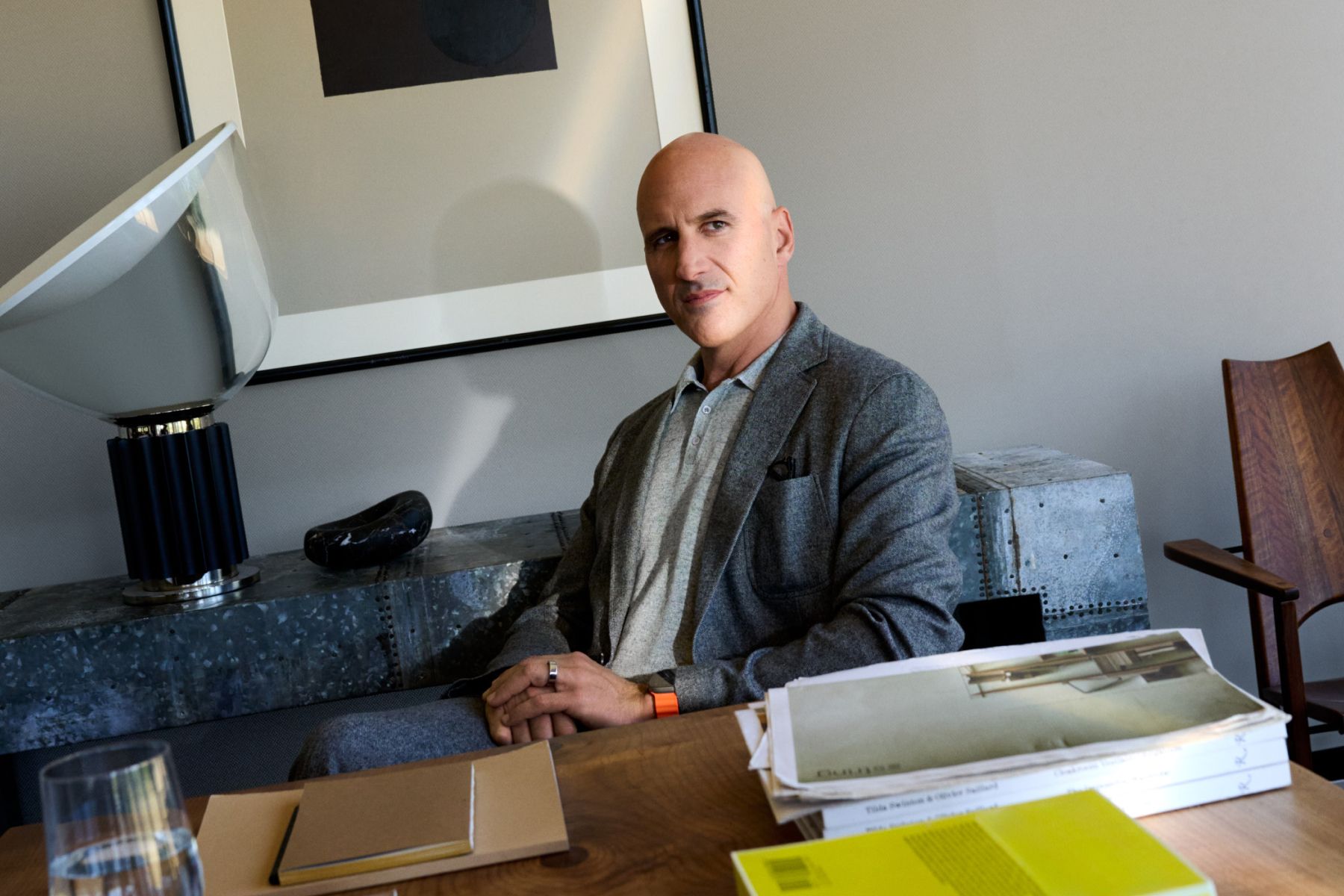

Riccardo Zacconi. Long-distance swimmer. Lifelong risk-taker. Mobile game legend.

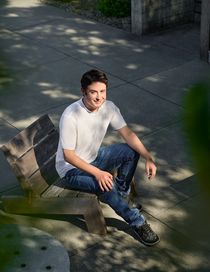

Dylan Field. Tech enthusiast. Futurist. Design advocate.

Linda Lian. Community builder. First generation trailblazer. Slayer of inefficiencies.

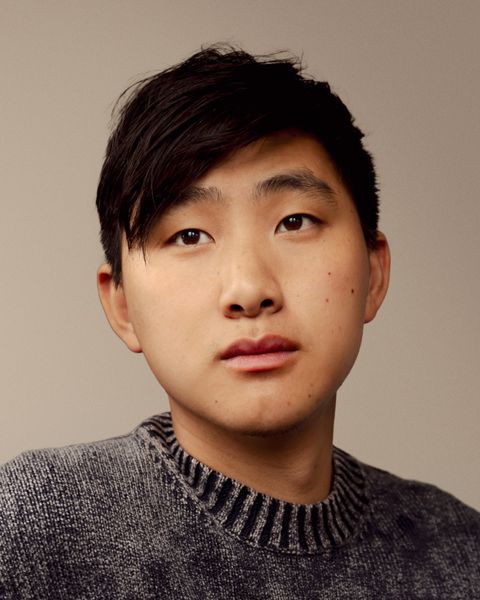

Alexandr Wang. Self-made success story. Former violin teacher. AI visionary.

News

-

This link opens the post, "Musicians-Turned-AI Researchers at Mirelo Raise $41m to Unmute Videos, Games and Beyond"

This link opens the post, "Musicians-Turned-AI Researchers at Mirelo Raise $41m to Unmute Videos, Games and Beyond"Musicians-Turned-AI Researchers at Mirelo Raise $41m to Unmute Videos, Games and Beyond

by Index Ventures

-

This link opens the post, "Wealth Management for a New Generation: Wealthfront Goes Public"

This link opens the post, "Wealth Management for a New Generation: Wealthfront Goes Public"Wealth Management for a New Generation: Wealthfront Goes Public

by Mike Volpi

-

This link opens the post, "Security’s Agentic Era Starts Here: Our Investment in 7AI"

This link opens the post, "Security’s Agentic Era Starts Here: Our Investment in 7AI"Security’s Agentic Era Starts Here: Our Investment in 7AI

by Shardul Shah

-

This link opens the post, "Duvo raises $15m to give retail teams an AI workforce that goes live in weeks, cutting manual work by 40%"

This link opens the post, "Duvo raises $15m to give retail teams an AI workforce that goes live in weeks, cutting manual work by 40%"Duvo raises $15m to give retail teams an AI workforce that goes live in weeks, cutting manual work by 40%

by Index Ventures

-

This link opens the post, "Building for the Web’s Second User: Parallel’s $100M Series A"

This link opens the post, "Building for the Web’s Second User: Parallel’s $100M Series A"Building for the Web’s Second User: Parallel’s $100M Series A

by Shardul Shah

-

This link opens the post, "AI for the Real Economy: Our Investment in Beside"

This link opens the post, "AI for the Real Economy: Our Investment in Beside"AI for the Real Economy: Our Investment in Beside

by Martin Mignot

-

This link opens the post, "Wonderful secures $100m to drive adoption of AI agents, globally"

This link opens the post, "Wonderful secures $100m to drive adoption of AI agents, globally"Wonderful secures $100m to drive adoption of AI agents, globally

by Index Ventures

-

This link opens the post, "Inference is the New Runtime: Our Investment in Fireworks"

This link opens the post, "Inference is the New Runtime: Our Investment in Fireworks"Inference is the New Runtime: Our Investment in Fireworks

by Sahir Azam

-

This link opens the post, "From the AI Lab at EPFL to Building a Global Category Leader: Nexthink's Journey"

This link opens the post, "From the AI Lab at EPFL to Building a Global Category Leader: Nexthink's Journey"From the AI Lab at EPFL to Building a Global Category Leader: Nexthink's Journey

by Neil Rimer

-

This link opens the post, "nexos.ai Raises €30M Series A to Expedite Enterprise AI Adoption"

This link opens the post, "nexos.ai Raises €30M Series A to Expedite Enterprise AI Adoption"nexos.ai Raises €30M Series A to Expedite Enterprise AI Adoption

by Index Ventures

-

This link opens the post, "Europe’s Most Ambitious Startups Aren’t Becoming Global; They’re Starting That Way"

This link opens the post, "Europe’s Most Ambitious Startups Aren’t Becoming Global; They’re Starting That Way"Europe’s Most Ambitious Startups Aren’t Becoming Global; They’re Starting That Way

by Martin Mignot

-

This link opens the post, "The New Internationalists: How Founders Are Uniting a Divided World"

This link opens the post, "The New Internationalists: How Founders Are Uniting a Divided World"The New Internationalists: How Founders Are Uniting a Divided World

by Danny Rimer

Insights

-

This link opens the post, "Real Time: Aaron Katz’s Journey from Salesforce to ClickHouse"

This link opens the post, "Real Time: Aaron Katz’s Journey from Salesforce to ClickHouse"Real Time: Aaron Katz’s Journey from Salesforce to ClickHouse

-

This link opens the post, "Trade Winds: The Rise, Reckoning and Reimagining of Vlad Tenev"

This link opens the post, "Trade Winds: The Rise, Reckoning and Reimagining of Vlad Tenev"Trade Winds: The Rise, Reckoning and Reimagining of Vlad Tenev

-

This link opens the post, "Catching up with Vidya Peters, CEO of DataSnipper"

This link opens the post, "Catching up with Vidya Peters, CEO of DataSnipper"Catching up with Vidya Peters, CEO of DataSnipper

by Hannah Seal

-

This link opens the post, "Driven: How Chris Urmson and Aurora Are Building the Future of Self-Driving"

This link opens the post, "Driven: How Chris Urmson and Aurora Are Building the Future of Self-Driving"Driven: How Chris Urmson and Aurora Are Building the Future of Self-Driving

-

This link opens the post, "Our secret weapon for attracting world-class tech talent is broken"

This link opens the post, "Our secret weapon for attracting world-class tech talent is broken"Our secret weapon for attracting world-class tech talent is broken

by Hannah Seal

-

This link opens the post, "Daydream’s Julie Bornstein and Vlad Loktev on How AI is Transforming Shopping and Search"

This link opens the post, "Daydream’s Julie Bornstein and Vlad Loktev on How AI is Transforming Shopping and Search"Daydream’s Julie Bornstein and Vlad Loktev on How AI is Transforming Shopping and Search

-

This link opens the post, "In conversation: nexos.ai co-founder Tomas Okmanas and Hannah Seal"

This link opens the post, "In conversation: nexos.ai co-founder Tomas Okmanas and Hannah Seal"In conversation: nexos.ai co-founder Tomas Okmanas and Hannah Seal

by Hannah Seal

-

This link opens the post, "Candid with Index: In Conversation with Robinhood's Vlad Tenev"

This link opens the post, "Candid with Index: In Conversation with Robinhood's Vlad Tenev"Candid with Index: In Conversation with Robinhood's Vlad Tenev

-

This link opens the post, "Power Couple: How Anine and Nico Bing Created a Global Fashion Phenomenon"

This link opens the post, "Power Couple: How Anine and Nico Bing Created a Global Fashion Phenomenon"Power Couple: How Anine and Nico Bing Created a Global Fashion Phenomenon

-

This link opens the post, "Catching up with Cradle's co-founder Stef van Grieken"

This link opens the post, "Catching up with Cradle's co-founder Stef van Grieken"Catching up with Cradle's co-founder Stef van Grieken

by Sofia Dolfe, Carlos Gonzalez-Cadenas

-

This link opens the post, "The King of Candy: How Riccardo Zacconi and King Conquered Mobile Gaming"

This link opens the post, "The King of Candy: How Riccardo Zacconi and King Conquered Mobile Gaming"The King of Candy: How Riccardo Zacconi and King Conquered Mobile Gaming

-

This link opens the post, "Mirage’s Gaurav Misra Talks Leveraging AI Opportunities"

This link opens the post, "Mirage’s Gaurav Misra Talks Leveraging AI Opportunities"Mirage’s Gaurav Misra Talks Leveraging AI Opportunities

All

News

Insights

All Posts

-

Ankar Raises $20M Series A to Accelerate and Protect Innovation

by Bastian Hasslinger -

Musicians-Turned-AI Researchers at Mirelo Raise $41m to Unmute Videos, Games and Beyond

by Index Ventures -

Wealth Management for a New Generation: Wealthfront Goes Public

by Mike Volpi -

Security’s Agentic Era Starts Here: Our Investment in 7AI

by Shardul Shah