Trending

-

Close ups

Cloud Captains: How Assaf Rappaport and His Extraordinary Co-Founders Built the World’s Fastest-Growing Company

-

Insights

Healthcare's "Why Now" Moment

-

News

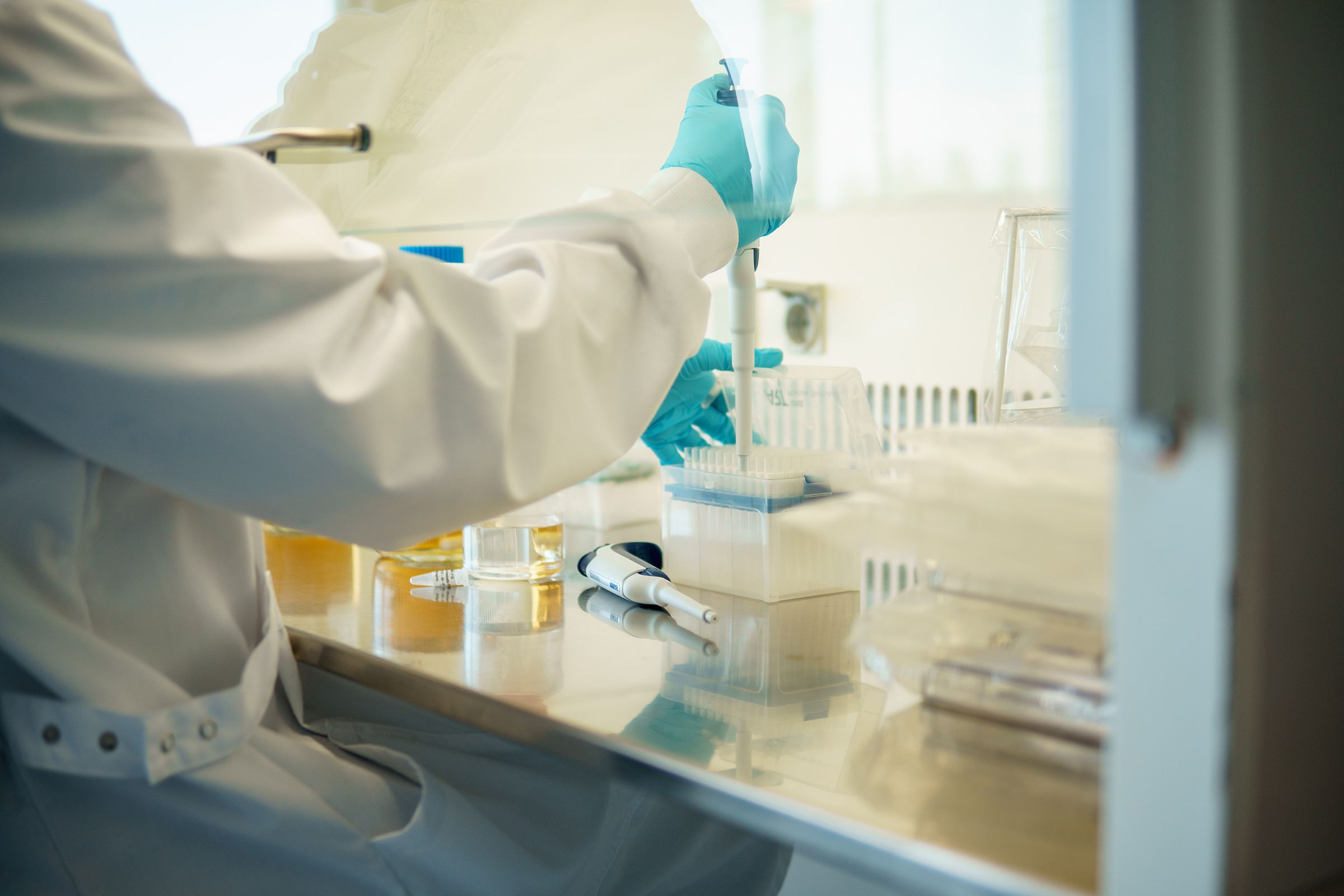

Nourish raises $35M to help millions live longer, healthier lives

-

News

Inside Vizcom’s vision to transform industrial design with AI

-

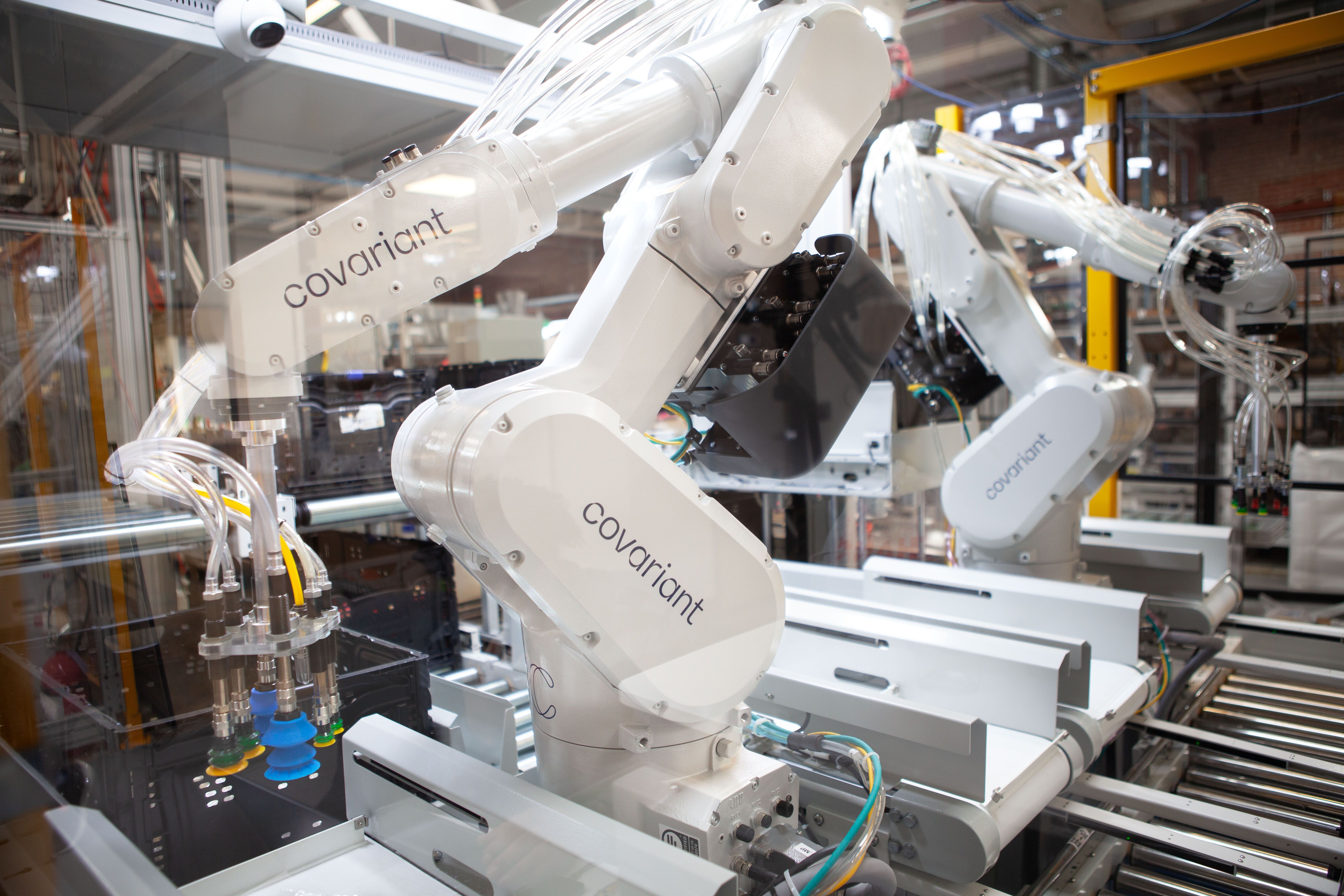

The Rise of Vertical AI

- News

- Insights

- Close Ups

- Conversations